- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- Stanbic Bank has revealed that it has empowered over 45,000 women entrepreneurs in the last three years

- Under its DADA initiative, the bank further revealed it had provided innovative solutions to women amounting to KSh 6.9 billion ($58.5 million) in lending

- As a way of supporting women growth, the bank has been providing training and capacity building which have so far benefitted more than 17,000 women

Kenyan-based lender Stanbic Bank has revealed that it has empowered over 45,000 women entrepreneurs in the last three years.

The bank further revealed it had provided innovative solutions which have enabled Dada’s access KSh 6.9 billion ($58.5 million) in lending.

The bank has additionally provided credit guarantee schemes to the tune of over KSh 1 billion ($8.4 million) and over KSh 40 million ($339,587) in grant funds.

Under the credit guarantee scheme, the bank is working with the African Guarantee Fund (AGF) and the …

- A severe shortage of health workers in Africa is undermining access to and provision of health services even though countries in the region have tried to bolster the workforce

- A study by the World Health Organization (WHO) found that the region has a ratio of 1.55 health workers (physicians, nurses and midwives) per 1000 people

- The figure is below the WHO threshold density of 4.45 health workers per 1000 people needed to deliver essential health services and achieve universal health coverage

- The shortage is a consequence of several factors, including inadequate training capacity, rapid population growth and international migration

A new report has indicated that a severe shortage of health workers in Africa is undermining access to and provision of health services even though countries in the region have tried to bolster the workforce.

The report by the World Health Organization (WHO) dubbed “The health workforce status in the WHO …

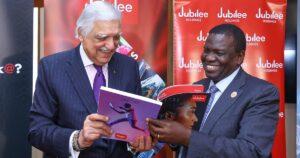

- Jubilee Holdings Limited’s shareholders have approved a final dividend of KSh 13.0 per share

- The payout follows the exceptional results posted in 2021, where the gross profit hit KSh 8.4 billion, after increasing by 66% from the KSh 5.1 billion reported in 2020

- The performance was despite the increase of medical and life claims relating to COVID-19 cases, which was partly driven by the gain on the sale of controlling interests in the general businesses in Kenya and Uganda

Jubilee Holdings Limited’s shareholders have approved a final dividend of KSh 13.0 per share, bringing the total dividend payout to KSh 14.0 (including a special dividend of KSh 5.0).

The payout follows the exceptional results posted in 2021, where the gross profit hit KSh 8.4 billion, after increasing by 66% from the KSh 5.1 billion reported in 2020.

According to the regional insurer, the performance was despite the increase of medical …

- New data now shows that over 40 per cent of Small and Medium Enterprises (SMEs) in Africa are earning more money than before the pandemic

- Mastercard indicates that 46 per cent of SMEs in Africa, Eastern Europe, and the Middle East have surpassed pre-pandemic levels

- Online business and international sales are key drivers, with seven in ten (71 per cent) recording above-global-average growth in online sales, while 77 per cent are planning to do more business internationally

Over 40 per cent of Small and Medium Enterprises (SMEs) in Africa are earning more money than before the pandemic.

New data by Mastercard indicates that 46 per cent of SMEs in Africa, Eastern Europe, and the Middle East have surpassed pre-pandemic levels.

According to the Borderless Payments Report, online business and international sales are key drivers, with seven in ten (71 per cent) recording above-global-average growth in online sales, while 77 per …

- The Kenyan economy will expand by 4.9 per cent in 2022, according to the NCBA Economic Outlook

- The figure is a 0.3 per cent drop from its initial 5.2 per cent forecast made in November 2021

- The downgrade is a consequence of several challenges being witnessed in Kenya

- Top of the challenges includes the negative spillover effects of the Russia-Ukraine crisis, an uncertain external landscape, and domestic election jitters

A new report has indicated that Kenya’s Gross Domestic Product (GDP) will expand by 4.9 per cent in 2022.

In its latest instalment, the NCBA Economic Outlook Report observed a 0.3 percentage point decline from its initial 5.2 per cent forecast in November 2021.

According to the report, the downgrade of Kenya’s economic growth is a consequence of several challenges being witnessed in East Africa’s largest economy.

Top of the challenges includes the negative spillover effects of the Russia-Ukraine crisis, an

- Mastercard has partnered with the Kenya Tourism Board (KTB) to help the country’s tourism sector rebound to its pre-pandemic level

- The MoU aims to drive the growth of tourism numbers in Kenya by leveraging various Mastercard channels, including its Priceless.com platform

- It also includes increasing transparency on tourism trends, anonymised traveller profiles and economic impact through Mastercard’s Data Insights capabilities, which will enable KTB to plan, execute and improve its campaign reports

Mastercard has partnered with the Kenya Tourism Board (KTB) to help the country’s tourism sector rebound to its pre-pandemic level.

In a statement, Mastercard said the three-year collaboration is its first in Africa.

The MoU aims to drive the growth of tourism numbers in Kenya by leveraging various Mastercard channels, including its Priceless.com platform.

It also includes increasing transparency on tourism trends, anonymised traveller profiles and economic impact through Mastercard’s Data Insights capabilities, which will enable KTB to …