- From safari icons to status symbols: The dual fate of Tanzania’s black rhinos

- Tanzania taps $149 million IMF loan for budgetary support

- Africa poised for fastest growth in $8 trillion cooling systems market

- Rwanda-based Bboxx eyes generating $100M worth of carbon credits in Africa

- Telemedicine Services in Murang’a County: Kenya’s technological Initiative to Decentralize Healthcare

- The bitter pill of cocoa’s value chain in Ghana and Ivory Coast

- Rwanda, Kenya, and Guinea: Is Africa’s plastic-free revolution taking shape?

- Africa’s AI revolution: Navigating opportunities, risks, and security concerns

Investing

- With its multiple technologies, Bboxx is trailblazing in the green energy space, scaling its operations across Africa and projecting to offset over 20 million tonnes of CO2.

- Bboxx has been awarded Gold Standard certification for carbon credit programs based on solar home systems, clean cooking alternatives, and solar-powered water pumps.

- Implementing carbon programs allows Bboxx to accelerate market growth potential by reaching over 4 million customers in five African countries.

Rwanda-based Bboxx plans to offset over 20 million tonnes of carbon and generate $100 million worth of carbon credits through clean energy projects in Africa.

In this initiative, Bboxx projects to positively impact the lives of over four million customers across Rwanda, Kenya, Nigeria, Togo, and the Democratic Republic of Congo (DRC).

These revelations follow Bboxx’s recognition with the Gold Standard certification for its continued rollout of clean energy projects in five African countries. This certification marks a vital moment …

- Kenya’s private equity deals size are expected to remain modest this year.

- However, despite the high optimism, deal sizes in East Africa are expected to remain modest.

- However, businesses are concerned that firms will be scouting for exits, too.

Kenya and its East Africa peers are confident that the fundraising environment for businesses will continue improving in the next 12 months even as the continent experiences mixed expectations.

New findings by Audit firm Deloitte show that while East and West Africans largely anticipate an improvement, opinions in North and Southern Africa are divided, with some expecting improvements, others predicting stagnation, and some foreseeing deterioration.

This outlook comes against the backdrop of persistent high interest rates, inflation, and geopolitical uncertainty, which led to a 9 per cent drop in finalized funds year-on-year in 2023.

The Deloitte Africa Private Equity Confidence Survey 2024, shows that in East Africa, optimism is on …

The opulent and contemporary Downtown Dubai is a global attraction for Vietnamese investors. It is a lively neighbourhood that was built by Emaar Properties and contains some of the most famous structures in the world such as Burj Khalifa and Dubai Mall; therefore, it is an ideal place for investing in property. In this article, we will look at different kinds of real estate in Downtown Dubai which are attractive to Vietnamese buyers.

Overview of Downtown Dubai

Situated between Sheikh Zayed Road and Financial Centre Road, the Downtown Dubai neighbourhood is a mixed-use development located at the centre of the city. This area contains everything; residential, commercial, and leisure spaces for both residents and visitors. The tall skyscrapers, luxury apartments, and top-notch facilities define this as among the best areas to invest in Dubai property-wise.

Types of Properties Available

Apartments

Downtown Dubai provides a broad choice of luxury apartments that …

As a form of private equity funding, venture capital finance African startups at the nascent stage. Money is given to firms with significant growth and revenue creation potential. Across economies, VC firms are critical drivers of growth and development in Africa. They drive job creation and innovation and finance the rollout of new products and technologies.…

[elementor-template id="94265"]

- Globally, it’s time to usher in an era of sustainable resource management, embrace green practices, or face the risk of extinction.

- Achieving development without polluting our surroundings is not only vital for human well-being but is the bedrock of our very survival.

- Fuel subsidies provided to oil companies by governments have perpetuated the use of polluting fuels, leading to staggering mortality figures.

The world’s pursuit of progress and development has come at a hefty price, as pollution and environmental degradation threaten our very existence. Clean air, land, and water – the fundamental pillars of life – are now under siege due to unchecked industrialization and unsustainable practices. (Alprazolam) The question looms: Can humanity continue to advance without imperiling its own survival?

Sustainable financing

The urgency of the situation is crystal clear. Achieving development without polluting our surroundings is not only vital for human well-being but is the bedrock

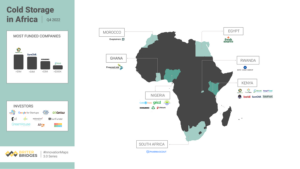

- The Middle East and Africa cold chain market will expand by 7.4% to $35.1 Billion by 2028.

- Over one third of food from Africa is lost to spoilage or wastage partly due to poor storage capacity.

- Studies show that leading cause of food wastage is spoilage due to lack of cold storage systems.

The demand for cold storage supply chain products in Africa is rapidly growing. The segment has been tipped as critical in solving the food insecurity crisis ravaging the continent of 1. (Phentermine) 4 billion people. Rise of cold storage systems is also attributable to growing demand from consumers as Africa’s urbanization and modernization intensifies.

According to Market Data Forecast, the size of the Middle East and Africa (MEA) cold chain market will expand at a CAGR of 7.4 per cent to $35.1 billion by 2028 from 23.8B of 2022. The bellwether for this trajectory has

- AfDB is eyeing $2.3 trillion in sovereign wealth funds, strategic investment funds, pensions, and life insurance assets.

- The AfDB wants to unlock the potential of various wealth funds in Africa.

- Lender is now seeking set up of the African Sovereign Wealth Funds secretariat.

The African Development Bank (AfDB) is calling for unity to drive investments by mobilizing capital in Africa currently held in various funds and estimated at estimated at $2.3 trillion. This massive capital in Africa is in sovereign wealth funds, strategic investment funds, pensions, and life insurance assets.

Speaking at the Second Annual Meeting of the Africa Sovereign Investors Forum (ASIF), AFDB Vice President for Private Sector, Infrastructure, and Industrialisation Solomon Quaynor said the Bank is committed to supporting the establishment and operations of the African Sovereign Wealth Funds secretariat.

ASIF was launched in June 2022 by a group of 10 African sovereign wealth funds with a goal …

- One in five people in Africa suffers from hunger.

- With the rising population, action is necessary to ensure access to healthy and sufficient food.

- AfCFTA can serve as a strong incentive for farmers and other participants in agri-food value chain.

Africa’s population is expected to hit two billion by 2050 yet her food security systems remain a fleeting mirage largely due to delayed financial commitments. Granted, in the past two decades, most African governments have placed great emphasis on transforming their food systems but it progress has been rather slow.

Financing of food systems

Currently one in five people in Africa suffers from hunger. And with a population of 1.1 billion people, it is imperative to take immediate action to ensure access to healthy and sufficient food by 2050. So how will Africa achieve this momentous goal? Experts say all the moving parts are in place, all except one, the …

- Kenya is putting together incentives that could help mobilize Foreign Direct Investments in upstream oil activities.

- The latest developments add to efforts by the government to support Tullow Oil in scouting for investors for Project Oil Kenya.

- India and China are some of the countries where the government is keen on in tapping from.

In May 2023, an announcement by British oil explorer Tullow Oil that it wants out of Kenya's oil dream send shockwaves in the industry as its move threatened to derail the country's journey of becoming a net oil exporter.

At that moment, Tullow Oil partner, a Canadian firm Africa Oil Corp had left the project on concerns over difficulties in finding an investor, who can support Kenya's commercial oil export business.

The other partner TotalEnergies is fast shifting investment focus to oil producing fields in other markets. For Kenya to evacuate its crude, it has to…