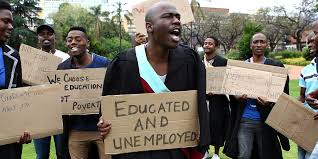

- Youth Unemployment in Kenya: The Role of Vocational Training

- New $900,000 initiative aims to boost sustainable trade in Tanzania

- Organization of the Petroleum Exporting Countries’ (OPEC) pride in its African roots

- AIM Global Foundation pushes for stronger Gulf-Africa trade partnerships

- Investment opportunities in South Sudan’s emerging gold industry

- Family planning drive in Kenya gets 450,000 self-injectable contraceptive doses from UK

- AfDB commits $2 billion to revolutionise clean cooking in Africa, save forests

- The harsh realities of family laws for African women revealed

Investing

- South Sudan is recognised for its vast mineral resources, including a burgeoning gold industry.

- Over 50 alluvial sites near the Luri River, about 40 km southwest of Juba, have reported gold concentrations.

- Other alluvial gold concentrations have been found near the Kinyeti River, Nimule, and northeast Karpeto.

Globally, South Sudan is recognised for its vast mineral resources, including a burgeoning gold industry. This industry represents promising opportunities for collaboration with established gold producers, enabling the country to leverage its expertise for enhanced exploration, extraction, and value addition.

For the first time in its eight-year history, the South Sudan Oil and Power Conference and Expo has been extended to four days to include a concurrent mining forum. This forum aims to explore and promote South Sudan’s untapped mining potential.

It invites international investors and private companies to participate and engage directly with South Sudan’s Ministry of Mining, offering a unique opportunity …

- Inaugural event promises to be a cornerstone in the region’s wood and woodworking machinery industry

- As construction projects continue to increase, the demand for woodworking machinery is expected to escalate

- Saudi WoodShow is showcasing an impressive line-up of exhibitors, including renowned companies such as Al Arak Wooden Manufacturing Company

Thousands of delegates are converging in city of Riyadh for the Saudi International Wood and Woodworking Machinery Exhibition (Saudi WoodShow) is all set to close tomorrow, May 14. Organized under the banner of WoodShow Global, this inaugural event promises to be a cornerstone in the region’s wood and woodworking machinery industry.

Globally, woodworking machinery market is projected to experience a steady Compound Annual Growth Rate (CAGR) of 4.5 percent between 2023 and 2032, fueled by the robust expansion of the construction sector worldwide.

With the industry witnessing significant growth momentum, the woodworking machinery market, valued at $4.9 billion in 2022, is …

- “Africa is like China 20 years ago, you see where China is now, so Africa is moving there,” Nael Hailemariam, Founder/CEO Chapa tells global leaders, and investors at AIM Congress 2024.

- Africa’s startup evolution is on, fueled by innovation and a youthful demographic dividend.

- This comparison of Africa to China’s meteoric rise serves as a compelling narrative for investors seeking untapped markets brimming with promise.

A panel discussion titled “The New Geographical Focus of Startups: Spreading Digital Innovation to Africa and Other Places” at the ongoing AIM Congress 2024 in Abu Dhabi has shed light on the startup evolution unfolding across Africa.

Expert speakers lifted the lid on the continent’s burgeoning potential, citing untapped opportunities that are ripe for investment. Nael Hailemariam, CEO/Cofounder of online payment gateway Chapa, captured Africa’s momentum, likening it to China’s trajectory two decades ago. “Africa is like China 20 years ago, you see where …

- In a body blow, Fitch Ratings has moved Ethiopia’s rating from “CC,” where it had been downgraded in November, to the new status of “C”.

- This adjustment reflects the agency’s deepening concerns about Ethiopia’s economic health and the rising risk of default following a missed interest payment on 11 December.

- A further severe downgrade by Fitch Ratings to ‘restricted default’ (RD) looms if Ethiopia fails to make the coupon payment within the set 14-day grace period.

Fitch Ratings agency has served Ethiopia’s economy a gut punch by further downgrading Ethiopia’s credit rating into junk territory, expressing concerns about the “increased likelihood” of default by the second most populous country in Africa.

This economic setback for Ethiopia, home to approximately 120 million people, comes as a result of the country’s failure to meet its financial obligations to creditors. Specifically, Ethiopia was unable to pay a coupon on its single …

- Global economic trends, such as interest rate changes, inflation, and geopolitical uncertainties, significantly impact gold-backed financing products.

- Some financial products are now linking gold investments to environmentally and socially responsible mining practices.

- This trend reflects a broader shift towards sustainable and ethical investment practices across financial markets.

Gold has been a symbol of wealth and a form of currency for centuries, but its role in the modern financial system has evolved significantly. Today, gold-backed financing encompasses a range of innovative financial products and services, from traditional loans secured by gold to gold trading CFDs. These new trends reflect the enduring value of gold and its growing versatility in the global financial market.

The Evolution of Gold as a Financial Instrument

Historically, gold was used directly as currency or as a standard backing fiat currencies. However, with the end of the gold standard, gold’s role shifted from a direct form

- AfDB will provide US$98.62 million to Burundi in the form of grants and US$597.79 million to Tanzania in the form of loans and guarantees.

- The Joint SGR Project plays a pivotal role in fostering development, facilitating trade, and enhancing accessibility across East Africa.

- Investment will also unlock and connect key economic processing zones, industrial parks, Inland Container Depot, and population centers along the central corridor.

The Board of AfDB has taken a significant step in advancing East Africa’s regional connectivity and infrastructure development by approving a total financing package of U$696.41 million for Burundi and Tanzania Standard Gauge Railway (SGR) Project.

This funding is designated for the initiation of Phase II of the Joint Tanzania-Burundi-DRC SGR Project. The ambitious investment aims to construct 651 kilometers on the Tanzania-Burundi railway line, a key component of the broader effort to enhance transportation and trade links in the East African region.

The financing …

- Kenyan and Nigerian stores will soon experience absence of Procter & Gamble (P&G) products, as the American multinational embarks on a phased withdrawal.

- In Kenya, P&G has set its sights on leaving Nairobi by June 2024, citing high cost of doing business, dollar shortages, and dip in sales.

- P&G’s response to these challenges involves increased pricing as a strategy to mitigate currency impacts, but this has seen it lose market share to rivals.

The shelves of Kenyan and Nigerian stores will soon experience a noticeable absence of Procter & Gamble (P&G) products, as the American multinational consumer goods manufacturer embarks on a phased withdrawal from these markets.

The decision stems from the challenging macroeconomic and fiscal conditions prevailing in both countries. Specifically, in Kenya, P&G has set its sights on leaving Nairobi by June 2024, citing a confluence of factors such as the high cost of doing business, dollar shortages, …

- Since ascending to office in September 2022, President Ruto has remained relentless in his bid to boost Kenya’s agricultural productivity.

- Agriculture remains the bedrock of the country’s development and the key to creating equitable and sustainable growth for its citizens.

- President Ruto has focused on implementing policies and programs to enhance productivity, improve farmers’ incomes, and ensure food security.

Agriculture as a bedrock of Kenya’s economic prosperity

Kenya has made impressive economic strides in innovation and entrepreneurship, private sector enterprise, infrastructure, and human skills development. However, agriculture remains the bedrock of the country’s development and the key to creating equitable and sustainable growth for its citizens. The importance of agriculture has been highlighted in Kenya’s Vision 2030

Moreover, research has demonstrated that agriculture remains a major driver of economic prosperity for most African countries. In addition to driving economic growth, agriculture creates jobs for most rural communities and is essential …

- Glencore spin off of its coal business is the result of mounting pressure from its shareholders over Environmental Social and Governance (ESG) and climate concerns.

- The company resolved to spin off its coal activities after finalizing its acquisition of the coal assets belonging to Teck, a Canadian mining company.

- Glencore had initially sought to acquire Teck Resources entirely but was thwarted by the target company’s controlling shareholder.

- Shareholders in the company have since 2021 rejected the company’s climate report and its disclosures leading to the resolution to spin off its coal business.

Glencore spin off, the background

Glencore, one of the largest mining companies in the world, that is listed on the Johannesburg Securities Exchange and the London Stock Exchange announced that it would demerge its coal assets and list them as a separate business on the NYSE and JSE in two years’ time.

This follows pressure from shareholders that …