- Will Tanzania’s new truck assembly plant revive old coal mines?

- Communications Authority of Kenya needs $820M for digital superhighway goals

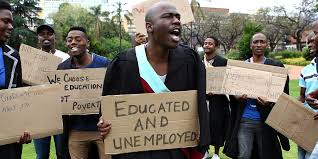

- Youth Unemployment in Kenya: The Role of Vocational Training

- New $900,000 initiative aims to boost sustainable trade in Tanzania

- Organization of the Petroleum Exporting Countries’ (OPEC) pride in its African roots

- AIM Global Foundation pushes for stronger Gulf-Africa trade partnerships

- Investment opportunities in South Sudan’s emerging gold industry

- Family planning drive in Kenya gets 450,000 self-injectable contraceptive doses from UK

Tech & Business

- With Yeeo—a web app—individuals have the privilege of saving their time and cost of printing cards, which often end up being dumped and ensure their money is invested elsewhere.

- Yeeo’s business strategy brings together environmental conservation and this vision to help enterprises save billions spent on card printing.

- Dubai-based Yeeo has already secured intellectual property rights in 179 countries around the world.

As I navigated through the bustling crowd of delegates from around the world at the Startups Showcase during the AIM Congress 2024, I felt a gentle tug on my jacket. It was Abdullah AlShetiwi, a determined look in his eyes and a welcoming smile on his face.

As I reached out to offer my business card to Abdullah, he intercepted with a gesture, saving me the customary exchange. Instead, he swiftly pulled out his phone, suggesting we swap contacts via a QR Code. With a quick scan …

- Four innovators from Kenya, Côte d’Ivoire, and Uganda, selected from a shortlist of 16, vie for the £50,000 (over $62,000) Africa Prize.

- Their innovations encompass recycling in construction, AI tools for healthcare and farming, and reengineered waste collection, addressing crucial societal needs.

- The three runners-up will each receive £15,000 (over $18,000), while a £5,000 (over $6,000) prize titled ‘One to Watch’ will be awarded to the most promising business among the shortlist.

- Since 2014, the Africa Prize has empowered nearly 150 entrepreneurs across 23 African countries, creating over 28,000 jobs and positively impacting more than 10 million people with their innovative products and services.

The Royal Academy of Engineering is set to host the final showdown of the 10th Africa Prize for Engineering Innovation, the continent’s premier engineering accolade, on June 13, 2024, in Nairobi, Kenya. Out of an initial pool of 16 visionary innovators crafting sustainable, scalable engineering solutions …

- Russian Investment Forum at AIM Congress 2024 highlighted Russia’s robust economic standing.

- Various Russian regions showcased unique investment opportunities, from the Far East’s oil and gas sector to Tatarstan’s diverse industries.

- Discussions also revolved around innovation and technology, with an emphasis on Abu Dhabi’s potential as a global technology hub.

Amidst the grandeur of the Abu Dhabi National Exhibition Centre (ADNEC), the Russian Investment Forum emerged as a unique centre of opportunities during the 2024 AIM Congress.

Under the International Partners’ Track, this forum brought together luminaries from Russia’s business landscape to showcase the nation’s unique investment propositions and affirm Abu Dhabi’s suitability as a global technology hub.

Spearheading the discussions was Sergey Katyrin, President of the Chamber of Commerce and Industry of the Russian Federation. Katyrin painted a picture of Russia’s robust economic stature, ranking first in Europe and fifth globally in terms of GDP.

He cited Russia’s …

- UK-based financial services corporation Ebury has announced its initial foray into Africa’s fintech sector through the acquisition of Prime Financial Markets, a South Africa-based company.

- Prime Financial Markets offers extensive expertise in financial market advice and intermediary services.

- According to Boston Consulting Group and QED investors, Africa’s fintech market is projected to reach $65 billion by 2030.

In the past decade, Africa’s fintech industry has garnered significant attention from global corporations. Its rapid growth and extensive benefits have facilitated the thriving of multiple fintech startups in its adaptable ecosystem. Today, the region boasts several success stories, including Flutterwave and Yellow Card, which stand as proud achievements in Africa’s fintech industry.

The economic instability and low financial inclusion rate have motivated numerous investors, innovators, and entrepreneurs to explore opportunities within this burgeoning industry.

In recent developments, the UK-based financial services corporation Ebury has announced its initial foray into Africa’s fintech sector …

- The collaboration seeks to play a significant role in closing the tech skills gap in Africa, fostering job creation, entrepreneurship, and empowering the continent’s youth with in-demand digital skills.

- Through the partnership, Microsoft and Gebeya aim to upskill 300,000 developers across eight countries over the next three years.

- They include Kenya, South Africa, Ethiopia, Democratic Republic of Congo, Lesotho, Nigeria, Egypt and Mozambique.

Microsoft and Gebeya Inc., the leading Pan-African SaaS-enabled tech talent marketplace, have partnered to launch a new skills and jobs matching platform called Microsoft.Gebeya.com.

The collaboration seeks to play a significant role in closing the tech skills gap in Africa, fostering job creation, entrepreneurship, and empowering the continent’s youth with in-demand digital skills.

Through the partnership, Microsoft and Gebeya aim to upskill 300,000 developers across eight countries over the next three years, including Kenya, South Africa, Ethiopia, Democratic Republic of Congo, Lesotho, Nigeria, Egypt and Mozambique.

Applications …

- Airtel Africa has launched Nxtra by Airtel (“Nxtra”), a new data center business, as demand for data centers continues to rise across the continent.

- Nxtra aims to build one of the largest networks of data centers in Africa, with high-capacity data centers strategically located in major cities across Airtel Africa’s footprint, complementing its existing edge sites.

- Airtel Africa’s Group CEO, Segun Ogunsanya, said that a rapid increase in data center capacity is needed to support the growth potential of Africa’s digital economy.

Airtel Africa has launched Nxtra by Airtel (“Nxtra”), a new data center business, as demand for data centers continues to rise across the continent.

Nxtra aims to build one of the largest networks of data centers in Africa, with high-capacity data centers strategically located in major cities across Airtel Africa’s footprint, complementing its existing edge sites.

Airtel Africa’s Group CEO, Segun Ogunsanya, stated that a rapid increase in …

Tanzania’s island of Zanzibar, once known for tourism, is now charting a new course toward becoming a powerhouse in technology and e-commerce. The recent launch of an electronic products shop in Zanzibar is not just a commercial opening; it symbolises the dawn of an ambitious era for the island’s investment sector.…

- Kenya’s online retailer, Sky.Garden has relaunched operations following a $1.6 million buyout by Lipa Later Group.

- This move has propelled Sky.Garden will revamp its platform, aiming to onboard 100,000 merchants in 2024.

- The revamped platform introduces a suite of new products, including Sky.Tickets, Sky.Logistics, Sky.Commerce, and Sky.Wallet.

Sky.Garden, one of Kenya’s online retail platforms, has relaunched operations in East Africa’s most advanced economy following a $1.6 million buyout by the Lipa Later Group.

This strategic move has propelled Sky.Garden will revamp its platform, introducing innovative features and diversified product offerings, to onboard 100,000 merchants by 2024.

During the launch event, Juliet Wanjiru, the Head of e-commerce at Sky.Garden shared the company’s visionary strides, highlighting the platform’s evolution into a comprehensive e-commerce ecosystem transcending conventional online retail. Wanjiru emphasized.

Sky.Garden unveils a new suite of platforms.

“Today marks a significant milestone in the evolution of Sky. As we embark on a …

- Engineers from Botswana, Côte d’Ivoire, Ghana, Kenya, Nigeria, Rwanda, Tanzania, and Uganda have made it to the Africa Prize shortlist.

- The innovations for 2023 span a range of novel ideas, including fabrics crafted from fungi cultivated on human waste, technological advancements in chicken farming, recycled plastic roof tiles, and an app-driven waste management service.

- These inventive projects contribute to the extensive network of Africa Prize innovators, which now boasts 133 alumni spread across 21 African countries, all dedicated to catalyzing transformative change through locally-driven solutions.

- The culmination of the competition will see four finalists competing for a portion of £60,000, with the ultimate winner receiving £25,000.

Africa Prize has shortlisted 16 innovators, marking the 10th anniversary and featuring representation from eight African nations, including Botswana that is making its debut.

The initiative which was started in 2014 by the Royal Academy of Engineering in the UK, the Africa Prize serves …