Airlines are expected to make big losses in 2020 with the challenges being experienced in containing new coronavirus variants and slower vaccination in some African countries according to the International Air Transport Association (IATA).

According to IATA, airlines are expected to post-tax losses of 47.7 billion in 2021 from the initial projection of $38 billion in December.

“Financial performance will be worse and more varied this year than we expected in our December forecast, because of difficulties in controlling the virus variants and slower vaccination in some regions,” said IATA.

The aviation sector is expecting $81 billion in cash burn despite large airlines having raised enough cash to cover for losses. IATA said that smaller airlines will need support from the government or to raise funds from banks or capital markets which will add to the debt burden and balance sheet leverage problem in the industry.

African airlines in 2020 received $2.04 billion in government aid which was mostly distributed through direct government loans, cash injections and equity financing. Eight airlines in Africa filed for bankruptcy or entered into business administration last year despite the support given.

“Government relief comes in many forms. Cost reductions in terms of taxes and charges will help. And the release of the $601 million of airline revenues that are currently blocked from repatriation by certain governments would be an immediate boost in some markets. Governments will need a financially viable air transport sector to energize economic recovery from COVID-19. Many of Africa’s airlines were weak even before the crisis. Reducing costs and freeing blocked cash has long been a priority for African aviation. If ever there was a time for decisive government action on these issues, it is now,” said Al Awadhi, IATA Regional Vice President Africa, and the Middle East.

With some airlines such as RwandAir and Kenya Airways having suspended flights to India due to high cases of covid-19, airlines woes are yet to end. The rising cost of fuel is also expected to have a negative impact on the airlines.

“We now expect much higher fuel prices with a jet at $68.9 per barrel from $49.5 and oil rising to $64.2 per barrel from 45.5 previously as the stronger global economy pulls all energy prices higher,” IATA said.

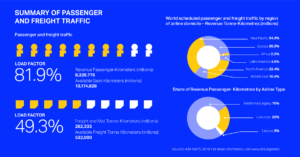

It also noted that the second quarter of 2020 was the most affected in terms of profits where the airline’s operating losses were more than 70 percent of revenues due to the pandemic. In that quarter, strong cargo and cutting cost eased the losses but to only 50 per cent of the revenues, because airline’s costs are fixed over a short period of time and hard to avoid, IATA explained.

By the end of 2020, Kenya Airways losses nearly tripled to $335.4 million as the national carrier experience low summer bookings due to the pandemic.

IATA said that in 2020 African airlines posted a combined $2 billion loss and in 2021 they expect only a slight improvement of $1.7 billion loss due to the ongoing pandemic. Kamil said that traffic is not likely to return to post COVID-19 levels until 2023.

“Financial relief measures are still desperately needed, particularly those that do not increase the industry’s debt burden. Additional relief measures and activating existing pledges are essential,” said Kamil Al Awadhi.

With a strong economy driving an increase in the share of world trade, cargo remains a very promising business for airlines in 2021, IATA explained. Cargo business is expected to see a 13.1 growth in volumes which is higher than the 8 per cent growth forecast by the World Trade Organization for global trade.

In February, demand for African airline cargo increased by 44.2 per cent compared to the same period in 2019 making it the strongest growth from all the regions.

During the 9th virtual aviation stakeholders convention which was hosted by the African Airlines Association (AFRAA) and the Ethiopian Airlines, cargo operators were also urged to treat cargo as core business and to give it a priority in strategy, network growth, fleet planning and to be represented at the board level.