- Ten state-owned enterprises (SOEs) are being prepared for listing on the Ghana Stock Exchange (GSE).

- Most of these SOEs have appealed to the government through the Ministry of Finance to assist them in recapitalizing their businesses.

- The approval of the President of Ghana is required because these SOEs are wholly or partially owned by the government. Consequently, presidential approval is required for these companies to offer their shares on the stock market.

Ten state-owned enterprises in Ghana are about to be listed at the Ghana Stock Exchange (GSE) after being selected by the State Interest and Governance Authority (SIGA) and the Ministry of Public Enterprises following a market readiness assessment. The move is seen as a way to recapitalize these state-owned companies and make them a tool for economic development in the country.

The GSE’s executive director, Abena Amoah, made the announcement at SIGA’s just-concluded annual meeting in Kwahu Abetifi in the Eastern Region. However, she did not name the state-owned companies selected for listing.

State-owned enterprises (SOEs) in Ghana are companies that are wholly or partially owned by the government. These companies operate in various sectors of the economy and are established to perform specific functions, such as providing essential public services or promoting economic development. Sectors in which SOEs operate in Ghana include energy, transport, agriculture, banking, insurance, and telecommunications.

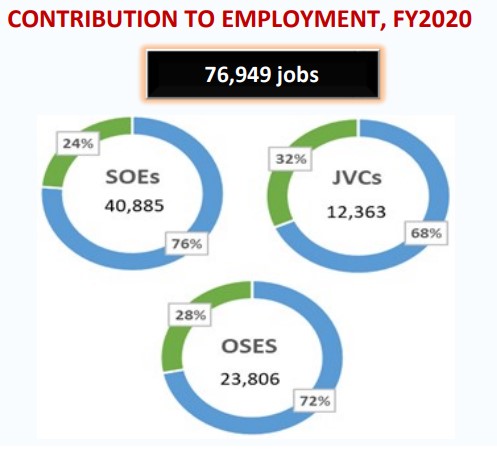

32% and 28% of total employees in the SOE, JVC and OSE categories,

respectively, are women. [Photo/ Ghana 2020_State_Ownership_Report]

“The stock exchange presents an opportunity to strengthen and grow SOEs. GCB Bank, Goil, SIC, among others are some of our success stories on how the stock market can help develop SOEs.”

She said President Nana Addo Dankwa Akufo-Addo could sign off on the 10 SOEs identified to allow them to list on the stock market.

The signature of Ghana’s president is required because these SOEs are wholly or partially owned by the government. Consequently, presidential approval is required for these companies to list their shares on the stock exchange.

The listing represents a great opportunity for these SOEs to raise additional capital for their businesses. It provides them with a platform to access capital from investors in the form of equity and debt financing. Access to these funds enables the SOEs to expand their businesses, embark on new projects and improve their operations.

In addition, listing on the stock exchange brings greater accountability and transparency to these SOEs, as they must abide by the rules and regulations of the exchange. This can help improve their performance, corporate governance and financial reporting, which in turn can attract more investors and lead to sustainable growth.

Read: Ghana’s business activity inches higher in December on IMF Deal

“At the stock exchange, we focus on accountability and transparency and these are very important to build sustainable businesses.

“Aside giving you capital, being on the market also ensures that you are able to manage your capital and be a long-term global player,” she explained.

Ms. Abena Amoah pointed out that there is enough money in the country that can be valued by state-owned enterprises through the local capital market.

“Government has been able to borrow a GH¢130 billion that it seeks to restructure now. Our private pensions industry has about GH¢40 billion under management. SSNIT has over GH¢12 billion under management.

“There is money in Ghana, and the lesson is that the international capital markets are closed to us, but domestic capital markets can be built to raise the money we need to develop our country,” she explained.

She said companies listed on the Ghana Stock Exchange have collectively raised more than GH¢20 billion on the equity market, GH¢12 billion on the Ghana fixed income market and GH¢8 billion on the main equity market.

“We need state-owned enterprises like Ghana Re, Ghana Gas and the stronger ones to list on the market. What makes capital markets grow is when you bring your best, because the investors need a strong success story.

“We are willing and able to work with the rest progressively. When they have a massive capital plan that has a good balance, we will migrate them onto the market,” she explained.

According to an article published by African Markets on February 14, 2023, SIGA Director General Edward Boateng said in an interview with Graphic Business that the country needs to be cautious about listing of some of its state-owned companies.

He said the country must be careful not to list some of its strategic assets, which could cause them to fall into foreign hands.

Ghanaians are not the only ones investing in the capital market, with funds coming in from Abu Dhabi, Toronto, and all over the world. On the bourse, 60 per cent of trades are by foreign investors.

Mr Boateng said the country must, therefore, ensure that there is local capacity such that when some of these strategic SOEs are listed, the local entrepreneurs and local institutions could take them up.

“So, we are looking at all those options but definitely some of these SOEs are going to be listed on the stock exchange or in some cases privatised or divested off government hands so that government can focus on its core mandate,” he stated.

The importance of SOEs in Ghana cannot be overstated. Despite controlling around half of the country’s assets, they contribute just five per cent to the country’s gross domestic product (GDP). This under performance has largely been due to mismanagement, which has led to some legacy debts, making it difficult for them to raise additional capital to expand their businesses. As a result, many of these SOEs have made appeals to the government to assist them in recapitalizing their businesses.