- Fruit exports played a pivotal role in bolstering Kenya’s agricultural sector, posting a surge of 84.3 per cent to 59,684.5 metric tonnes in September this year.

- Kenya’s vegetable exports reached 20,427.1 metric tonnes, while tea production soared to 138,771.6 metric tonnes in the quarter under review.

- Other sectors that experienced notable growth were financial, ICT as well as the accommodation and food service industries.

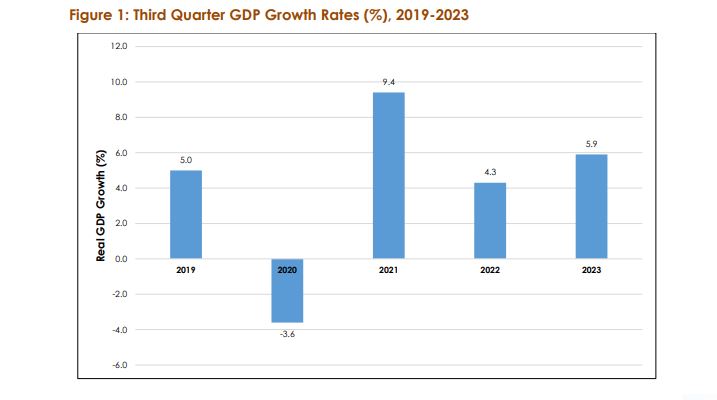

Kenya’s GDP growth witnessed an upswing, with the real Gross Domestic Product increasing by 5.9 per cent in the third quarter of 2023. This marked a substantial improvement from the 4.3 per cent recorded during the same period in 2022, signaling positive momentum in the country’s economic landscape.

This GDP growth can be primarily attributed to the increasing production and export volumes of agricultural products including fruits and vegetables. The uptick of East Africa’s giant economy underscores its resilience and adaptability in the face of various economic challenges including high fuel prices, inflation and interest rates.

In an update released Friday, just days to the end of 2023, the Kenya National Bureau of Statistics (KNBS) sheds light on key contributors to this growth, highlighting significant expansions in various sectors. Notably, the financial and insurance sector experienced a robust growth of 14.7 per cent, while information and communication activities surged by 7.3 per cent.

However, the most notable leap was seen in the accommodation and food service sector, which exhibited an extraordinary growth of 26.0 per cent. KNBS attributes this growth to a substantial increase in visitor arrivals, highlighting the pivotal role of tourism in propelling Kenya’s economic advancement.

Despite the overall positive trajectory, some sectors faced challenges, as evidenced by the dip in Gross Value Added (GVA) for transportation and storage activities, which decreased to 2.8 per cent during the review period. The high cost of petroleum fuels played a role in this decline, contributing to the reduction from 5.1 per cent reported in the third quarter of 2022.

Kenya’s GDP growth sectoral analysis: agriculture, forestry and fishing

The agricultural sector in Kenya experienced a remarkable turnaround, exhibiting a substantial growth of 6.7 per cent in the quarter under review. This positive shift marked a significant improvement from the corresponding quarter of 2022, which saw a contraction of 1.3 per cent.

The key driver behind this strong performance was the favorable weather conditions that characterized the first nine months of 2023, providing an optimal environment for agricultural activities to flourish.

Fruit exports played a pivotal role in bolstering agricultural sector, showcasing a surge of 84.3 per cent. The export figures increased from 32,388.1 metric tonnes in the third quarter of 2022 to 59,684.5 metric tonnes during the period under review.

Similarly, both vegetable exports and tea production experienced noteworthy upticks, recording growth rates of 35.4 per cent and 28.0 per cent, respectively. Vegetable exports reached 20,427.1 metric tonnes, while tea production soared to 138,771.6 metric tonnes in the period. Furthermore, the intake of milk by processors witnessed a positive upswing, contributing to the overall robustness of the agricultural sector.

However, amidst these successes, the sugarcane subsector faced a downturn. KNBS said cane deliveries experienced a substantial decline of 55.1 per cent, dipping from 1,944.7 thousand metric tonnes in the third quarter of 2022 to 874,000 metric tonnes by September this year.

This decline highlights the challenges faced by certain segments of the agricultural industry, underscoring the need for strategic interventions to address specific issues and ensure the overall resilience of the sector.

Manufacturing powered by milk, tea processing

Kenya’s manufacturing sector demonstrated notable growth in the period, expanding by 2.6 percent, a marked improvement from the 1.8 per cent growth recorded in the corresponding quarter last year.

The positive trajectory in the manufacture of food products played a significant role, primarily supported by the processing of dairy and tea products. Milk deliveries to processors witnessed a substantial increase, surging by 12.5 per cent to 210.4 million litres from 187 million litres recorded in the third quarter of 2022.

Additionally, tea production experienced a commendable uptick, rising to 138,800 metric tonnes from 108,400 metric tonnes in the third quarter of 2022.

However, the growth of the food products segment faced constraints due to challenges in sugar processing, resulting in a significant decline of 56.1 per cent in sugar production. The third quarter of 2023 saw sugar production stand at 77,700 metric tonnes, reflecting the difficulties within this specific subsector.

On the other hand, the non-food products segment contributed to the overall growth, with the production of cement playing a pivotal role. Cement production grew by 6.8 per cent, reaching 2,541,800 tonnes in the third quarter of 2023.

The growth in the manufacturing sector was complemented by a noteworthy increase in credit advanced to enterprises within the sector. As of September 2023, credit extended to manufacturing enterprises amounted to US$3.98 billion (KSh620.9 billion), a significant rise from US$3.26 billion (KSh508.8 billion) recorded in September 2022. This infusion of credit speaks to the support and investment in the manufacturing sector, underscoring its vital role in Kenya’s economic landscape.

Read also: EPA pact paves the way for a surge in EU investments in Kenya

Electricity supply contracts by 1.9 per cent

The electricity and water supply sector in Kenya experienced a contraction of 1.9 per cent in the third quarter of 2023, marking a notable slowdown from the robust 6.0 per cent growth observed in the corresponding quarter of 2022.

Despite this deceleration, the sector continued to play a crucial role in the nation’s infrastructure. Total electricity generated during the third quarter of 2023 remained relatively stable, standing at 3,287.0 million kilowatt hours (KWh), comparable to the levels realized in the same quarter of the previous year.

Within the energy mix, geothermal power generation showcased positive growth, increasing from 1,521.8 million KWh in the third quarter of 2022 to 1,529.6 million KWh in the period under review. Similarly, hydropower generation witnessed an uptick, rising from 753.0 million KWh in the third quarter of 2022 to 785.4 million KWh in the corresponding quarter of 2023.

However, the thermal power generation recorded a decline of 4.4 per cent, standing at 328.1 million KWh in the third quarter of 2023. Wind power production also faced a setback, experiencing an 11.5 per cent decline from 594.7 million KWh in the third quarter of 2022 to 526.42 million KWh in the quarter under review.

Construction sector expands on cement consumption

The construction sector grew by 3.8 per cent in the quarter under review, surpassing the 3.5 per cent growth recorded in the third quarter of 2022. Cement consumption played a pivotal role in this positive trajectory, escalating by 5.9 per cent to reach 2.43 million metric tonnes during the review period, in contrast to the third quarter of 2022.

The quantity of imported bitumen also experienced a substantial expansion, surging by 24.6 per cent from 24,929.5 tonnes in the third quarter of 2022 to 31,053.5 tonnes in the period under review.

Conversely, the volume of imported iron and steel exhibited a slight contraction, decreasing from 198,800 tonnes in the third quarter of 2022 to 198,100 tonnes in a similar period in 2023. Additionally, the value of building plans approved in Nairobi City County witnessed a decline, falling from US$278.8 million (KSh45.3 billion) in the third quarter of 2022 to US$237.2 million (KSh37.0 billion) in the third quarter of 2023.

Despite these variations, credit extended to enterprises in the construction sector demonstrated a positive trend, increasing by 8.6 per cent to stand at US$958.97 million (KSh149.6 billion) as of September 2023. This financial support reflects a commitment to sustaining growth and development within the construction industry.

Transportation and storage slows to 2.8 per cent on high fuel costs

Kenya’s transportation and storage sector exhibited a slower pace of activities in the third quarter of 2023 in comparison to the corresponding quarter of 2022. The estimated growth for the sector stood at 2.8 per cent, a decrease from the 5.1 per cent growth observed in September last year.

However, this growth was primarily buoyed by key components such as transport via railway, port activities, and air transportation. Freight transported through the Standard Gauge Railway (SGR) experienced an upswing, reaching 1.74 million metric tonnes in the quarter under review, surpassing the 1.57 million metric tonnes transported during the third quarter of 2022.

Moreover, the number of passengers using the SGR witnessed a notable increase of 13.9 per cent, rising from 615,760 in the third quarter of 2022 to 701,132 in the review period.

Port throughput also demonstrated a positive trend, recording a growth of 4.7 per cent during the review quarter, a significant improvement compared to the 0.9 per cent growth observed in the similar quarter of 2022.

The period under review also saw a substantial increase in visitor arrivals into the country, indicating positive developments in the tourism sector. However, the consumption of diesel, a crucial input for land transportation, experienced a slight decline of 2.3 per cent, standing at 557,600 metric tonnes in the third quarter of 2023.

Read also: Kenya’s tourism sector growth impressive in the first half of 2023

Accommodation and food service grows by 26 per cent

The sector experienced robust growth of 26.0 per cent in the third quarter of 2023, marking a significant increase from the 16.9 percent expansion observed in the same quarter of 2022.

This growth was attributed in part to the accelerated influx of visitors, particularly during the Africa Climate Summit Conference held in September 2023. Additionally, the sector benefitted from the country’s stabilization following the uncertainties associated with elections in the third quarter of 2022.

Arrivals through Jomo Kenyatta International Airport (JKIA) and Mombasa International Airport (MIA) played a pivotal role in this surge, recording impressive growth rates of 27.5 per cent and 95.6 per cent, respectively.

The quarter under review saw a total of 410,926 visitors arriving through JKIA, while MIA welcomed 40,515 visitors. This substantial increase in visitor numbers underscores the positive impact of international events and the country’s political stability on the growth of the tourism sector.

Information and communication grows on voice, internet and cashless deals

In the third quarter of 2023, the information and communication sector exhibited a growth rate of 7.3 per cent, a slight decrease from the 11.8 per cent growth recorded in the corresponding quarter of 2022. The sector’s expansion was fueled by notable increases in voice traffic, internet usage, and mobile money transactions.

Domestic voice traffic, in particular, saw a substantial rise of 17.3 per cent, surging from 19.0 billion minutes in the third quarter of 2022 to 22.2 billion minutes in the reviewed quarter. Moreover, the total utilized international bandwidth experienced a significant increase, climbing from 6,132.8 Gigabits per second (Gbps) in the third quarter of 2022 to 10,964.9 Gbps during the third quarter of 2023, KNBS data shows.

Mobile money transactions further contributed to the sector’s growth, witnessing a notable uptick of 7.7 per cent from 569.3 million transactions in the third quarter of 2022 to reach 613.0 million transactions in the third quarter of 2023. However, in contrast, the use of domestic Short Messaging Services (SMSs) exhibited a decline, contracting by 14.2 per cent from 14.2 billion messages in the third quarter of 2022 to 12.2 billion messages in the current reporting period.

Financial and Insurance Activities boost Kenya’s GDP growth

The financial and insurance expanded by 14.7 per cent, a notable increase from the 9.6 per cent growth observed in the corresponding quarter last year. Notably, during the period under review, the Central Bank Rate underwent an upward revision, reaching 10.50 per cent in September 2023 compared to 8.25 per cent in September 2022.

This adjustment had implications for the cost of credit issued by commercial banks, with average interest rates on loans and other advances increasing to 13.98 per cent in September 2023, up from 12.41 per cent in September last year. Simultaneously, the interbank rate experienced a substantial rise from 4.36 per cent to 12.36 per cent over the same period.

The average yield for 91-day Treasury Bills witnessed improvement, reaching an average of 14.38 per cent in September 2023 compared to an average of 8.92 per cent in September 2022. This positive shift was largely influenced by the depreciation of the Kenyan Shilling.

Speaking of the currency, the Kenyan Shilling exhibited depreciation against major international trading currencies during the third quarter of 2023 in contrast to the corresponding quarter of 2022.

On average, the Kenyan Shilling conceded ground against the Euro, Pound Sterling, US Dollar, and Japanese Yen by 30.3 per cent, 29.7 per cent, 20.6 per cent, and 15.3 per cent, respectively. Additionally, the local currency notably depreciated against the South African Rand, Tanzania Shilling, and Uganda Shilling.