- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Kenya Shilling

- Fruit exports played a pivotal role in bolstering Kenya’s agricultural sector, posting a surge of 84.3 per cent to 59,684.5 metric tonnes in September this year.

- Kenya’s vegetable exports reached 20,427.1 metric tonnes, while tea production soared to 138,771.6 metric tonnes in the quarter under review.

- Other sectors that experienced notable growth were financial, ICT as well as the accommodation and food service industries.

Kenya’s GDP growth witnessed an upswing, with the real Gross Domestic Product increasing by 5.9 per cent in the third quarter of 2023. This marked a substantial improvement from the 4.3 per cent recorded during the same period in 2022, signaling positive momentum in the country’s economic landscape.

This GDP growth can be primarily attributed to the increasing production and export volumes of agricultural products including fruits and vegetables. The uptick of East Africa’s giant economy underscores its resilience and adaptability in the face of various …

- The Kenyan shilling has fallen to a new low of 140.04 against the US dollar.

- Central Bank of Kenya data shows the unit is also losing to other major currencies including British Pound and Euro.

- Last year, the Kenyan shilling depreciated by about 7.5 per cent against the US dollar, the UAE dirham (7.5%), Saudi Riyal (7.4%) and the Chinese Yuan (3.1%), the Kenya Economic Survey 2023 shows.

As developing market currencies continue to suffer from the worldwide increase in interest rates, which is being spearheaded by the US Federal Reserve, the Kenyan Shilling has dropped to a historic low in relation to the US Dollar.

The Fed has increased the benchmark rate ten times in a row, or a total of five percentage points, since March of last year. In the last 40 years, these increases are the most abrupt. In an effort to combat US inflation, interest rates …

- The government of Kenya is deploying measures to protect local industries from the onslaught of cheap imports.

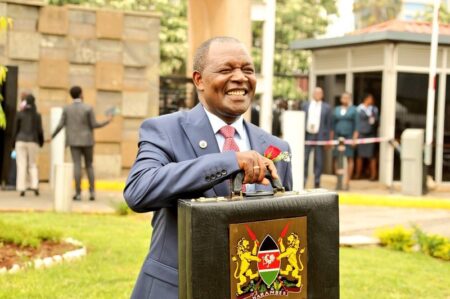

- Kenya’s $26.4 billion FY2023/24 budget is an increase from $23.6 billion plan for the fiscal year ending June 30.

- The country is, however, facing high inflation, ballooning debt, and a high rate of joblessness.

President William Ruto’s first $26.4 billion budget for the FY2023/24 starting July 1st seeks to boost job creation, power growth of industries, and reduce borrowing.

Kenya’s $26.4 billion FY2023/24 budget is an increase from the $23.6 billion plan for the fiscal year ending June 30. East Africa’s economic powerhouse, Kenya, continues to struggle with growing inflation, skyrocketing debt, and a high unemployment rate.

Job creation targets Kenya’s youth

The lack of enough jobs is disproportionately affecting the country’s young people. The economy is also struggling from the impact of external shocks. For instance, Kenya is hurting from the Russia-Ukraine …

- Weaker currencies make the fight to tackle inflation harder given Africa’s dependence on imports.

- According to the IMF, the average depreciation for the region since January 2022 is about eight percent, but events vary by country.

- Ghana’s cedi and Sierra Leone’s leone depreciated by over 45 percent. An analysis by The Exchange Africa shows the Kenya shilling has shed about 18.4 per cent since May last year.

Most African currencies have weakened against the US dollar, fanning inflationary pressures across the continent as import prices surge, IMF now says. This, together with a growth slowdown, leaves policymakers with difficult choices as they balance keeping inflation in check with a fragile recovery.

According to the IMF, the average depreciation across Africa since January 2022 is about eight percent though events vary by country. Ghana’s cedi and Sierra Leone’s leone depreciated by more than 45 per cent.

An analysis by The Exchange …

- The Kenya Shilling depreciated by 0.9% against the US Dollar to close the month of November at KSh 122.4, from KSh 121.3 recorded at the end of October 2022

- A Cytonn Investments report has partly attributed the depreciation to increased dollar demand from importers, especially oil and energy sectors, against a slower supply of hard currency

- The report said it expects the Kenya shilling to remain under pressure for the rest of the year owing to several factors, such as rising oil prices

The Kenya Shilling depreciated by 0.9% against the US Dollar to close the month of November at KSh 122.4, from KSh 121.3 recorded at the end of October 2022.

A report by Cytonn Investments has partly attributed the depreciation to increased dollar demand from importers, especially oil and energy sectors, against a slower supply of hard currency.

For instance, in the last week of the month, the …

The Kenya shilling depreciated by 0.7 percent against the US Dollar to close the month of July at Sh108.6, from Sh107.9 recorded at the end of June 2021, mostly attributable to increased dollar demand from general importers.

Data collected by Cytonn Investments further reveal that last week, the shilling depreciated by 0.4 percent against the US dollar to close the week at Sh108.6, from Sh108.2 recorded the previous week.

This was partly attributable to the build-up of dollar demand from energy importers as they meet their end of the month hard currency obligations.

On a year to date basis, the shilling has appreciated by 0.5 percent against the dollar, in comparison to the 7.7 percent depreciation recorded in 2020.

Despite the recent appreciation of the shilling, analysts from the investment firm expect the shilling to remain under pressure in 2021.

This will be as a result of several factors among …

The Kenya Shilling showed the first sign of loosing ground against major currencies since the Central Bank of Kenya introduced new notes and decided to recall the Ksh 1, 000 note in order to curb illicit flow.

Commercial banks have quoted the Shilling trading against the US dollar at Ksh 101.95/102.15 per dollar, compared with 101.80/102.00 at last week’s close. This weakening despite being marginal is the highest rate the currency has traded this year. (https://richmondartcenter.org/)

At the beginning of June, Central Bank of Kenya announced measures to introduce new currencies meeting a long overdue constitutional requirement to introduce new faces of the currency. In doing so, the CBK governor also announced that the Ksh 1,000 note in circulation was to be recalled and removed from the list of legal tender in Kenya due to illicit use in the country and the region.

Holders of the old …

The Kenya shilling is arguably the strongest currency among the East Africa Community (EAC) member states, giving the region’s economic power house a competitive edge over her peers in international trade.

READ:Here are Kenya’s biggest trading partners

However, the country has been operating a managed shilling than a free float currency, running a risk of making its exports more expensive in the short run as compared to competitors, eventually causing a reduction in export earnings and the economy’s growth, a report by Amana Capital has established.

Amana’s “Kenya’s Economic Puzzle – Putting the pieces together” report highlighted that 10 years ago, the Consumer Price Index (CPI) stood at 97 but has since shot up to 192 to date, meaning what the value Ksh100 (USD0.99) could buy in January 2009 can only buy 50 per cent of that now.

This translates into a 50 per cent devaluation of the purchasing …