- Zimbabwe’s Minister of Finance, Economic Development, and Investment Promotion has unveiled a significant policy shift regarding the levy on sugar content in beverages.

- This measure is scheduled to take effect from January 1, 2024, to discourage the consumption of high-sugar beverages.

- While introducing the sugar content levy is presented as a measure to address health concerns, its impact on consumers, beverage industries, and the healthcare sector remains uncertain.

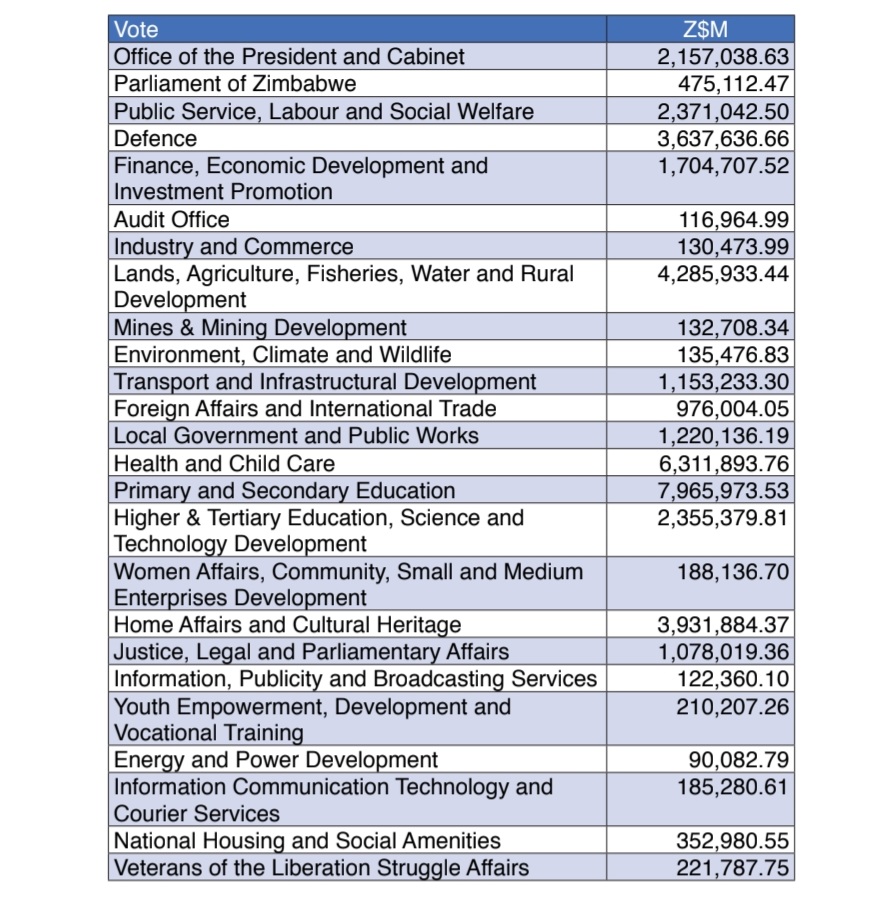

The 2024 National Budget Speech, presented to the Parliament of Zimbabwe by Prof. Mthuli Ncube, Zimbabwe’s Minister of Finance, Economic Development, and Investment Promotion, has unveiled a significant policy shift regarding the taxation of sugar content in beverages.

Citing global concerns about the health implications of high sugar consumption, especially in beverages, Minister Ncube acknowledged the worldwide trend of implementing sugar taxes, including in the Southern African Development Community (SADC) region. The proposed policy change is driven by the adverse health effects associated with the consumption of beverages with high sugar content, which increase the risk of non-communicable diseases.

In response to these concerns, Minister Ncube proposed the introduction of a levy amounting to US$0.02 per gram of sugar contained in beverages, excluding water. This measure is scheduled to take effect from January 1, 2024, to discourage the consumption of high-sugar beverages.

How Levy on Sugar Content of Beverages funds are going to be utilized

A notable aspect of this policy change is allocating funds generated from the sugar content levy. These funds will be ring-fenced specifically for procuring cancer equipment for diagnosis and therapy. The targeted allocation reflects an effort to address healthcare infrastructure challenges, particularly in the context of cancer care.

Read also: Econet Wireless Zimbabwe adopts eSim to align with global trend

Levy on sugar content of beverages in South Africa

Following the recent announcement by Zimbabwe’s Minister of Finance regarding the introduction of a levy on sugar content in beverages, a similar development is unfolding in South Africa. South Africa’s Minister of Finance, Enoch Godongwana, in his 2023–2024 budget speech, revealed plans to extend the Health Promotion Levy (HPL) on sugary beverages to include pure fruit juice. Pending public input, a levy could be imposed on 100 per cent juice, aligning with the primary goal of the sugary beverage levy: to reduce incidents of diabetes and obesity.

The HPL is currently calculated at a fixed rate of 2.1 cents per gram of sugar content exceeding four grams per 100 ml. The first four grams per 100 ml are currently exempt from the levy. This levy is in addition to any other Customs and Excise duty payable. Both intrinsic and added sugar and other sweetening materials contribute to the sugar content calculation. For powder and liquid concentrates, the sugar content is calculated based on the total volume of the prepared beverage. The government raised about US$116.6 million (R2.2 billion) from the so-called health promotion levy on sugar-sweetened drinks in the fiscal year through March 2022.

While introducing the sugar content levy is presented as a measure to address health concerns, its impact on consumers, beverage industries, and the healthcare sector remains uncertain. Critics argue that it has negatively impacted the South African sugar industry. According to Virusha Subban, Partner and Head of Tax, and Kamogelo Mashigo, Candidate Attorney at Baker McKenzie, thousands of jobs have reportedly been lost since the tax’s implementation. The proposed extension to pure juice is predicted to result in an additional estimated 5,000 job losses.

Legal experts and industry stakeholders, including the Consumer Goods Council of South Africa (CGCSA), have criticized the expansion of the ‘sugar tax.’ They argue that it could lead to the loss of sustainable livelihoods for sugar farmers, contributing to further job losses. Additionally, concerns have been raised about the utilization of funds collected through the sugar tax, with only a small percentage allocated to promoting healthy living.

Levy on sugar content of imported beverages

However, the budget did not explicitly address whether the proposed levy would apply to imported beverages.

The Competition and Tariff Commission (CTC) confirmed in its latest quarterly report that Zimbabwe imports energy drinks from Zambia and South Africa using SADC preferential rates and/or COMESA. Under the Trade Kings group, the Zambian company has increased supplies of its Mojo and Wild Cat energy drinks brands in Zimbabwe.

Zimbabwe National Statistics Agency (ZIMSTATS) trade data show that Zimbabwe’s imports of energy drinks rose from 416 528 to 29 869 862 units between 2019 and 2022. In response, in the 2022 budget, Finance Minister Mthuli Ncube imposed a tax of US$5.00 cents for every litre of energy drink imported into the country.

According to the Competition Commission, “traditional trade defence tools” such as import prohibitions, quotas, and tariff hikes violate trade agreements under SADC and COMESA.