- Ratings agency Moody’s has downgraded Kenya’s local and foreign-currency long-term issuer ratings to Caa1 from B3, with a negative outlook.

- This downgrade ushers the economy into an era of reduced capacity to rollout revenue-based fiscal consolidation.

- The move also has broader implications for the country’s near-term economic stability.

East Africa’s giant economy is at a pivotal moment following ratings agency Moody’s move to downgrade its local and foreign-currency long-term issuer ratings to Caa1 from B3, with a negative outlook.

This downgrade, which comes just a week after a three-week nationwide revolt forced the government to shelve the Finance Bill 2024, ushers the economy into an era of reduced capacity to roll out revenue-based fiscal consolidation. This negative outlook also has broader implications for the country’s near-term economic stability, Moody’s states.

Kenya’s fiscal consolidation challenges amid negative outlook

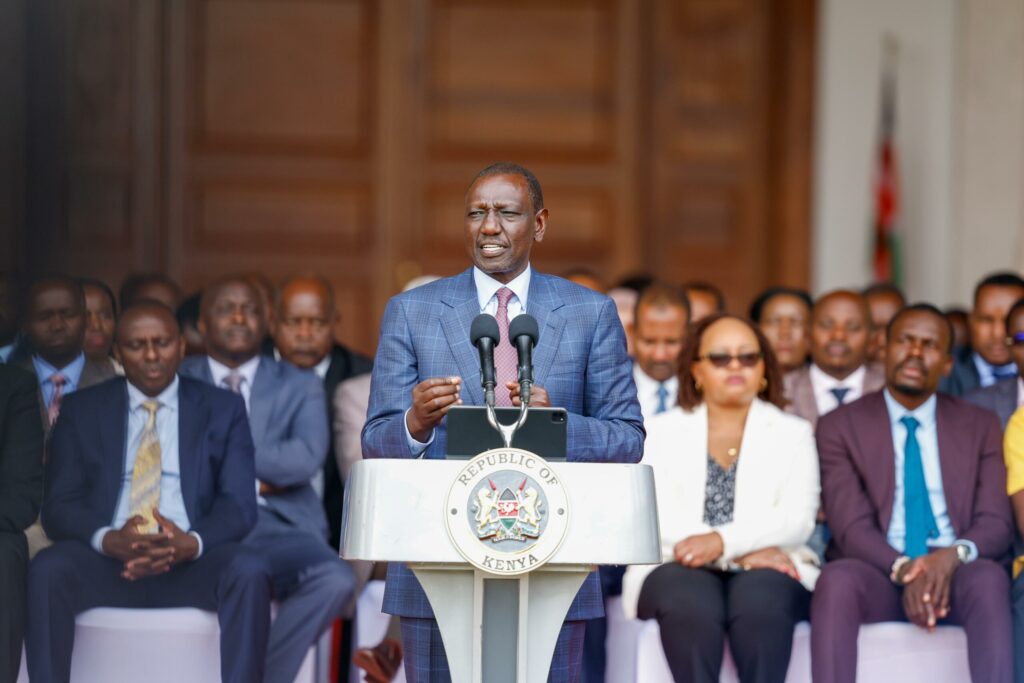

Moody’s downgrade signals the Kenyan government’s shift away from planned tax increases, opting instead for expenditure cuts to reduce the current fiscal deficit. This policy change, driven by heightened social tensions and protests against the Finance Bill 2024, marks a huge deviation from previous fiscal strategies that banked on revenue-raising measures.

The Finance Bill 2024 aimed to increase revenue by $2.69 billion or KES346 billion (1.9 percent of GDP), but these plans were abandoned in favour of reducing spending by $1.38 billion or Kes177 billion and increasing borrowing. As a result, Kenya’s fiscal deficit is expected to narrow more slowly than previously anticipated, with projections indicating average deficit of 4.4 percent of GDP for fiscal years 2025 and 2026.

“In the context of heightened social tensions, we do not expect the government to be able to introduce significant revenue-raising measures in the foreseeable future. As a result, we now expect the fiscal deficit to narrow more slowly, with Kenya’s debt affordability remaining weaker for longer. In turn, larger financing needs stemming from a wider deficit increase liquidity risk against more uncertain external funding options,” Moody’s statement reads in part.

Although the 4.4 percent fiscal deficit in 2025 is an improvement from the 5.9 percent deficit in fiscal 2024, it represents a slower pace of expenditure cuts rather than revenue increases limits the support for debt affordability, a critical weakness for Kenya.

Read also: Kenya’s Parastatal Set for Privatisation Declared Insolvent Over $71m Debt

Impact on Kenya’s debt affordability

Kenya’s debt affordability is set to deteriorate further due to the increased interest payments resulting from the government’s fiscal strategies. The interest-to-revenue ratio is expected to rise to 33 percent in fiscal 2025 from 30 percent in fiscal 2024, indicating that the economy is set to encounter fiscal constraints.

Despite the Central Bank’s efforts to ease monetary policy and the appreciation of the Kenya Shilling, domestic borrowing costs remain elevated in the country.

President William Ruto’s administration’s plan to reduce spending faces huge implementation risks, Moody’s highlighted. More than half of Kenya’s government spending in fiscal 2025 is categorized under Consolidated Fund Services, which includes statutory obligations and allocations that are generally non-discretionary. Efforts to reduce spending involve dissolving 47 state-owned enterprises, suspending new hiring in public service, and accelerating the retirement of workers above the retirement age of 60.

However, these measures primarily target discretionary items such as operations, maintenance, and development spending, which have already been significantly cut.

“Although development spending is more flexible, the development budget has already been reduced significantly. Further cuts will likely have a negative economic impact,” added Moody’s.

External shocks and increased liquidity risk

Kenya is vulnerable to external shocks that have the potential to increase spending needs throughout the year. Crop failures as witnessed in 2021 and 2022, reduced agricultural productivity, and extreme weather events necessitate emergency relief measures and infrastructure repair, further straining the government’s fiscal capacity. Larger fiscal deficits will increase the government’s borrowing requirements, adding pressure on domestic borrowing costs and liquidity risks.

Going forward, the government’s ability to secure external funding remains uncertain, noted Moody’s. While the International Monetary Fund (IMF) and the World Bank have been great sources of external financing, the government’s revised budget and fiscal policies could affect these relationships.

The IMF programs were expected to provide $976 million in external funding for fiscal 2025, but delays or complications could increase reliance on the domestic market, further elevating borrowing costs.

Implications for investor confidence

Uncertainty over Kenya’s fiscal trajectory and the government’s commitment to fiscal consolidation is likely to weigh investor sentiment. The government’s ability to access alternative sources of external funding, such as sustainability-linked bonds or Samurai bonds, will depend on its fiscal policies and credibility, noted Moody’s.

The increased borrowing requirements and elevated domestic borrowing costs could reduce investor appetite for government securities, challenging the government’s ability to service domestic debt.

President Ruto’s strategy to finance larger fiscal deficits through increased domestic borrowing has already contributed to elevated domestic borrowing costs. In fiscal 2024, Moody’s observed that the average interest rate on newly issued Treasury bonds was 17.8 percent, up from 14.4 percent in fiscal 2023. The need to roll over maturing Treasury bonds, coupled with higher borrowing costs, further exacerbates the government’s fiscal woes.

“Our forecast assumes the incremental borrowing by the government, from 3.3 percent of GDP in the original budget to 4.6 percent of GDP based on the latest estimates, will be met mainly through increased domestic borrowing,” explained Moody’s.

Long-term economic implications

Moody’s negative outlook reflects the downside risks related to government liquidity over the next few years. Larger financing needs and increased borrowing costs will amplify liquidity risks, complicating the government’s fiscal policy plans and potentially jeopardizing existing IMF programs.

The government’s ability to sustain improvements in capital and funding structure, asset quality, developmental impact, and overall enterprise risk management is crucial for stabilizing Kenya’s economic outlook.

Kenya’s exposure to environmental, social, and governance (ESG) risks further complicates its economic outlook. The country’s high levels of poverty, unemployment, and limited access to basic services, combined with environmental risks such as climate change and natural disasters, constrain its fiscal resilience.

Weak fiscal policy effectiveness, high levels of corruption, and weak rule of law also undermine investor confidence and economic stability, Moody’s warned.