In theory, a redesign begins with a problem.

According to the New York Times Magazine, redesigns fail when they address the wrong problem or something that really wasn’t a problem in the first place. While progress may entail change, change does not necessarily guarantee progress.

But a clever redesign, one that addresses the right problem in an intelligent fashion, improves the world, if just by a bit.

- Nigeria’s central bank announced that it plans to redesign the 200-, 500-, and 1000-naira notes in a bid to mop excess cash liquidity from the economy, take control of money supply and curb spiraling inflation.

- Among other benefits, the decision is a crucial step towards bringing back large volumes of money circulating outside the banking system.

- The central bank has President Buhari’s support to launch the new currency designs and he “is convinced that the nation will gain a lot by doing so.”

The Central Bank of Nigeria (CBN) has announced that it would redesign the country’s N200, N500 and N1, 000. The change would be done to reduce the amount of money in circulation and control inflation, according to the CBN Governor, Godwin Emefiele.

The CBN highlighted concerns of “illicit” funds in circulation, which it said bandits and kidnappers had been exploiting in perpetrating their crimes.

The regulator said as much as 85 per cent of currency in circulation were outside the vaults of the country’s banks, encouraging criminality, currency hoarding and reducing the efficacy of the central bank’s monetary policies.

Nigeria’s President Muhammadu Buhari agreed with the central bank’s plan to replace high-value currency notes will help the economy deal with currency counterfeiting, excess cash in circulation and address inflation.

The redesigning decision especially considering the short time frame could trigger a rush by the people to banks to dispose of old notes, as well as withdrawal, runs at automated teller machines immediately after the new notes come into circulation.

Rea: Money forgery: Tanzania adds security features to new bank notes

The Executive Director, Centre for the Promotion of Private Enterprise (CPPE) and former Director-General of the Lagos State Chamber of Commerce, Muda Yusuf, told The ICIR that rural dwellers who live far from where banking services are available would experience hardship dumping the old notes, as well as, initially, obtaining the new ones.

“There will be lots of long queues in the banking hall. It’s going to create lots of inconveniences for the people. The unbanked and the elderly may not be able to cope since we don’t have banks in most local government areas,” he said.

Research conducted by SBM Intelligence Nigeria, a notable research outfit, noted that it is typical for monetary authorities to redesign currency notes to make them difficult to counterfeit.

According to the research, more and more transactions are being consummated through transfers, especially at the business-to-business level. It noted, however, that at the business-to-consumer level, the economy is still largely cash-based.

The SBM report stated, “CBN sees the policy move as a means of bringing currency from outside the banking system into the banking system, thereby making monetary policy more effective in combating inflation.”

Part of the functions of the central bank is currency issuance and distribution within the country. Central banks are required to redesign, produce and circulate new local legal tender every five to eight years, but the naira has not been redesigned in the last 20 years.

In 1962, the currency form of Nigeria was changed, showing its status as an independent country, unlike before when it was under the British rule. The inscription ‘Federation of Nigeria’ was replaced with ‘Federal Republic of Nigeria’ on the notes.

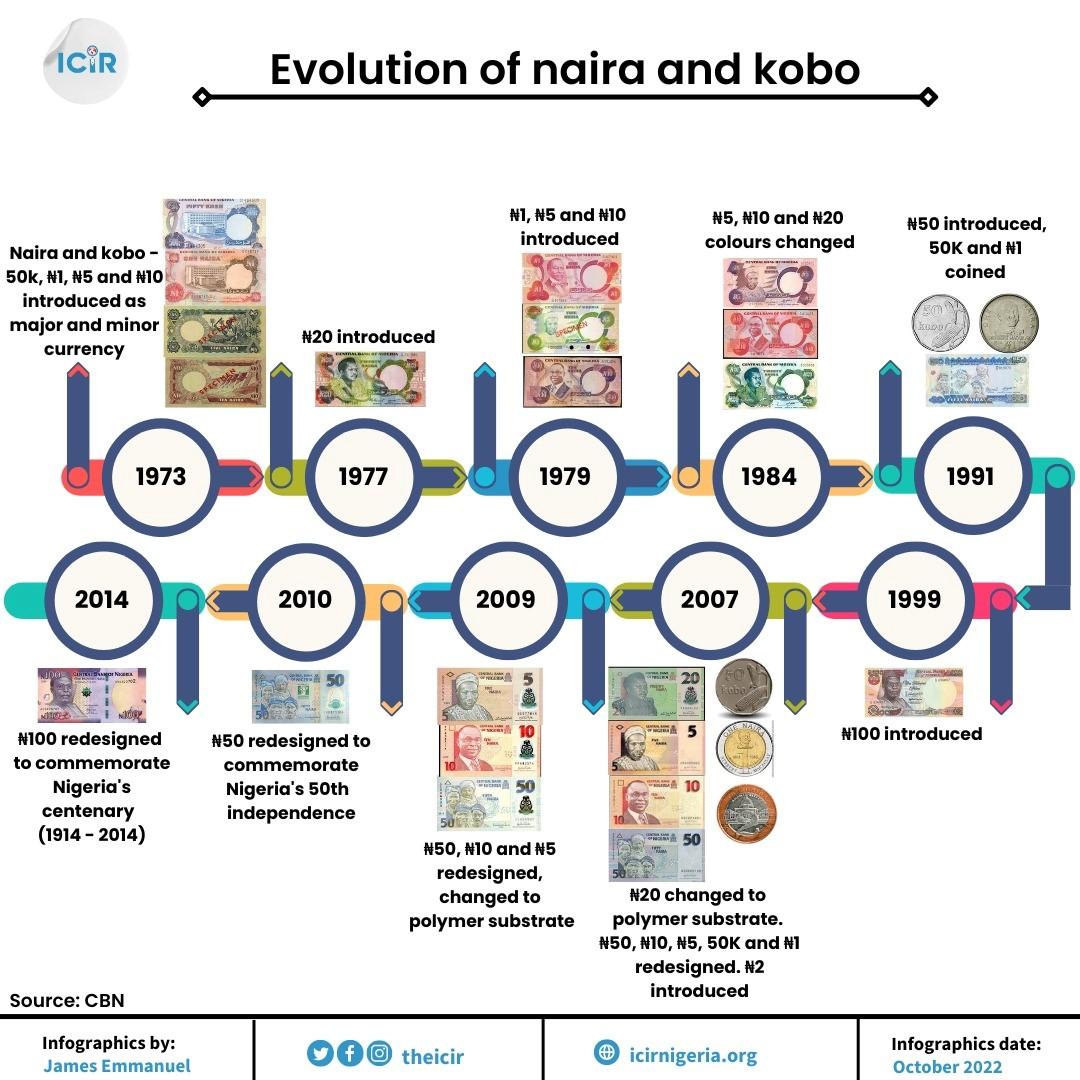

The name of the Nigerian currency was changed from pound to naira in 1973. A naira at the time was equal to 10 shillings while 100 kobo became one naira.

In 1977, a new ₦20 banknote was introduced. At that time, it was the big banknote in the country introduced by the CBN because of the development of the country’s economy. For the first time, the image of a prominent citizen was put on the banknote.

Three new banknotes were introduced, one naira, five naira and ten naira (₦1, ₦5, ₦10) in 1979. In order for people to be able to recognize and differentiate them, they were made of different colours. Then on the back of each of them, there was a picture that showed the culture of the country.

Around 1984, all the colours of the banknotes were changed except for the 50 kobo note which according to the authorities was to control the withdrawal of the money to foreign countries.

To expand the country’s economy and facilitate trade, banknotes ₦100, ₦200, ₦500 and ₦1000 notes were introduced in December 1999, November 2000, April 2001 and October 2005 respectively.

On February 28, 2007, as part of economic reforms, N20 was issued for the first time in polymer substrate, while the N50, N10 and N5 banknotes; as well as N1 and 50 kobo coins were reissued in new designs, and the N2 coin was introduced.

Also, on September 30, 2009, the redesigned N50, N10 and N5 banknotes were converted to polymer substrate following the successful performance of the N20 (polymer) banknote. Similarly, the apex bank, as part of its contribution towards the celebration of the 50th anniversary of Nigeria’s Independence and 100 years of its existence as a nation, had issued the N50 Commemorative polymer banknote on September 29, 2010; and the N100 Commemorative banknote on December 19, 2014.

The central bank explained that the proposed redesigning of the currency was sequel to the approval of President Muhammadu Buhari and that the circulation of the new banknotes would commence on December 15, 2022.

The central bank further insisted that it followed the law and due process to carry out the redesigning exercise, which is 12 years due.

CBN Director in charge of Corporate Communication, Osita Nwanisobi said the CBN management, in line with provisions of section 2(b), section 18(a), and section 19(a)(b) of the CBN Act 2007, duly sought and obtained the approval of President Muhammadu Buhari in writing to redesign, produce, release and circulate new series of N200, N500, and N1,000 banknotes.

Nwanisobi urged Nigerians to support the currency redesign project, stressing that some persons were hoarding significant sums of banknotes outside the vaults of commercial banks.