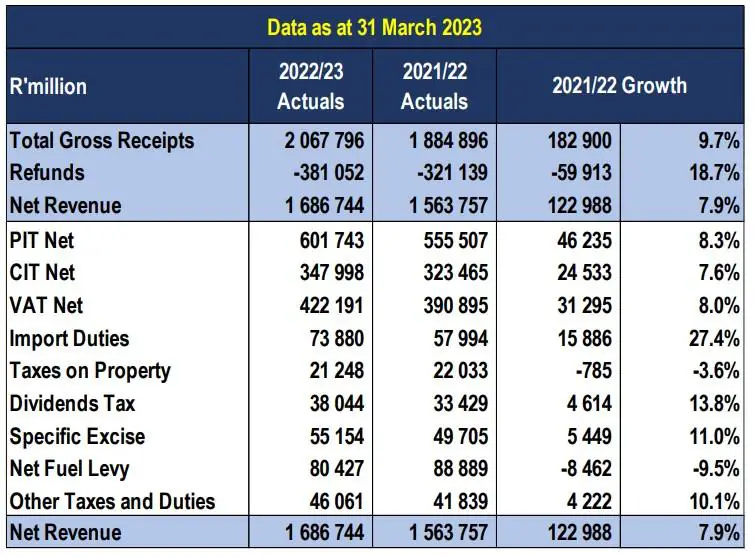

- The South African Revenue Service (SARS) has exceeded the 2022 revenue collection by R123 billion after collecting a net revenue of R1.687 trillion in the financial year that ended in March 2023.

- Gross tax revenue collected exceeded R2 trillion for the first time after gross revenue rose to R 2.068 trillion over the same period.

- The gross revenue collected excludes the refunds of R381.1billion, an 18.7 per cent growth or an increase of R60 billion from 2022.

The South African Revenue Service (SARS) has reported an impressive growth of 7.9 per cent in net revenue for the 2022/2023 financial year. The net revenue collected by SARS represents year-on-year an increase of 7.9 per cent over the net 2022 amount of R1563.8 billion ($872 billion).

SARS collected a record gross amount of R2067.8 billion. The net collection after payment of R381.1 billion in refunds is R1686.7 billion. This is the first time since it was formed that SARS collected more than R2068 Billion. The amount paid in refunds is also the largest ever paid since its formation.

The 2023 gross amount represents an increase of 9.7 per cent over the 2022 collection of R1884.9 billion, while the refunds paid for 2023 is an increase of 18.7 per cent over the 2022 amount of R321.1 billion. The 2023 net revenue collected represents year-on-year an increase of 7.9 per cent over the net 2022 amount of R1563.8 billion.

The net amount of R1687 billion must be seen against the 2021/22 outcome of R1.568 trillion, representing a year-on-year R123 billion increase.

“The achievement of R1.687 trillion represents a year-on-year growth of 7.86 per cent against a nominal GDP growth of around 5.8 per cent or a tax buoyancy of 1.38,” said SARS commissioner Edward Kieswetter.

The Minister of Finance, Mr Enoch Godongwana, in his 2023 Budget Speech, stated that “our country is reaping the benefits of a more efficient and effective tax administration that is building trust to increase voluntary compliance and boost revenue collections.”

Refunds returned to taxpayers

Refunds returned to taxpayers of R381 billion represents a year-on-year growth of 18.7 per cent. This is the highest quantum ever paid out in refunds, up R60-billion from last year. Just in VAT refunds the amount of R319 billion represents a growth of 21.5 per cent since last year.

Speaking at the revenue collection announcement in Pretoria, Kieswetter pointed out that this was the highest quantum of refunds ever paid out representing about 5 per cent of GDP.

“I remain concerned about the abuse, especially of our VAT refund system, but we are pleased that the R381-billion returned into the hands of taxpayers is good for the economy. In fact, refunds this year, represent about 5 per cent of GDP. It is further pleasing that R130-billion and R35-billion of the refund benefit, respectively, were directed to medium to small businesses and individual taxpayers. This is good when business and individuals remain cash strapped,” he said.

Compliance revenue, resulting from targeted interventions across all segments of taxpayers, yielded R227 billion in revenue, compared to last year’s figure of R215.4 billion. These interventions include focused debt collection, a focus on criminal and illicit activities, and declaration compliance among large businesses, among others.

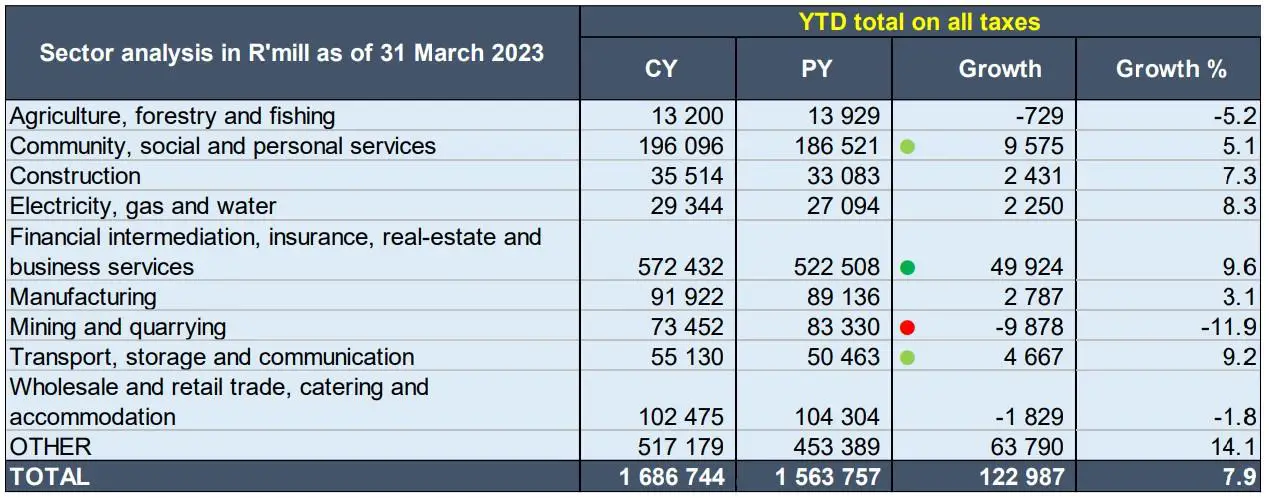

Sector contributions to total revenue collected

The biggest sector – the financial sector – contributed increased by R50 billion year-on-year to R572.43 billion, representing a contribution of 33 per cent to the overall tax pie.

Read: South Africa expects higher tax revenues buoyed by technology

Segments contributions to total revenue collected

The revenue contribution from the Large Business and International (LBI) Segment is R526 billion, a growth of 1.7 per cent year-on-year. This segment represents 32 per cent of total collection. The main sectors are Finance, Manufacturing, and Mining. The register consists of 43,823 active taxpayers, according to Kieswetter.

The revenue contribution from the Small, medium and micro segment (SMMEs) is R373-billion (11.2 per cent YoY). This segment represents 28 per cent of total collection. The main sectors are Finance, Manufacturing, Wholesale, Retail Trade, and Catering. The register consists of 3.2 million taxpayers.

The revenue contribution from the Importers and Exporters segment is R488.6-billion (15.6 per cent year-on-year). The register consists of 379 000 taxpayers. This segment represents 20 per cent of total collection.

According to Kieswetter, there are two segments which are newly established segments that are being grown. These are High Wealth Individuals (HWI) and Tax Exempt Institutions.

Revenue contribution from the former segment is R11-billion, and at present include 58000 taxpayers excluding related entities.

Revenue contribution from the latter segment is R14.9 billion, and covers 65,000 entities (PBO’s, NPO’s etc). However, the commissioner said the level of abuse and low compliance in this area remain a huge concern and SARS will step up its focus.

National Treasury Acting Director General, Ismail Momoniat says, he is confident SARS will still do its best.

“I think it’s going to be tough because if you are going to have low growth, and it does seem, if you look at SARB, IMF, they have even bleak projections and it depends on how much load shedding we are going to have. That’s the challenge we have to face, because the difficulty we face is that once we have set the revenue target, the estimate, that the minister set in the February Budget this year, the expenditure level is set, if you don’t, then you just get higher deficit, more borrowing. That’s the risk that we face. But I’m confident that SARS will still do the best that it can, and of course, the economy is a determining factor of what the revenue will be.”

Read: South Africa: Retail sales declined by 0.8 per cent year-on-year in January