In your copy of The Exchange this month

*How AI will change the landscape for Africa

*Understanding the tough times African economies will face as the global business slows

*Gold for Oil: How Ghana aims to rebuild its economy

*Democracies and Elections in Africa in 2023

*Achieving Nuclear Energy in Africa

Guinea has announced a single-use plastic ban, signalling the growing momentum of the African plastic ban movement. Guinea prohibits the production, import, sale, and…

Last year, the mining sector suffered 6.5% contraction, attributable to a dip in production of titanium and soda ash minerals. Overall, Kenya’s total earnings…

The UAE, Saudi Arabia, and Qatar, have poured billions into developing airports, airlines, and seaports across Eastern Africa in the last 10 years. In…

Africa must invest in human development to catch up to the Fourth Industrial Revolution (4IR). There is a need for policy commitment to developing…

Under a new COMESA programme, farmers in the five East African countries are expected to access quality seeds, and training on how to improve…

For the first time, the China-Africa Economic and Trade Expo (CAETE) came to Africa, with Nairobi playing host last week. According to the Ministry…

International arrivals increased from 1.48 million in 2022 to 1.95 million as the sector turned around from lows of 569,848 at the peak of…

Kenya is keen on extending its pipeline to Malaba (Kenya-Uganda border), with Uganda expected to construct a link line to Kampala. According to the…

Tanzania to earn $400 million annually from tobacco export/sells. The country now ranks second largest tobacco producer in Africa after Zimbabwe. Tobacco has no…

Shell Nigeria is selling off major stakes in the west African country. Critics blame the government of Nigeria for allowing the sell at a…

Every year, the Serengeti wildebeest migration involves the movement of vast herds of gnu, zebras, and gazelles. It is a tourism spectacle that sees…

Tanzania’s coffee industry enjoyed a bumper harvest of beans in the 2022/23 season, earning the economy an impressive $238 million. Coffee is the East…

A staggering $8 trillion would be invested in installing renewables to achieve COP28 renewable targets. The report finds that COP28 renewable targets must continue…

Analysts observe numerous loopholes in global climate talks, with a failure to address glaring food security concerns. Financial commitments for food systems remain low,…

Tanzania sugar shortage is sparking unrelenting hike in prices. The government of Tanzania has approved the import of over 100,000 tonnes of sugar. President…

Sports industry in Africa is expected to grow by 8 percent in 3 to 5 years according to advisory giant PwC Currently, milions of…

Kenya-DRC and Tanzania-DRC Corridors have been identified as the key links that will drive East Africa trade. Within the Southern Africa region, higher integration…

The ongoing conflict in the Gaza Strip, Palestine, is threatening to impose a new burden on food security systems in Africa. African economies find…

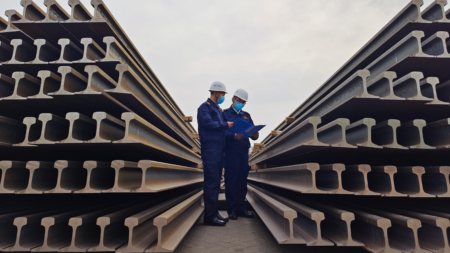

Ongoing China’s real estate crash is causing a ripple effect in the steel industry. Market prices for steel have fallen sharply in Asia amid…

Kenyan Shilling, which has been on a free-fall against the Dollar since mid-last year, fell to a record-low of 162 to the greenback with…

Uganda has moved to the East African Court of Justice (EACJ) over alleged Kenya’s move to block it from importing its refined petroleum products.…