- In this article, we will explore the top-rated replica Breitling watches that offer an authentic look, precision, and exclusivity.

- Here you can find various series of fake watches, best assurance, and fast delivery.

- The largest & most trusted name to buy ultimate Rolex replica watches. Best selection, Free shipping, paypal payment only at Replica Valley online store.

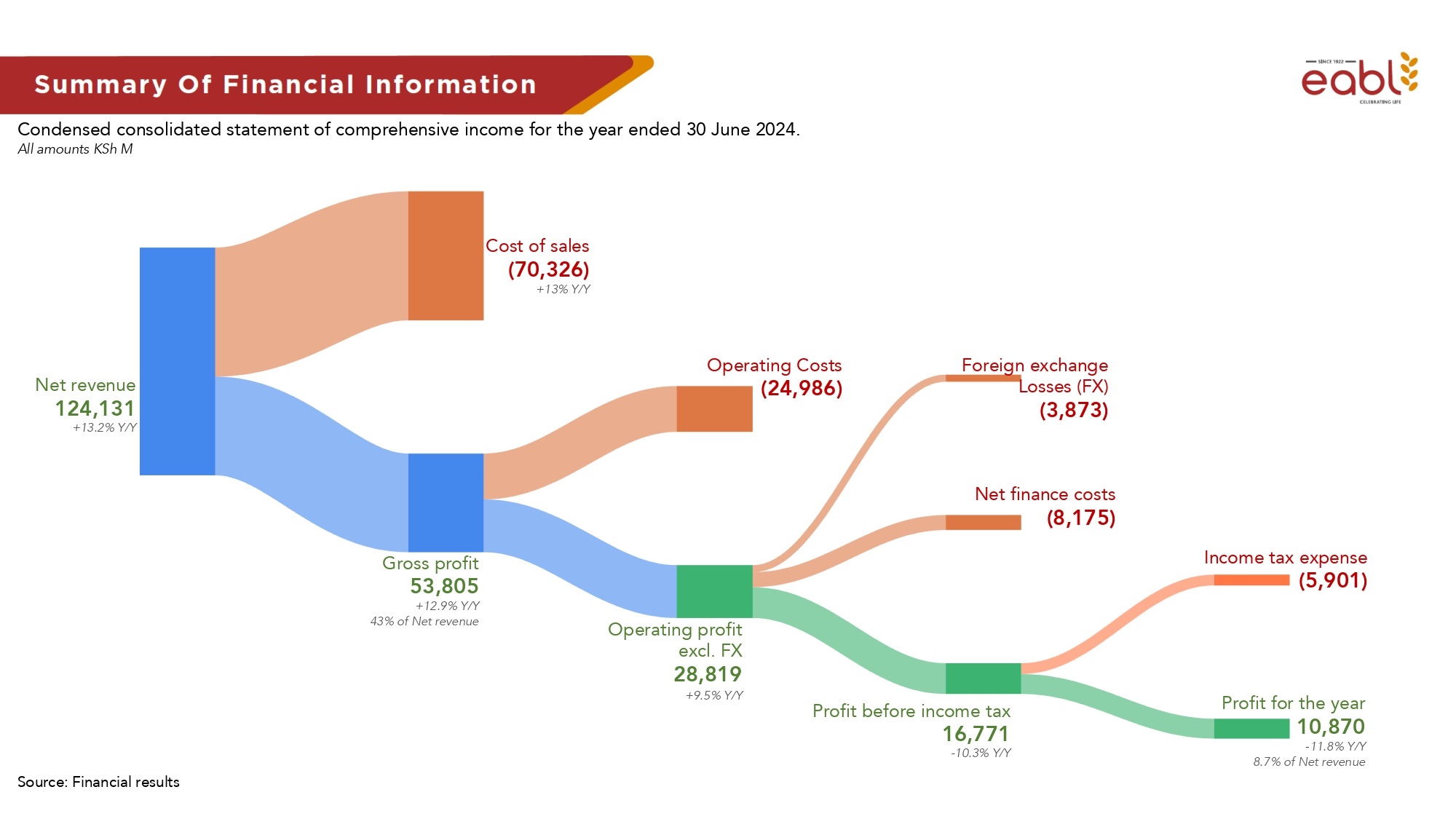

- EABL recorded strong topline and operating profit growth in a challenging market.

- Net sales totaled $958.3 million, up from $846.3 million in the FY ended June 2023, as the brewer defied tough macroeconomic conditions and evolving microeconomic factors.

- Profit after tax dropped to $84.2 million, down from $94.9 million last year.

East African Breweries PLC (EABL) has reported a 12 per cent drop in net profit for the fiscal year that ended June 30, 2024, as significant increases in interest rates and currency devaluation ate into the group’s earnings. East Africa’s leading brewer and non-alcoholic drinks dealer saw profit drop after tax to $84.2 million, down from $94.9 million last year.

This is despite a strong net sales growth totaling $958.3 million, up from $846.3 million in the financial year ended June 2023, as the brewer defied tough macroeconomic conditions and evolving microeconomic factors.

During the period under review, EABL reported an operating profit (excluding foreign exchange) of $222.4 million, representing an impressive double-digit growth of 10 per cent, against the prior year. The growth in sales is attributable to volume growth of 1 per cent led by beer (+9 per cent), strategic pricing, a strong portfolio boosted by disruptive innovation, solid commercial execution, and supply productivity. Growth was recorded across its three core markets Kenya, Tanzania, and Uganda.

East African Breweries bit by reduced consumer buyer power

EABL achieved these results on the backdrop of a challenging and unpredictable operating environment characterised by reduced consumer purchasing power, driven by the higher cost of living, as well as disruptions brought about by El Nino rains and political unrest.

Kenya had the highest inflation rates among the key markets in the region during the financial year covering July-June this year.

The East African Community (EAC) economic powerhouse’s inflation averaged 6.9 per cent in the second half of last year before easing to 6.3 per cent in the first quarter of this year (January-March), and further dropping to 4.9 per cent in the second quarter (April-June).

Uganda and Tanzania enjoyed relatively lower inflation rates (the measure of the cost of living) where the former’s inflation averaged between three per cent and 3.6 per cent while the latter’s inflation averaged between 3 per cent and 3.2 per cent.

Read also: EAC Set for Fastest Economic Growth as Sub-Saharan Africa Recovers in 2024

Currency devaluation erodes profit margin for EABL

Significant increases in interest rates and currency devaluation, particularly in the first half of the fiscal, however, increased the Group’s cost base majorly impacting profitability, as the company’s profit after tax dropped by 12 per cent.

In the period under focus, the Kenyan shilling recorded the biggest loss to the dollar (-11.9 per cent) in the second half of last year before gaining by 6.3 per cent in the first quarter of this year and 7.6 per cent in the second quarter. Uganda’s shilling loses by 3 per cent, 5.8 per cent, and by 1.3 per cent, in the respective periods.

Tanzania’s shilling equally lost by 3.9 per cent, 6.2 per cent, and 9.4 per cent in the second quarter of this year, the biggest weakening among the three currencies. The group’s foreign exchange losses jumped 84 per cent.

EABL Group Managing Director and CEO Jane Karuku commented: “We have delivered a solid double-digit topline and operating profit growth in a challenging environment, highlighting the strength of our core business and our ability to capture market opportunities effectively. The results were achieved by leveraging our advantaged portfolio, brilliant commercial execution, and exciting, consumer-led, innovations. Additionally, effective supply productivity allowed us to mitigate some of the impact of cost inflation.”

Ms. Karuku added that the company’s new microbrewery continues to accelerate the group’s innovation pipeline to tap into the next generation of consumers, while the investment in digital capabilities has assisted in serving customers and consumers more efficiently.

“Further, we continue to make great progress against our Environmental, Social, and Governance goals, surpassing our targets for the year. Looking ahead, we are committed to delivering consistent and sustainable long-term growth and our F24 results give us confidence that we are well positioned to do so,” she said during the group’s investor briefing in Nairobi, on Tuesday.

East African Breweries PLC (EABL) is a regional leader in the production of beverage alcohol with its products being sold in more than 10 countries across Africa and beyond. Its business is however concentrated on the three core markets of Kenya, Uganda, and Tanzania.

Read also: Kicking out king dollar: the advantages of trading in local currencies

Disruption to the operating environment

EABL has cited climate change, unpredictable tax policy, social unrest (mainly in Kenya), and rising costs of doing business as major disruptors to its business. The recent heavy rains in Kenya and Tanzania (El Nino rains) impacted operations.

Kenya has also witnessed a series of demonstrations for the better part of July, which disrupted the supply of both raw materials and finished goods. During the period under review, consumer behavior was also impacted by the macro environment which saw spend reprioritisation amid a lower purchasing power.

Even so, the industry recorded growth in the beer market. Spirits however recorded the fastest growth. Kenya recorded the strongest growth in net sales (15 per cent) followed by Uganda (12 per cent) while net sale volumes in Tanzania grew by 9 per cent.

The EABL Board has declared a final dividend of Ksh6.00 per share ($0.046), bringing the total dividend to Ksh7.00 per share ($0.054), an increase of Kshs1.50 per share ($0.012), compared to the total dividend in the prior year.

Read also: Depreciation of Kenyan Shilling Erodes EABL Profits Despite 16% Sales Growth

Looking ahead for East Africa’s largest brewer, EABL

There are also possible adverse impacts on customers, suppliers, and financial players. The imposition of levy on import, investment, or currency limitations (affecting the potential impact of any global, regional, or local trade disputes or any tariffs, duties, or other barriers put on the import or export of goods between regions).

Other factors that could change business patterns include changes in consumer preferences and needs, as a result of changes in demographics, evolving social media trends, changes in travel or leisure activity patterns, weather conditions, health concerns, pandemics, and or a downturn in economic conditions.

The group is headquartered in Nairobi with subsidiaries in Kenya, Uganda, and Tanzania. It shut down its South Sudan depot in 2020 after a free-fall of the South Sudan pound which sent it into huge currency losses.

Diageo Kenya Limited is the firm’s largest shareholder (65 per cent) while the rest of the brewer is owned by nominee shareholders. About 42 individuals have over a million shares in the Nairobi Securities Exchange (NSE) listed firm.

Read also: NSE’s upgrade by FTSE Russell reflects rising confidence in Kenya’s equity market