Global investment in energy is set to rebound to nearly 10 percent in 2021 to $1.9 trillion according to a report by International Energy Agency (IEA).

According to the report, there are signs that developers are using the opportunity provided by accommodative monetary policy and government backing to plan infrastructure developments and investments in new projects despite many energy companies being in a fragile financial state.

The anticipated improvement in investments in 2021 is a mixture of a recurring response to recovery and a structural change in capital flows towards cleaner technologies.

“With energy investment returning to pre-crisis levels, its composition is continuing to shift towards electricity: 2021 is on course to be the sixth year in a row that investment in the power sector exceeds that in traditional oil and gas supply.” World Energy Investment said in their 2021 report.

In 2021, the report noted that the global power sector investments are set to increase by around five per cent to more than $820 billion which will be its highest level ever after remaining constant in 2020. In the new power generating capacity, renewables are dominating investments and are expected to account for 70 per cent of the total in 2021.

“The rebound in energy investment is a welcome sign, and I’m encouraged to see more of it flowing towards renewables. But much greater resources have to be mobilised and directed to clean energy technologies to put the world on track to reach net-zero emissions by 2050. Based on our new Net Zero Roadmap, clean energy investment will need to triple by 2030.” said Fatih Birol, the IEA’s executive director.

According to the 2021 report by the World Energy Investment, growth is heavily concentrated in markets and sectors with clear government policies against a backdrop of relatively low fuel prices.

In new areas such as carbon capture utilisation and storage (CCUS) and low-carbon hydrogen, Policies and stimulus spending are spurring projects. Despite these encouraging signs, stimulus spending on clean energy technologies is still declining regardless of its importance in ensuring a sustainable recovery from the Covid-19 crisis.

The report noted that early signs of inflation in some economies has led to questions about how long the current environment of low-interest rates will last as many developing countries lack the means to pursue expansive recovery strategies.

Upstream oil and gas investment is expected to rise by 10 per cent in 2021 as companies recover financially from the effect of the pandemic although spending still remains below pre-covid levels, the report noted.

The report also highlighted the diverging strategies among different oil and gas companies with the major companies in oil and gas collectively spending flat in 2021 despite the recovering of prices.

If demand continues to grow, the national oil companies that are increasing investment will raise the possibility of an increased market share.

“As set out in detail in our recent Roadmap to Net Zero by 2050, governments need to go beyond making pledges to cut emissions and take concrete steps to accelerate investments in market-ready clean energy solutions and promote innovation in early-stage technologies. Clear policy signals from governments would reduce the uncertainties associated with clean energy investments and provide investors with the long-term visibility they need. Our Roadmap shows there are huge opportunities for companies, investors, workers and entire economies on the path to net-zero. Governments have the power to unlock these broad-based benefits.” said Dr Birol.

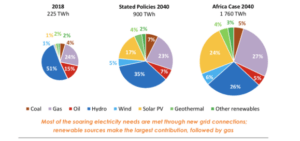

According to a report by the African Energy Chamber, large-scale natural gas projects have continued to advance in West and East Africa despite a slow down in the global energy market catalyzing major gas reserves in Senegal and Mozambique and several final investment decisions expected in 2021.

Sub Saharan African countries contributed close to 55 per cent of the overall hydrocarbon production in 2020 while the rest of Africa is expected to contribute close to 55 per cent of the production by 2025. This is because major producers in Sub Saharan Africa are experiencing a decline in production.