- Startups in Africa have attracted over $1.2 billion in financing this year.

- Experts note that debt financing for startups in Africa is increasingly taking centre stage.

- In July, startups d.light, Va1U, Terrapay as well as Cartona all settled on debt financing to boost operations.

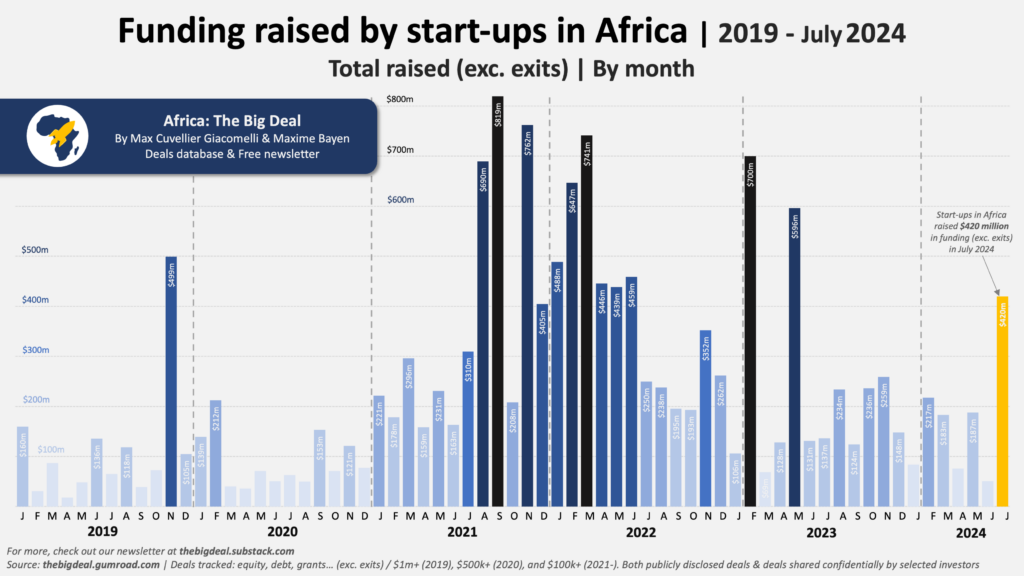

Startups in Africa have defied the odds in declining global capital flow, attracting a record $420 million in financing in July. This funding, which excludes exits, takes to $1.2 billion the amount of money channeled to startups in Africa this year and is the highest on record in 14 months.

“The numbers were heavily skewed by the two mega deals that were announced during the month: d.light’s $176 million securitisation facility and MNT-Halan’s $157.5 million raise. NALA’s $40 million Series A also deserves a mention. Combined, these three deals represent 90 percent of the funding raised,” an update by startup funding tracker, Africa: The Big Deal states.

“This great monthly performance means that the ecosystem was able not only to comfortably cross the $1 billion mark in terms of funding raised in 2024 so far ($1.2 billion), but also to top the amount raised in 2020. The next milestone—the $1.4 billion raised in 2019—is now within reach,” it added.

A comparable analysis by United Kingdom-based Briter Bridges Ltd shows that in July, over 110 startup financing deals were reported across key economies in Africa, constituting diversified sources of capital.

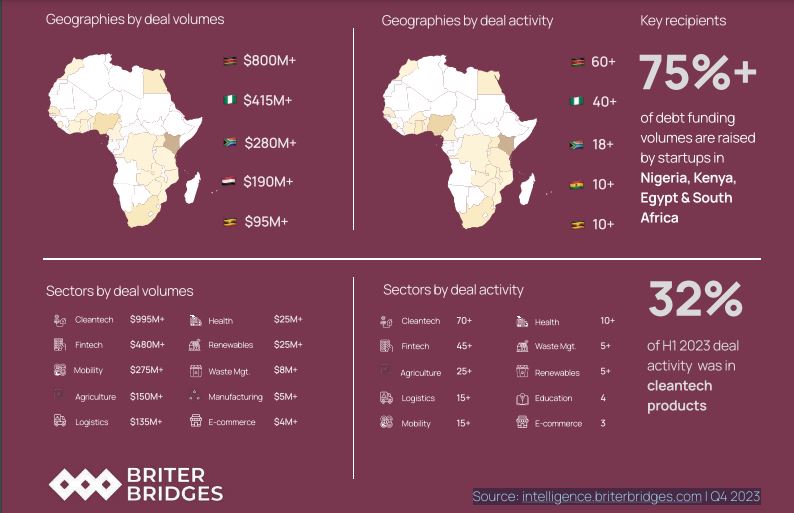

According to Briter Bridges, investors in startups are increasingly opting for diversified instruments of providing capital beyond traditional equity.

For example, in July, a total of five startups reported debt deals while 23 startups settled for capital deals in the mold of grants or awards. At the same time, an estimated 40 startups agreed on other forms of business support such as mentoring and business knowledge to drive expansion.

Debt financing is now a key source of capital for startups in Africa

Briter Bridges report underscores the increasing role of debt in the provision of capital for startups in Africa. In this aspect, July did not disappoint with five entities reporting debt deals, including two major securitisation agreements.

The UK-based insights and business advisory firm observes that debt financing constituted over a third or 35 percent of the total funding recorded in July.

For example, d.light a startup that specialises in providing a platform for communities living in off-grid areas to access solar-powered equipment announced securitisation deal amounting to $176 million. This was the second deal of its kind for d.light this year.

d.light noted that this funding, which was secured from African Frontier Capital, will enhance its pay-as-you-go offering, thereby seeing it reach more customers in Kenya, Tanzania, and Uganda, giving them affordable solar lanterns payable in installments.

In the same vein, Egypt-based fintech Va1U announced that it agreed on a $24 million securitisation funding plan from EFG Holding. This latest financing will see Va1U expand its buy now, pay later platform for its growing customer base in the north African market.

Still on debt financing, July saw Terrapay settle for $95 million in debt financing from two sources: The International Finance Corporation (IFC) and the British International Investment (BII).

Terrapay noted that this fresh financing will see it accelerate the development of its products that are geared toward cutting the cost of remittances in Sub-Saharan Africa, which currently ranks the highest globally.

In the month under focus, another startup, Cartona, secured debt financing from Camel Ventures and GlobalCorp amounting to $2.5 million. Cartona announced that this financing will offer the startup more working capital and help it to connect its buyers and sellers across its market in Egypt.

Read also: Climate tech startups in Africa defy odds, see record surge in financing to $325 million

Why startups in Africa are going for debt financing

July deals are simply pointers that debt is on the rise in Africa’s startup ecosystem. Startup founders and CEOs are drifting towards debt financing “driven by a combination of a rapid decline in equity funding, innovations in debt financing, and a better understanding of if and where debt can best meet the funding needs for startups,” observes Briter Bridges.

In recent years, startups in Africa within the cleantech and fintech segments are the ones attracting the most capital in the form of debt funding. However, Briter Bridges notes that cleantech’s debt funding is going to “hardware asset heavy businesses that can borrow against the underlying asset.”

“The rise of debt is a positive sign for the ecosystem, but needs to avoid being a hammer in search of nails. It will continue to increase, especially over the next year, but it should be seen as part of a range of funding instruments and support that can best unlock sustainable investment and innovation ecosystems across Africa.

“In many cases, debt may not be appropriate for startups and in others it may be more appropriate for innovative business and projects that are not startups, such as financing wind or solar farm projects,” Briter Bridges Q3 2023 Debt financing in Africa’s innovation ecosystem report notes in part.

Funding for early-stage startups gathering pace, too

Another outstanding trend in July was increased appetite by venture capitalists to channel their financing to early-stage startups.

“Incubator and accelerator programmes continue to contribute to Africa’s startup ecosystem by providing valuable knowledge, mentoring, and occasionally small amounts of capital to help founders develop their solutions,” Briter Bridges notes in its July brief.

In the month, a total of 11 different incubation and acceleration programs selected over 65 startups in Africa, offering various forms of support to target entities.

“Out of the 11 programs, five provided grant funding, contributing less than 1% to the total funding in July,” Briter Bridges observes.