- Government has reduced the e-levy rate from 1.5 per cent to one per cent of the transaction value, finance Minister, Ken Ofori-Atta has announced presenting the 2023 budget statement.

- The Ghanaian government has announced its decision to increase the Value Added Tax (VAT) by 2.5 per cent. This will move the tax policy from its current percentage of 12.5 per cent to 15 per cent.

Ghana is set to reduce the rate of the Electronic Transfer Levy to one per cent from 1.5 per cent.

As part of the review of the e-levy act, however, the GHS 100 daily threshold meant to cushion vulnerable people will be removed.

This was announced by the Finance Minister, Ken Ofori-Atta on Thursday, November 24, 2022, during the 2023 budget presentation.

“Review the E-Levy Act and more specifically, reduce the headline rate from 1.5 per cent to 1 per cent of the transaction value as well as removal of the daily threshold,” Ken Ofori-Atta said.

The Electronic Transfer Levy Act, 2022 (Act 1075) was controversially passed in March 2022 and imposes a levy of 1.5 per cent on electronic transfers.

The 1.5 per cent rate was a downward revision from the initially proposed 1.75 per cent.

Mobile money transactions between 2017 and 2021 increased from ¢1.55 billion to GH¢9.86 billion, but the figure has drastically reduced.

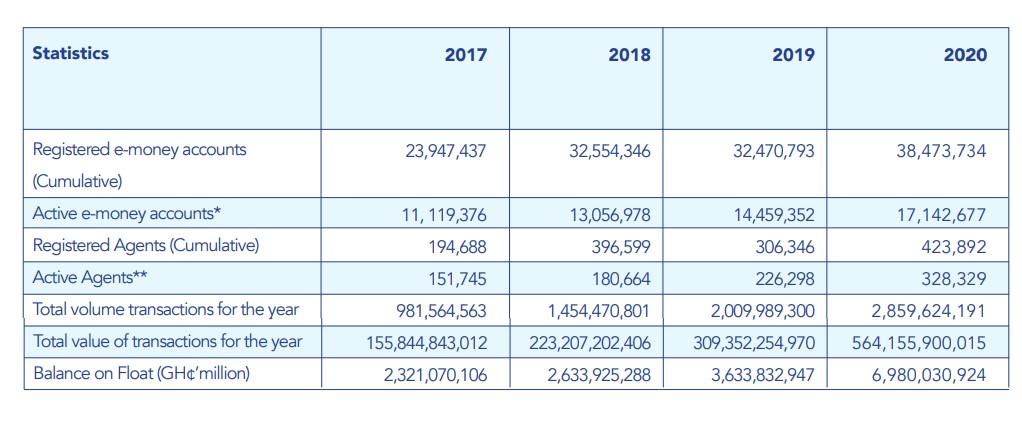

According to Bank of Ghana, mobile money transactions increased year-on-year by 42.27 per cent in transactional volume from 2.00 billion transactions in 2019 to 2.86 billion in 2020.

According to the Bank of Ghana, float account balances went up consistently on monthly basis throughout the year with major growth of 23.8 per cent and 25 per cent achieved in quarter two (Q2) and quarter four (Q4) respectively. The average balance per account holder increased by 6 per cent on a monthly basis from GH¢ 112 in January to GHS 179.45 end 2020.

The growth in transactional and float activity was bolstered by an 18.56 per cent year-on-year growth of active mobile money customers from 14.46 million active customers in 2019 to 17.14 million in 2020. In 2020, the count of active agents that provided electronic money agency services to customers increased by 45.09 percent from 226,298 in 2019 to 328,329 in 2020 according to the central bank.

The minister admitted that the levy which was introduced in the 2022 budget “has not yielded the resources as expected.” The introduction of the electronic levy was to help the government mobilise domestic revenue.

This review was part of a “seven-point agenda aimed at restoring macroeconomic stability and accelerating our economic transformation.”

Mr. Ofori-Atta also noted that the government received several proposals for a review of the E-Levy “and is working closely with all stakeholders to evaluate the impact of the Levy.”

He said these could include the revision of the various exclusions.

“As a first step, however, the headline rate will be reduced to one percent of the transaction value alongside the removal of the daily threshold,” Mr. Ofori-Atta stated.

The government reduced expectations for revenue collection from the levy after an initial projection of GHS 7 billion.

In July 2022, projections were reduced by about ten-fold to GHS 611 million. The levy faced stiff opposition from the Minority in Parliament and was generally unpopular with Ghanaians.

An Afro-Barometer survey showed that three-fourths of Ghanaians disapproved of the e-levy, including 67 per cent who “strongly disapproved” of it, local media house, citinewsroom reported.

The Electronic Transfer Levy Act, 2022, was approved at the end of March.

Ghana’s parliament approved the tax on electronic transactions. President Nana Akufo-Addo‘s government claimed it will help raise over US$900 million and address the problems of unemployment and high public debt. But for some Ghanaians, the tax represents an additional burden on top of the high cost of living with fuel prices rising following the russian invasion of Ukraine.

Members of the opposition refused to take part in the vote and walked out of the assemblee describing the tax as unfair.

According to the country’s General Revenue Authority (GRA), the electronic transfer levy (e‑levy) covers transactions such as mobile transfers between accounts on the same electronic money issuers, and between different electronic money issuers; transfers between bank accounts and mobile money accounts; and bank transfers from bank accounts owned by individuals via an instant pay digital platform or application. Banks, electronic money issuers, payment service providers, specialised deposit‑taking institutions, and other financial institutions are all now required to charge the one per cent e‑levy on the transfer value as part of their fees and remit the collected tax to the GRA.

Exempted from the e‑levy were cumulative transfers of up to GHS100 (US$13.30) per day by the same individual; transfers between accounts belonging to the same individual; and transfers for the payment of government taxes, charges and fees but this will be removed. Transfers between principal, agent and master‑agent accounts; specified merchant payments; and electronic clearing of cheques are also exempt.

Meanwhile, the Ghanaian government has announced its decision to increase the Value Added Tax (VAT) by 2.5 per cent. This will move the tax policy from its current percentage of 12.5 per cent to 15 per cent.

Presenting the 2023 budget the Finance Minister said the review is to directly support road construction projects and the digitization agenda. Among others, the Minister said government will fast-track the implementation of the Unified Property Rate Platform programme in 2023.

According to Ken Ofori-Atta, the upward adjustment forms part of government’s initiative “to aggressively mobilize domestic revenue.”

In line with the tax policy proposals in the 2022 Budget Statement, Parliament of Ghana passed the Value Added Tax (Amendment) Act, 2021 (Act 1072) to bring VAT proposals into effect. The Amendment Act has a gazette date of December 31, 2021, hence effectively came into force from January 1, 2022.

According to Deloitte, The Value Added Tax Act, 2013 (Act 870) was amended by the Value Added Tax (Amendment) Act, 2021 (Act 1072) to revise the application of the VAT flat rate scheme (VFRS).