- The UN report attributes this slowdown to the ongoing COVID-19 pandemic, Russia’s war in Ukraine, high inflation, and the climate crisis.

- Africa has long been dependent on exports and foreign investment to drive its economic growth.

- The slow global economic growth also means that African countries will have less access to funding from international organizations like the World Bank and the International Monetary Fund (IMF).

The recent United Nations (UN) report on the state of the global economy has painted a dim picture in 2023, with slow growth projected for the global economy. The report attributes this slowdown to the ongoing COVID-19 pandemic, Russia’s war in Ukraine, high inflation, and the climate crisis.

While the near-term economic outlook remains uncertain, the report forecasts a moderate pick-up of growth to 2.7 per cent in 2024. However, the report also states that “myriad economic, financial, geopolitical, and environmental risks persist.” This means that the global economy is still at risk from a variety of factors that could further slow or even reverse any projected growth.

But what does this all mean for Africa? The continent has been hit hard by the pandemic and has had to contend with a variety of other economic and social challenges in recent years. The slow growth projected for the global economy will undoubtedly have a ripple effect on the African continent, with the potential to further exacerbate existing economic and social challenges.

One of the most significant impacts will likely be on the continent’s trade and investment relations. Africa has long been dependent on exports and foreign investment to drive its economic growth. However, with the global economy slowing down, demand for African exports is likely to decrease, and foreign investment may become more scarce. This could lead to job losses and a decline in economic growth for many African countries.

The slow growth of the global economy will also have a significant impact on Africa’s already fragile economies. Many African countries have struggled with high inflation and a lack of foreign currency in recent years. A slowdown in the global economy could lead to further depreciation of local currencies and exacerbate inflation. This could lead to increased poverty and hardship for many people across the continent.

The pandemic has also had a significant impact on Africa’s small and medium-sized enterprises (SMEs) which are the backbone of many African economies. With the global economy slowing down, many SMEs may struggle to stay afloat, leading to job losses and a decline in economic growth.

The slow global economic growth also means that African countries will have less access to funding from international organizations like the World Bank and the International Monetary Fund (IMF) to address the economic and social challenges they face. This could make it harder for African countries to respond to the current crisis and to invest in the long-term development of their economies.

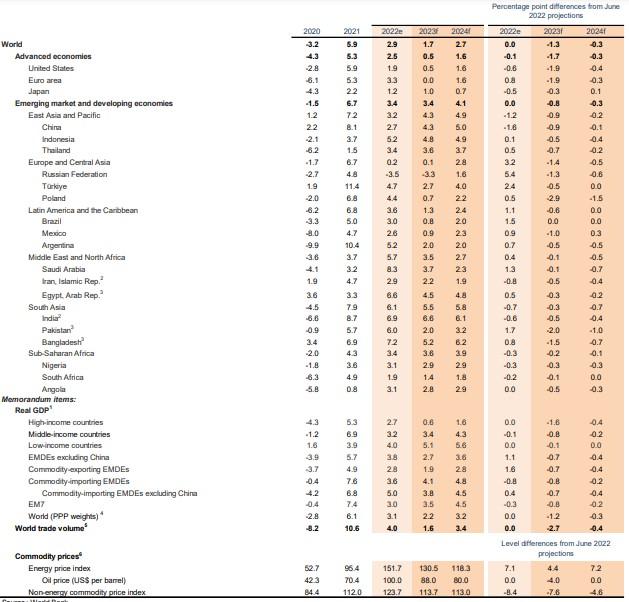

The IMF also forecasts slower growth for 2023, with no “dramatic improvement” in its current global growth forecast. The impact of these projections is expected to be felt most strongly in developed economies like the US and EU, while China’s economy is projected to accelerate in 2023 but with a bumpy reopening process.

The International Monetary Fund (IMF) is also set to release its World Economic Outlook update later this month, and the current forecast for global growth in 2023 is 2.7 per cent, down from around 3.2 per cent last year. In October, the IMF put a 25 per cent probability of global growth falling below 2 per cent next year – a phenomenon that has occurred only five times since 1970. IMF head Kristalina Georgieva said last week that she saw no “dramatic improvement” in the current forecast.

The UN report also highlights the adverse effects that weakened growth in the United States, the European Union, and other developed economies have had on the global economy. The report projects that US gross domestic product (GDP) will only expand by 0.4 per cent in 2023, compared to an estimated growth of 1.8 per cent in last year. The EU is forecast to grow by 0.2 per cent in 2023, down from an estimated 3.3 per cent in 2022. These projections align with the IMF’s October forecast of US economic growth of 1 per cent in 2023 and growth of 0.5 per cent in the EU.

On the other hand, the report predicts that China’s economy will accelerate in 2023, with a forecasted growth rate of 4.8 per cent. This is after the government abandoned its zero-COVID-19 policy and began easing monetary and fiscal policies. This compares to an expected 3 per cent expansion in 2022. However, the report also notes that “the reopening of the economy is expected to be bumpy. Growth will likely remain well below the pre-pandemic rate of 6 to 6.5 per cent.” The IMF is forecasting Chinese growth of 4.4 per cent for 2023.