- Black tax, also known as the “financial burden of supporting extended family,” is a growing issue in Africa that affects individuals, families, and society as a whole.

- It is a cultural norm that has developed over time and is deeply ingrained in many African societies.

- The financial burden of supporting extended family members can be overwhelming, and the emotional and psychological toll can be significant.

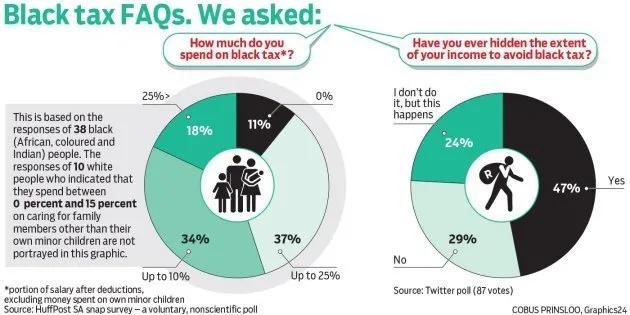

Black tax is a term used to describe the financial burden that is often placed on black individuals, particularly in the African community. This burden can take many forms, from supporting extended family members to paying for education and other expenses. While it can be a source of pride and a way to support one’s community, black tax can also be a significant financial strain that can make it difficult for individuals to achieve their own financial goals. In this article, we will explore what black tax is, how it affects the African community, and strategies for dealing with it.

Understanding Black Tax

First, it is important to define black tax. The term refers to the financial responsibility that many black individuals, particularly those living in Africa, have to support their extended family members. This includes providing financial assistance for education, healthcare, housing, and other basic needs. It is a cultural norm that has developed over time and is deeply ingrained in many African societies.

The origins of black tax in Africa can be traced back to the colonial period, when many African countries were forced to provide cheap labor for European colonizers. This resulted in the forced migration of many Africans, who were separated from their families and communities. In response, many individuals took on the responsibility of supporting their extended family members who were left behind. Over time, this cultural norm has been passed down from generation to generation and has become an integral part of many African societies.

Black tax is passed down through generations and often begins with the first generation of black individuals to achieve financial stability. These individuals are expected to support not only their immediate family members but also extended family members, such as grandparents, cousins, and even distant relatives. This support can take many forms, from providing financial assistance to helping with housing and other expenses. While this tradition of supporting one’s community can be a source of pride, it can also be a significant financial strain.

In addition to supporting extended family members, black individuals are often expected to pay for the education of younger family members. This can include paying for primary and secondary school, as well as tertiary education. The high cost of education in many African countries can make this a significant financial burden. Furthermore, many black individuals are also expected to contribute to community projects, such as building a church or mosque, or paying for a community event.

Impact of black tax

The impact of black tax on society is also significant. The economic impact is clear, as many individuals are unable to invest in their own businesses or pursue higher education and career opportunities due to the financial burden of supporting their extended family. This can result in a lack of economic growth and development. Additionally, black tax can contribute to poverty and inequality, as many individuals are unable to break the cycle of poverty due to the financial burden of supporting their extended family. Furthermore, black tax can also have a significant social and cultural impact, as it can perpetuate a cycle of dependency and reinforce traditional gender roles and stereotypes.

Black tax also affects different aspects of life and can make it difficult for individuals to achieve their own financial goals. For example, many black individuals are unable to save for their own retirement or purchase a home due to the financial burden of supporting their family and community. This can lead to financial insecurity and a lack of upward mobility.

Dealing with Black Tax

While black tax can be a significant financial burden, there are strategies for managing it. One of the most important is budgeting and saving money. By creating a budget and sticking to it, individuals can better manage their finances and set aside money for their own goals. It’s also important to set financial goals and work towards them. This could be saving for a down payment on a house, paying off debt, or saving for retirement.

Another important strategy for dealing with black tax is financial education and planning. It is important for individuals to understand their finances and make informed decisions about how to manage them. This could include learning how to invest, how to create a budget, or how to plan for retirement. Financial planners or financial advisors can also be a great resource for individuals looking to improve their financial literacy.

Communicating with family members and setting boundaries is also an important aspect of dealing with black tax. It is important for individuals to have open and honest conversations with family members about their own financial goals and limitations. This can be difficult, but it is important to be clear about what you can and cannot do financially. Setting boundaries can help individuals to manage their own finances while also supporting their family and community.

While it can be a source of pride and a way to support one’s community, it can also be a significant financial strain that can make it difficult for individuals to achieve their own financial goals.

Budgeting, saving, financial education and planning, and communicating with family members and setting boundaries help manage black tax. It’s important to remember that taking control of one’s finances and achieving financial stability is crucial for overall well-being.