- Econet Wireless Zimbabwe is Zimbabwe’s largest provider of telecommunications services.

- The financing is aimed at redeeming the outstanding debentures in the capital of both companies.

- EcoCash Holdings Zimbabwe is the ninth most traded stock on the Zimbabwe Stock Exchange over the past three months

Zimbabwe Stock Exchange (ZSE) listed Econet Zimbabwe and its subsidiary, EcoCash Holdings, have announced their intention to raise US$30.3 million through a renounceable rights issue. The move is aimed at redeeming the outstanding debentures in the capital of both companies.

The recent rights issue on the ZSE is similar to the 2020 offer made by retailer Edgar’s to its shareholders.

A renounceable rights issue is a type of share offering in which existing shareholders are given the opportunity to buy new shares in proportion to their existing holdings. This means that existing shareholders can choose to buy a certain number of additional shares at a discounted price, which is usually lower than the current market price.

According to statements released by the companies, the Board of Directors of Econet Wireless Zimbabwe Limited and EcoCash Holdings Zimbabwe Limited are considering proposals to call for an Extra Ordinary General Meeting of Members to discuss the rights issue. The funds raised from the rights issue will be used to redeem the outstanding Debentures in the Capital of the Company.

“Shareholders are advised that the Board of Directors of Econet Wireless Zimbabwe Limited (the “Company”) is considering proposals to call for an Extra Ordinary General Meeting of Members for the purpose of considering a renounceable rights issue (the “Rights Issue”) of new ordinary shares in the capital of the Company (the “Rights Shares”) to raise a total amount of approximately US$30.3 million that is required to redeem the outstanding Debentures in the Capital of the Company,” said C.A. Banda, Econet’s Group Company Secretary in a cautionary announcement.

Econet Wireless Zimbabwe is Zimbabwe’s largest provider of telecommunications services, providing solutions in mobile and fixed wireless telephony, public payphones, internet access and payment solutions.

Econet launched its network on July 10, 1998 and listed on September 17, 1998. It is one of the largest companies on the Zimbabwe Stock Exchange in terms of market capitalisation. The company continues to upgrade its network to carry more subscribers, and further widen its geographical coverage, which is already the most extensive in Zimbabwe.

In 2009, the network became the first operator in Zimbabwe to launch data services under 3G technology. The company’s key infrastructure at the start of 2010 included three switches. In 2009, Econet began building an extensive fibre optic network, and also commenced an accelerated rollout of other key network infrastructure.

Mrs. C R Daniels, EcoCash Holding’s Group Company Secretary also made the same announcement.

“Shareholders are advised that the Board of Directors of EcoCash Holdings Zimbabwe Limited (the “Company”) is considering proposals to call for an Extra Ordinary General Meeting of Members for the purpose of considering a renounceable rights issue (the “Rights Issue”) of new ordinary shares in the capital of the Company (the “Rights Shares”) to raise a total amount of approximately US$30.3 million that is required to redeem the outstanding Debentures in the Capital of the Company,” she said.

What is the effect of rights issue on company shareholding, market share price?

A rights issue can have several effects on a company’s shareholding and market share price. Here are a few possible scenarios:

Dilution of Shareholding: A rights issue involves the issuance of new shares, which can result in the dilution of existing shareholders’ stakes. This is because the new shares are usually offered to existing shareholders in proportion to their existing holdings, and they have the option to buy more shares at a discounted price. If existing shareholders choose not to participate in the rights issue, their ownership percentage in the company may decrease.

Increase in Number of Shares: The issuance of new shares through a rights issue increases the number of shares outstanding in the market, which can impact the market share price. If the market perceives that the new shares will dilute the earnings per share (EPS) of the company, the share price may decrease. However, if the market believes that the funds raised through the rights issue will be used to pursue growth opportunities or pay off debt, the share price may increase.

Boost in Investor Confidence: A rights issue can be seen as a sign of confidence by the company’s management that it has a solid plan for growth and is confident in its future prospects. This can increase investor confidence and attract new investors, which may result in an increase in the market share price.

Impact on Balance Sheet: A rights issue can also have an impact on a company’s balance sheet. If the funds raised through the rights issue are used to pay off debt, it can improve the company’s financial health and creditworthiness. This can result in a positive impact on the market share price.

Econet Zimbabwe market performance

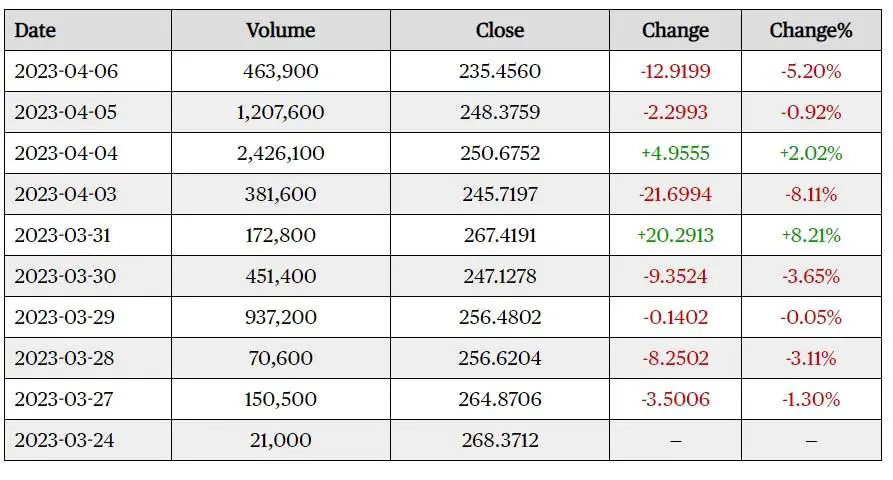

Econet Wireless Zimbabwe closed its last trading day (April 6, 2023) at 235.4560 ZWL per share on the Zimbabwe Stock Exchange (ZSE), recording a 5.2 per cent drop from its previous closing price of 248.3759 ZWL. Econet Wireless began the year with a share price of 96.2759 ZWL and has since gained 145 per cent on that price valuation, ranking it 13th on the ZSE in terms of year-to-date performance.

Read: Strive Masiyiwa: The Zimbabwean doyen of African business

EcoCash Holdings market performance

According to African X’changes, EcoCash Holdings Zimbabwe closed its last trading day (April 6, 2023) at 66.6218 ZWL per share on the Zimbabwe Stock Exchange (ZSE), recording a 1.9 per cent drop from its previous closing price of 67.9047 ZWL. EcoCash began the year with a share price of 40.0810 ZWL and has since gained 66.2 per cent on that price valuation, ranking it 24 on the ZSE in terms of year-to-date performance.

EcoCash Holdings Zimbabwe is the ninth most traded stock on the Zimbabwe Stock Exchange over the past three months (January 9 – April 6, 2023). EHZL has traded a total volume of 8.78 million shares valued at ZWL 592 million over the period, with an average of 139,386 traded shares per session. A volume high of 797,800 was achieved on April 4, and a low of 200 on March 3, for the same period.