Africa has boasted promising prospects for investors looking to invest in the continent’s untapped sectors and industries, attractive growth opportunities and an improving business environment.

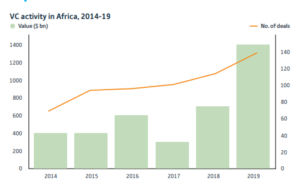

Venture Capital in Africa has seen significant growth in recent years and as the entrepreneurial space on the continent matures it remains optimistic. In addition, once the African Continental Free Trade Area is fully implemented it will significantly shape the path of Venture Capital and Private Equity.

According to a report by the African Private Equity and Venture Capital Association (AVCA), the trends that will drive Private Equity and Venture Capital in Africa are in sectors such as Health Care, renewable energy, Agriculture and ICT and Digitalisation.

Health Care Sector

In the years leading to 2020, the health care sector in Africa was already experiencing significant growth and attracting private equity investments.

In 2020 H1, the health care sector accounted for the largest share of PE deals value of 24 per cent, which is a double investment, compared to 2019 H1 in which the sector accounted for 12 per cent which was a significant improvement from 4 per cent of total deals in 2018 H1.

According to AVCA’s report, between 2014 and 2019, North Africa saw 11 per cent of total deal volume making it the fourth most prominent sector in the region.

According to data from Partech on tech VC funding in 2019, health tech received 13 deals worth $189 million accounting for 9.3 per cent of total VC tech funding which was a rise from 2018.

The International Financial Corporation (IFC) estimates that in emerging markets outside of Africa, health care investments deliver a 17.5 per cent investment level gross internal rate of return (IRR) and 9.6 in Africa which is generally the second-highest IRR by sector in emerging markets and the fourth highest returns after telecoms, consumer staples and IT in Africa.

According to AVCA, health insurance platforms, which focus on affordable micro-insurance and mobile payments, are expected to see rapid growth as well as health logistics, health infrastructure, pharmaceuticals and electronic medical records which were experiencing traction before the covid-19 pandemic.

Agricultural Sector

In Africa, agriculture accounts for 15 per cent of the region’s GDP with the figure increasing to 23 per cent in sub-Saharan Africa. The agricultural sector is dominated by small scale farms which produce 90 per cent output which is nearly two-thirds of the population employed in the sector.

Between 2017 and 2050, the World Bank estimates that there will be a 102 per cent increase in demand as global food demand continues to increase. Africa’s demand for food is expected to outdo the global average with the total market size expected to approach $1 trillion by 2030.

To unlock the full potential of agriculture in Africa, significant investments will be required to acquire more reliable data, infrastructure development, a more skilled workforce and higher crop yields.

The major challenge affecting agri-businesses in Africa is difficulty in accessing capital. Loans to agricultural players in 2018 accounted for 12 per cent of the total loan disbursements in Tanzania, 8 per cent in Mozambique, 6 per cent in Uganda, 4 per cent in Kenya, Nigeria and Ghana and 3 per cent in Sierra Leone.

By 2018, there were 82 startups in agri-tech in Africa. In 2017, $59 million was raised by agricultural ventures with $13.2 of the total comprising of agri-tech startups.

ICT and Digitalisation sector

Prior to the pandemic, the ICT sector was the driving forces of development in many African economies as companies in the sector bagged the most attractive investment opportunities in the region which contributed to the increase in PE and mostly VC funding between 2015 and 2020.

In sub-Saharan Africa, mobile technology contributed to the creation of 3.8 million jobs and generated $17 billion in tax re

venue.

Global tech giants like Microsoft and Google have significantly shifted their attention to Africa due to the opportunities the continent offers. The rapid growth in ICT and future expectations for digital technology has fueled an influx of investments in African tech startups with most of the funding from PE and VC firms. According to data from AVCA in 2019 ICT recorded $1.42 billion in equity funding from $736 million in the previous year.

Despite the pandemic slowing down Venture capital and private equity activities across emerging economies, Africa is still received a series of PE and VC deals in 2020 and 2021.

According to industry stakeholders, the factors that are likely to hinder limited partners (LPs) investments in Africa include currency fluctuations, political risk, poor historical performance, a limited number of established fund manager and a weak exit environment.

Also Read: African ventures raise $150 million to support start-ups in Egypt