There’s a fair probability that you’ve observed that certain companies have shares trading on different exchanges if you’ve looked up specific stocks or googled a company to check its share price.

Although it may seem unusual, this is a common occurrence. Shares of many companies will be listed on multiple exchanges. This is called dual listing.

The primary benefits of a dual listing include additional liquidity, increased access to capital, and the ability for shares to be traded for longer periods each day if the exchanges are in different time zones. A dual-listed stock also may gain greater market visibility, which in turn may result in additional media coverage and make its products or services more visible.

- The New York Stock Exchange, part of Intercontinental Exchange, and the Johannesburg Stock Exchange (JSE) have signed a memorandum of understanding to collaborate on the dual listing of companies on both exchanges.

- Listing of a security on more than one exchange, thus increasing the competition for bid and offer prices, the liquidity of the securities, and the length of time the stock can be traded daily.

- The NYSE and the JSE also agreed to jointly explore the development of new products and share knowledge around ESG, ETFs and digital assets.

The agreement was finalized during a visit to the NYSE by a South African delegation including JSE Group CEO Dr. Leila Fourie and South African Reserve Bank Governor Lesetja Kganyago. The signing ceremony took place shortly before the delegation rang the Closing Bell, followed by a keynote address by Kganyago on monetary policy.

“The New York Stock Exchange is pleased to sign this collaboration agreement with the Johannesburg Stock Exchange in support of the important economic and trade relationship between our two markets,” said Lynn Martin, NYSE president.

“Exploring the dual listings of companies on our two exchanges stands to increase opportunities for investors on both continents, underscoring the value public companies and our capital markets generate in the global economy. We look forward to collaborating on new product development with the JSE team and to the innovation that comes when two great organizations work together.”

“The agreement that we have signed today with the NYSE will unlock opportunities for investors and issuers of both bourses,” said Fourie.

“This is the beginning of a new chapter and I am excited about the opportunities we will explore together as we find synergies to grow both our markets. For the JSE, the largest stock exchange on the African continent with unparalleled market depth and liquidity, we aim to create world-class solutions for local and international investors.”

The Johannesburg Stock Exchange (JSE) and New York Stock Exchange (NYSE: ICE) have signed a memorandum of understanding to collaborate on the dual listing of companies on the exchanges. The collaboration is expected to increase opportunities for investors and issuers in both countries.

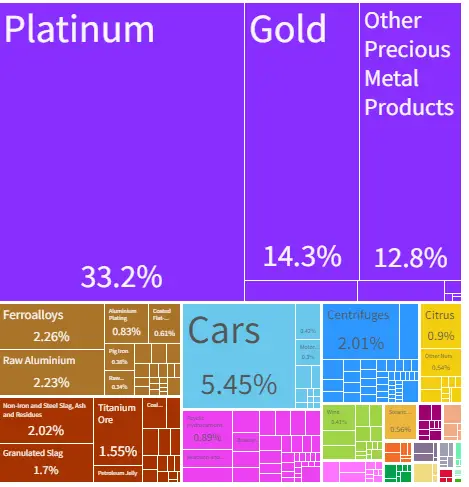

According to the company website, the JSE was formed in 1887 during the first South African gold rush. Following the first legislation covering financial markets in 1947, the JSE joined the World Federation of Exchanges in 1963 and upgraded to an electronic trading system in the early 1990s. The bourse was demutualised and listed on its own exchange in 2005.

Today the bourse offers five financial markets, namely Equities and Bonds, as well as Financial, Commodity and Interest Rate Derivatives.

According to remarks by Lesetja Kganyago, Governor of the South African Reserve Bank, at the JSE/NYSE Market Close Event in New York, the agreement will foster closer ties between the two markets. It will increase economic partnerships and trade opportunities.

“This new MoU will foster closer ties between the two markets and is aimed at increasing economic partnerships and trade opportunities. It is encouraging that the JSE and NYSE will continue to explore new areas of cooperation and collaboration in strengthening their value propositions for their respective markets,” he said.

South Africa shares significant economic interests with the United States (US). South Africa is the US’s largest African trading partner and has the most diversified and industrialised economy on the continent. Despite the rapid growth in Asian economies, the US remains one of South Africa’s top five main trading partners.

Lesetja Kganyago also punted South African investments to US investors. Kganyago said recent interest hikes in South Africa “will lead to stronger investment rates over time,” and that South African bonds will benefit from a sound underlying financial structure and a long maturity.

“This is an important reason why our yield curve is steep: long-term debt is genuinely being held, in volumes, by private investors, and it is priced accordingly. The point is: the news is in the price, and it is an attractive price. It is not an artificially low price, held down by policies that we cannot sustain or that are inconsistent with our economic conditions.”

Kganyago added that South Africa’s financial markets are deep, robust, and well-integrated with world markets. Financial system assets are roughly three times the emerging market average, nearly 300 per cent of GDP,

He added that the rand is another reason the prices of South African assets are attractive, saying that the Reserve Bank is “very tolerant of exchange rate fluctuations”.

“This is because we have low levels of foreign exchange debt and inflation expectations that do not react strongly to exchange rate movements. This means the currency is free to adjust to global conditions. When it depreciates, as it has done recently, it makes South African assets very attractive in foreign currency terms. You could say this is a strategy of attracting the smart money: when the currency moves a lot the smartest people buy, and this helps reverse the outflows,” he said.

Kganyago said moving faster on the reform of the energy sector and other structural reforms would make South Africa’s investment environment more attractive to domestic and foreign capital.