- Refugee Crisis in Chad as War and Hunger in Sudan Drive Thousands Across Border

- Senegal 2050: A Blueprint for Economic Transformation

- Kenya’s banking sector corporate taxes hit $563.7 million despite industry profit drop

- South Sudan Crisis: How a Broken Pipeline Has Plunged Juba into Chaos

- Nigeria’s Largest Flour Mills to Invest $1 Billion in an Expansion and Restructuring Drive

- Ampersand triples production as Kenya’s e-moto market booms

- Vantage Capital concludes a $71 million deal with telco Camusat

- Mukuru’s mobile wallet debuts in Malawi, boosting global transfers and financial access

Browsing: JSE

- Glencore spin off of its coal business is the result of mounting pressure from its shareholders over Environmental Social and Governance (ESG) and climate concerns.

- The company resolved to spin off its coal activities after finalizing its acquisition of the coal assets belonging to Teck, a Canadian mining company.

- Glencore had initially sought to acquire Teck Resources entirely but was thwarted by the target company’s controlling shareholder.

- Shareholders in the company have since 2021 rejected the company’s climate report and its disclosures leading to the resolution to spin off its coal business.

Glencore spin off, the background

Glencore, one of the largest mining companies in the world, that is listed on the Johannesburg Securities Exchange and the London Stock Exchange announced that it would demerge its coal assets and list them as a separate business on the NYSE and JSE in two years’ time.

This follows pressure from shareholders that …

- Thungela Resources Limited has been busy with mergers and acquisitions to grow its geographic footprint and diversify from its pure play coal business.

- The JSE listed miner recently made the news when it agreed to purchase an Australian coal miner called Ensham.

- The acquisition of Ensham is an all cash transaction wherein Thungela is taking a 65% interest.

The Johannesburg Stock Exchange (JSE) listed pure play coal mining company which was created from the demerger of Anglo American’s coal assets has been on a mergers and acquisitions spree. Thungela announced earlier this month that it had acquired an Australian coal mine. This move has been read by market analysts as a risk mitigation move by diversifying away from South Africa. It also bought out its Black Empowerment partners in a US$ 60 million transaction.

Green Bonds: A possible solution to the Zimbabwe power crisis

On the M&A front, Thungela bought …

The agreement was finalized during a visit to the NYSE by a South African delegation including JSE Group CEO Dr. Leila Fourie and South African Reserve Bank Governor Lesetja Kganyago. The signing ceremony took place shortly before the delegation rang the Closing Bell, followed by a keynote address by Kganyago on monetary policy.

“The New York Stock Exchange is pleased to sign this collaboration agreement with the Johannesburg Stock Exchange in support of the important economic and trade relationship between our two markets,” said Lynn Martin, NYSE president.

“Exploring the dual listings of companies on our two exchanges stands to increase opportunities for investors on both continents, underscoring the value public companies and our capital markets generate in the global economy. We look forward to collaborating on new product development with the JSE team and to the innovation that comes when two great organizations work together.”…

Patrice Thlopane Motsepe has entrepreneurship baked in his bones.

It seems the South African born mining magnate has natural instincts for enterprise.

Looking at his accomplishments in the mining industry and business world its not hard to imagine that he possesses the so called “animal spirits” that renowned British economist John Maynard Keynes said drives entrepreneurs and causes them to see opportunities for value where others cannot.

- Patrice Motsepe is a South African billionaire who has made a fortune estimated by Forbes to be in the region of US$ 2.6 billion.

- His fortune has come from investments in the mining industry through a company he founded in 1997 called African Rainbow Minerals Limited.

- African Rainbow Minerals is involved in the mining of gold, platinum, coal, ferrous and base metals.

According to Forbes, Motsepe’s personal fortune is estimated to be in the region of US$ 2.6 billion. Motsepe founded and …

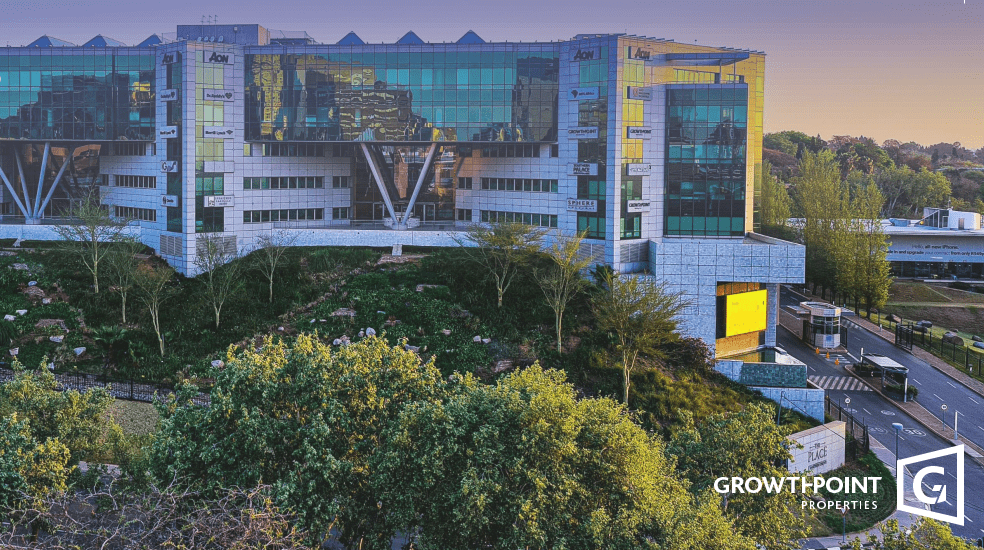

Growthpoint Properties Limited published its financial results for 2021 on the 15th of September 2022.

The real estate investment trust (REIT) is the largest such listed entity on the Johannesburg Stock Exchange and is reliable indicator for the sector as a whole. The real estate sector in South Africa as in the rest of the world was one of the biggest casualties of the COVID pandemic. REITs on the JSE were not spared.

The COVID pandemic created a perfect storm for property owners in South Africa. When COVID spread to the rest of the world after beginning in Wuhan in China in 2019 two things happened that adversely affected the REIT sector on the JSE including Growthpoint.

- Growthpoint Properties Limited which is the largest REIT listed on the JSE announced its results on the 15th of September 2022.

- Results for the REIT reflected an improved operating environment for

The remainder of Anglo’s coal assets were demerged from the group and bundled into a new company called Thungela Resources Limited. This strategy in coal mining circles is called “mine to mouth” and is being continued by Seriti. Eskom, South Africa’s power utility, has an agreement where its thermal power stations are fed with coal from the company’s Kriel and New Largo mines. These mines are adjacent to the power stations.

Seriti Resources (the company’s name is from the native Sotho language and means integrity) was formed in 2017. Mike Teke, through his investment vehicle Masimong Holdings Group owns 25% of Seriti Resources.

The remainder of the shares in the energy company is owned by Sandile Zungu’s Zungu Investments Company, Thebe Investments Corporation, and Community Investment Holdings.…

The underlying constituents of the new 1nvest ETF, which will track the MSCI World SRI Select Reduced Fossil Fuels Index, are companies that mitigate risks posed by climate change and exhibit high levels of the environment, and social, and governance (ESG) performance.

According to an article published by the JSE on July 28, 2022, to qualify for inclusion in the index, companies are required to have an MSCI ESG rating of ‘A’ or above.

The ETF has an investment mandate that excludes companies in industries related to goods and services such as nuclear weapons, tobacco, civilian firearms, conventional weapons, alcohol, gambling, adult entertainment, genetically modified organisms, thermal coal, and oil & gas.

Director of Capital Markets at the JSE, Valdene Reddy, said that the listing of the latest 1nvest ETF demonstrates the JSE’s commitment to remain a capital-raising platform of choice. As this segment grows, a listing on the JSE …

- Tharisa PLC will be the latest foreign platinum mining firm to enter and invest in the Great Dyke in Zimbabwe.

- The Great Dyke has the second-largest platinum reserves in the world after South Africa.

- Tharisa has entered the Zimbabwean platinum mining sector through Karo Mining Holdings which owns the Karo Platinum Project.

- Tharisa will get into an 85%-15% joint venture with the government of Zimbabwe.

- The Karo Platinum project is expected to come on stream in 2 years and produce at least 150,000 ounces of the precious metal a year.

https://theexchange.africa/investing/investment-in-africa-2022/

Tharisa PLC which is listed on the JSE took control of Karo Mining Holdings when it increased its interest in March from 28% to 85%. The company is building a mine which it has named the Karo Platinum Project and is envisaged to take at least 20 years to complete. The first phase of the mine's development is expected…

Sasol's results presentation in February was an awkward affair. The session was pre-recorded and then aired on the company's website.

It was not interactive. When the recording ended so did the webcast. Other corporate interactions and results announcements are usually interactive. The top executives of a company will meet in person with a group of individuals and the rest tune in online.

At the end of the session, the group of people in attendance are given the opportunity to speak to the executives of the company asking them questions and commenting on the financial results being presented. This was not the case with Sasol. But then again Sasol is not your typical company...

It left an impression that the top brass at the giant South African petrochemicals company does not like to take questions from stakeholders and analysts... Given that the company has just come out of severe financial distress…

In the cement industry, the South African Government has taken a protectionist stance, banning the import of cement especially for infrastructure projects that it is sponsoring. The ban came from Treasury in October.

This decision has been widely celebrated by the cement sector which has been struggling since 2014. This period is profound in that cheap cement flooded the South African market and reduced the profits of local producers.

These cement producers according to industry body, Cement and Concrete South Africa have been under siege from cheap imports from Pakistan, China, and Vietnam.…