- IBL Group, a multinational conglomerate has acquired an undisclosed stake in Harley’s, a pharmaceutical distributor based in Kenya.

- The transaction marks the group’s latest investment in Kenya, following the acquisition of a 26.32-percent stake in Naivas Limited for Ksh12.5 billion (US$100 million) last year.

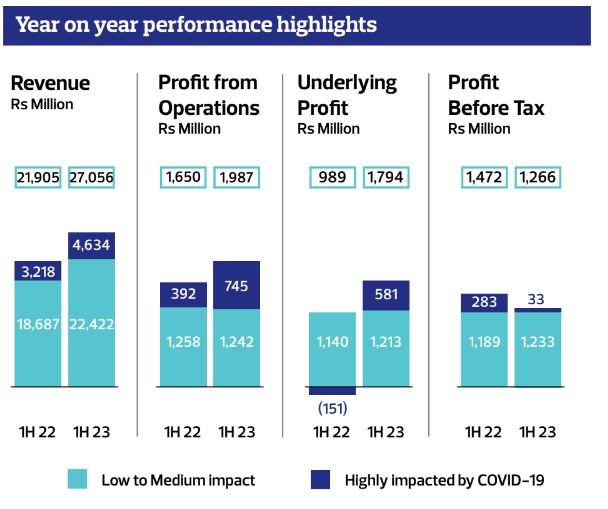

- IBL revenues for six months ended 31 December 2022 increased by 24 per cent to Rs 27.06 billion. Operating profit for the Group has increased to Rs 1.99 billion from Rs1.65 billion in 1H2022, representing a growth of 20 per cent.

Mauritian conglomerate Ireland Blyth Limited (IBL) has bought an undisclosed stake in Nairobi-based pharmaceuticals distributor Harley’s as part of a consortium that has taken control of the company.

This marks the latest investment in Kenya for IBL which last year acquired a 26.32 per cent stake in supermarket chain Naivas Limited for US$100 million (Sh12.5 billion) also as part of a consortium, underscoring the group’s commitment to the Kenyan market.

Already, Naivas witnessed a twofold increase in profits compared to last year. The share of profits from associate for Naivas amounts to Rs 131 million for six months ended 31 December 2022.

IBL Group is a leading Mauritian conglomerate and one of the island’s largest firms, with more than 200 brands spread across 19 countries. According to Billionaires Africa, under Arnaud Lagesse, one of the richest men in Mauritius, the group has grown into a leading conglomerate. Part of its expansion plans now includes venturing into Kenya’s construction, agrochemicals, consumer goods distribution, and reinsurance sectors.

After starting his career in finance in Paris, Arnaud joined the family company in 1993. Twelve years later he became CEO of the company that was launched by his grandfather in 1939. Known at the time as GML Group, Arnaud steered it successfully through a merger to become IBL Ltd in 2016.

As Group CEO of IBL Ltd, the largest business group on the island of Mauritius, Arnaud is one of the Mauritian private sector’s most prominent leaders.

The conglomerate established an office in Nairobi to lead its search for buyout opportunities as part of its strategy to expand in East Africa.

Read: Letshego Holdings appoints Gorata Tlhale as Company Secretary

Based in Nairobi’s Westlands, Harley’s supplies pharmaceutical products and medical equipment. It offers a range of products such as pharmaceuticals, hospital beds, intravenous poles, bedside cabinets, examination beds, delivery beds, and stainless steel buckets.

Additionally, it has formed strategic partnerships with renowned suppliers such as Bayer, GlaxoSmithKline, Merck, and Roche.

Harley’s presence spans across five locations including Nairobi (Central), Mombasa (Coast), Eldoret (Western), Dar es Salaam (Tanzania), and Kampala (Uganda), where it operates offices and stock points.

Rupen Haria, the managing director of Harley’s, expressed his enthusiasm for the newly formed partnership with IBL, stating: “We are excited to collaborate with IBL and believe that our shared values and strategic objectives will lead to a successful partnership.”

“With this alliance, we are poised to accelerate our growth and move into the next phase of our development,” Haria added.

Recently, IBL Group partnered with other investors to secure US$8 million in a Series-A equity-debt round for Qotto, a Burkina Faso and Benin-based solar kit provider.

This support from Arnaud Lagesse’s IBL Group followed the conglomerate’s collaboration with other investors to back 4Di Capital’s new $25-million seed fund, which occurred just three months prior.

Financial performance of IBL

Meanwhile, IBL Group’s revenues for 1H2023 increased by 24 per cent to Rs 27.06 billion compared to prior year. Operating profit for the Group has increased to Rs 1.99 billion from Rs 1.65 billion in 1H2022, representing a growth of 20 per cent. Underlying profit has increased by 81 per cent to reach Rs 1.79 billion, on the back, inter alia, of the recovery of businesses previously highly impacted by border closures.

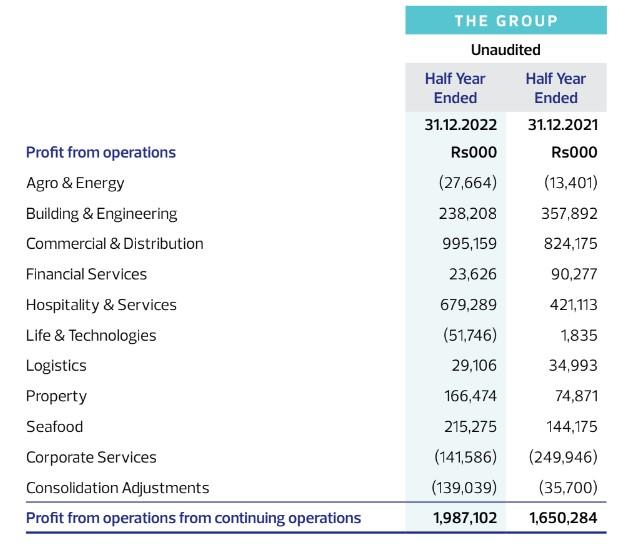

IBL Group’s building and engineering sector witnessed a decrease in profitability mainly on account of CNOI which registered an increase in costs related to ship building while the corresponding revenue will be only accounted in the second half of this financial year. According to IBL, UBP, another of its subsidiaries, also reported a marginally lower profit, largely owing to its core activities experiencing rising costs of production of imported inputs. Manser Saxon group, on the other hand, registered an increase in profitability with new contracts secured and tighter cost management.

As presented in the Group’s unaudited abridged financial statements for the first half of the current financial year, commercial and distribution cluster profitability was driven by Winners and BrandActiv mainly.

“BrandActiv registered higher sales on account of new products being marketed. Better performance from local operations of PhoenixBev pulled results upwards,” said the company.

However, lower results from Eagle Insurance negatively impacted results. The insurance company experienced major claims with severity. Investment and dividend income also yielded lower returns compared to last year. Higher running costs owing to expansion initiatives have affected profitability for DTOS Group.

Although IBL issued a cautionary announcement on its intention to dispose of its 30.29 per cent shareholding in AfrAsia Bank Limited to AFG Holding in late December. AfrAsia reported an increase in all its revenue segments as compared to last year, resulting in higher operating profit and profit after tax.

“Our hotels benefited from the pickup of travel and tourism and posted excellent results despite the closure of LUX* Belle Mare, due to the fire outbreak in early July 2022,” said the company.

In the meantime, reconstruction works at LUX* Belle Mare are well underway, and the hotel reopening is scheduled for the high season this year, according to IBL.

In its Life and Technologies vertical, the leading subsidiary in this sector, CIDP experienced a fall in profitability with the Euro rate depreciating along with rising operational costs.

“All the projects around our Health and Wellness activities are progressing to our satisfaction,” noted the holding company.

The aviation and shipping sub-segments within the cluster fared better. Aviation was impacted by border closures in 2021 while more vessel calls and higher charter hire days enhanced results for the shipping segment. Logidis was affected by higher running costs and Somatrans, the freight forwarding business, posted strong performance.

BlueLife drove the increase in the company’s sector profitability with the property and hospitality segments recovering with the re-opening of borders. Bloomage posted stable operating results but was affected by rising interest rate environment.