- Savannah Clinker seeks to acquire 100% of the Nairobi Securities Exchange-issued shares of Bamburi Cement for $197.3M (KES25.4Bn), an offer that is higher than the $180M (KES23Bn) placed earlier by Amsons Group.

- The competition between Savannah Clinker and Amsons Group underscores an ever-persistent rivalry between Kenyan and Tanzanian firms in the East African market.

- In July, Amsons’ $180M offer was seen as a strategic move to expand its footprint in Kenya and tap into the lucrative construction market.

The push by Tanzania-based conglomerate Amsons Group to grow its footprint across Kenya through the acquisition of Bamburi Cement has taken a fresh twist after a Kenyan-based mining firm Savannah Clinker Ltd placed a more attractive counter-offer for the full acquisition of Bamburi PLC.

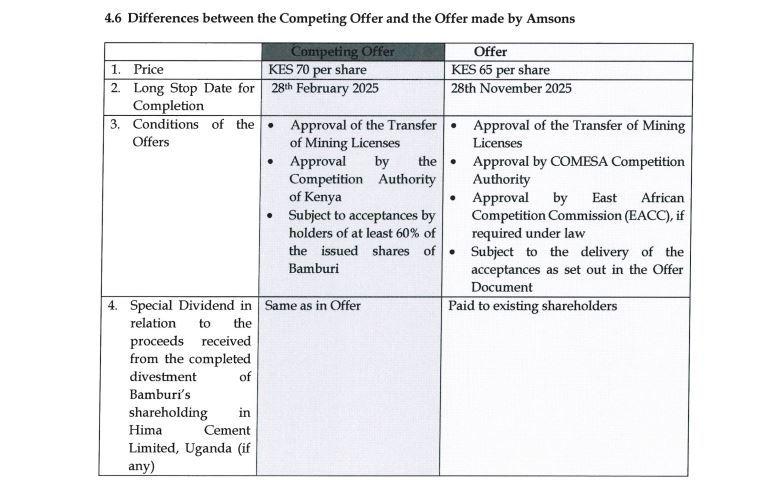

In the latest filing with market regulators, Savannah Clinker seeks to acquire 100 per cent of the Nairobi Securities Exchange-issued shares of Bamburi Cement for $197.3 million(KES25.4 billion), an offer that is higher than the $180 million or KES23 billion placed in July 2024 by Amsons Group.

Savannah Clinker’s offer not only surpasses the initial bid by cement manufacturer Amsons Group, but also highlights the strategic importance of Bamburi Cement as a key player in the region’s construction sector as well as industry.

“I am pleased to present this competing offer, which represents a patriotic commitment to secure Kenyan manufacturing interests, now that an opportunity to exit a major multinational player is on the table,” said Savannah Clinker Executive Chairman and Director Benson Ndeta in a statement.

He added, “I have been involved in the local [Kenyan] business and construction industrial sector for the last two decades. I have served as a former non-executive chairperson at the East African Portland Cement and a former majority shareholder at Savannah Cement until November 2022. I am therefore committed to investing in the growth of Bamburi Cement through this acquisition bid and an even larger capital expenditure outlay to accelerate modernization and operating efficiency programmes.”

Rivalry between Kenyan and Tanzanian firms

The competition between Savannah Clinker and Amsons Group underscores an ever-persistent rivalry between Kenyan and Tanzanian firms in the East African market. Bamburi Cement, one of the largest cement manufacturers in the region, is a valuable asset for any company looking to solidify its position in the mining, building, and construction industry.

Amsons Group, a Tanzanian conglomerate with diverse interests, had initially appeared to be the frontrunner in the race to acquire Bamburi PLC, which exited Uganda market late last year. Their $180 million offer was seen as a strategic move to expand their footprint in Kenya and tap into the lucrative construction market. However, Savannah Clinker’s counter-offer not only challenges Amsons’ position but also introduces a nationalist element to the bidding war, with Ndeta framing his bid as a move to keep Bamburi Cement firmly under the control of Kenyan hands.

Financial and strategic implications

Savannah Clinker’s offer of $0.54 (KES70) per share represents a 53.34 percent premium over the share price as of July 9, 2024, and a 64.55 percent premium over the 30-day volume-weighted average price (VWAP), the Kenyan company explained in a market update. This premium is a clear pointer to Ndeta’s commitment to securing Bamburi Cement and is likely to appeal to shareholders seeking immediate returns.

In addition to the financial incentives, Savannah Clinker’s bid offers several strategic advantages. By acquiring Bamburi Cement, Savannah Clinker would gain control of a major player in the East African cement market, with considerable production capacity, a well-established brand and market share, too. Subject to regulatory approvals, the acquisition would also allow Savannah Clinker to expand its operations and increase its market share, positioning it as a dominant force in the regional construction industry.

Moreover, Savannah Clinker’s commitment to retaining up to 40 percent of Bamburi’s shares as free float on the Nairobi Securities Exchange (NSE) reflects a desire to maintain transparency and continue engaging with institutional and local investors. This approach contrasts with Amsons Group’s offer, which has been criticized for potentially leading to the delisting of Bamburi from the Nairobi bourse.

Regulatory and market reactions

The Capital Markets Authority (CMA) and other regulatory bodies will play a crucial role in the outcome of this bidding war. Both Savannah Clinker and Amsons Group will need to navigate a complex regulatory space to secure approval for their respective offers.

Savannah Clinker’s commitment to completing the transaction by February 28, 2025, provides an additional advantage over Amsons Group, which has set a longer timeline with a long stop date of November 28, 2025. This accelerated timeline could prove attractive to shareholders eager to cash in on their investments sooner rather than later.

Market reactions to Savannah Clinker’s counter-offer have been largely positive, with analysts noting the strategic importance of keeping Bamburi Cement under Kenyan ownership. The offer has also sparked renewed interest in Bamburi’s shares, with prices expected to rise as the bidding war intensifies.

Read also: Tanzania’s Taifa gas to shake-up Kenya’s cooking gas market

Implications for the East African cement market

The outcome of this bidding war will have an impact on the East African cement market. If successful, Savannah Clinker’s acquisition of Bamburi Cement would strengthen Kenya’s position in the regional construction industry and potentially lead to increased competition between Kenyan and Tanzanian firms.

On the other hand, if Amsons Group were to prevail, it could mark a shift in the balance of power in the East African market, with Tanzanian firms gaining a stronger foothold in Kenya. This could lead to increased competition and potentially lower prices for consumers, but it could also raise concerns about foreign ownership of key industries in Kenya.

As the bidding war between Savannah Clinker and Amsons Group continues to unfold, the future of Bamburi Cement hangs in the balance. Shareholders will need to carefully consider the financial and strategic implications of each offer before making their decision.

For Savannah Clinker, the path forward involves not only securing the necessary regulatory approvals but also winning over shareholders and convincing them that their offer is in the best long-term interests of the company. The firm’s commitment to retaining Bamburi’s Kenyan identity and investing in its future could prove to be a decisive factor in this high-stakes battle.

As the deadline for final offers approaches, all eyes will be on the East African cement market, where the rivalry between Kenyan and Tanzanian firms is set to shape the future of the region’s construction industry. Whether Bamburi Cement remains under Kenyan ownership or becomes part of a Tanzanian conglomerate, the outcome of this bidding war will have lasting repercussions for both countries and the broader East African market.