Africa’s blue economy is set to flourish and gain a whole new prominence in 2023, with increased investments lining up to exploit this lucrative but undervalued sector.

One of the major announcements that has signalled an increased interest in the blue economy came out of the twenty-seventh session of the Conference of the Parties (COP 27) in Sharm el-Sheikh, Egypt in November 2022. The World Bank announced a Mangrove Blue Carbon Pilot Program, an initiative meant to catalyze financing and provide operational response to developmental challenges in coastal-marine areas of the African continent.

Dubbed the Blue Economy for Resilient Africa Program (BE4RAP), the initiative seeks to respond to the challenge coastal countries face in managing their marine resources, to spur economic growth and reduce poverty, while adapting to the effects of climate change. The program is set to convene a “Focus on Africa Blue Marketplace” in 2023.

Building on the vast existing portfolio of the World Bank in North Africa and Sub-Saharan Africa, the BE4RAP is intended to mobilize new support, financing, and partnerships to respond to the COP 27 ambition, to have an Africa-wide initiative bringing innovative climate solutions, notably to the Blue Economy.

The initiative has unlocked financing from both the public sector as well as from the Nordic private sector which has the potential to be replicated in the coastal landscape in other African countries. The $13.5 million program includes $2 million financing from IDA and $3 million from PROBLUE, a multi-donor trust fund housed at the World Bank, and $8.5 million from the Danish energy company Ørsted.

The funds will go towards planting, technical assistance, and maintenance over 20 years of 3,000 hectares of mangrove in Ghana, under the World Bank-financed West Africa Coastal Area Management Program (WACA). Other financiers, including private, public, and multilateral partners, have expressed interest in contributing to a portfolio of blue economy investments in Africa. The program will build upon successful programmatic experiences in the continent, such as Morocco’s Blue Economy Program, the Red Sea, the Gulf of Aden and analytical work such as the Blue Skies and the Blue Seas report.

During the 2022 Zanzibar Trade and Investment Forum, it was revealed that since 2020, Zanzibar has registered blue economy investment projects worth $3B. Upon completion and implementation, the island could see as many as 9000 jobs created for its residents.

Read: Africa should set its own terms for green energy

A week later, the 2022 African Economic Conference was held in Mauritius and organised by the African Development Bank Group, the United Nations Economic Commission for Africa (UNECA) and the UNDP. This was a plenary session that explored the theme; ‘From National to Regional Blue Bonds: Attract Blue Impact Investing to Unleash the Potential of the African Blue Economy for Climate-smart Development in Africa.’

Here, conversations revolved around the mobilization of blue bonds to meet sustainable development objectives and discussed how a regional approach could scale up blue economy activities to the point that they have an outcome on climate impact. Delegates also deliberated on the role of AfCFTA framework and how it can be leveraged to develop sustainable regional blue value-chains and how to promote Africa’s efforts to “build forward better.”

The blue economy encompasses the sustainable use of ocean resources for economic growth, improved livelihoods and jobs while preserving the health of ocean ecosystems and water resources. This includes all economic activities taking place in a marine or inland water environment, whether traditional, such as fisheries, tourism and transport, or innovative, such as biotechnology, aquaculture and renewable energy.

Photo/World Bank

Africa is endowed with rich marine and aquatic resources which include oceans, rivers, lakes, seas and rivers wielding massive potential for blue economy growth. The continent boasts of 38 coastal states and a number of island states such as Cape Verde, Sao Tomé and Principe, Mauritius, Seychelles, Madagascar and the Comoros.

African coastal and island states encompass vast ocean territories of an estimated 13 million km². These water bodies and wetlands have been identified to be of strategic importance to the continent and provide opportunities for fisheries, aquaculture, shipping, coastal tourism, offshore oil and gas energy mobilization and other blue economy related activities.

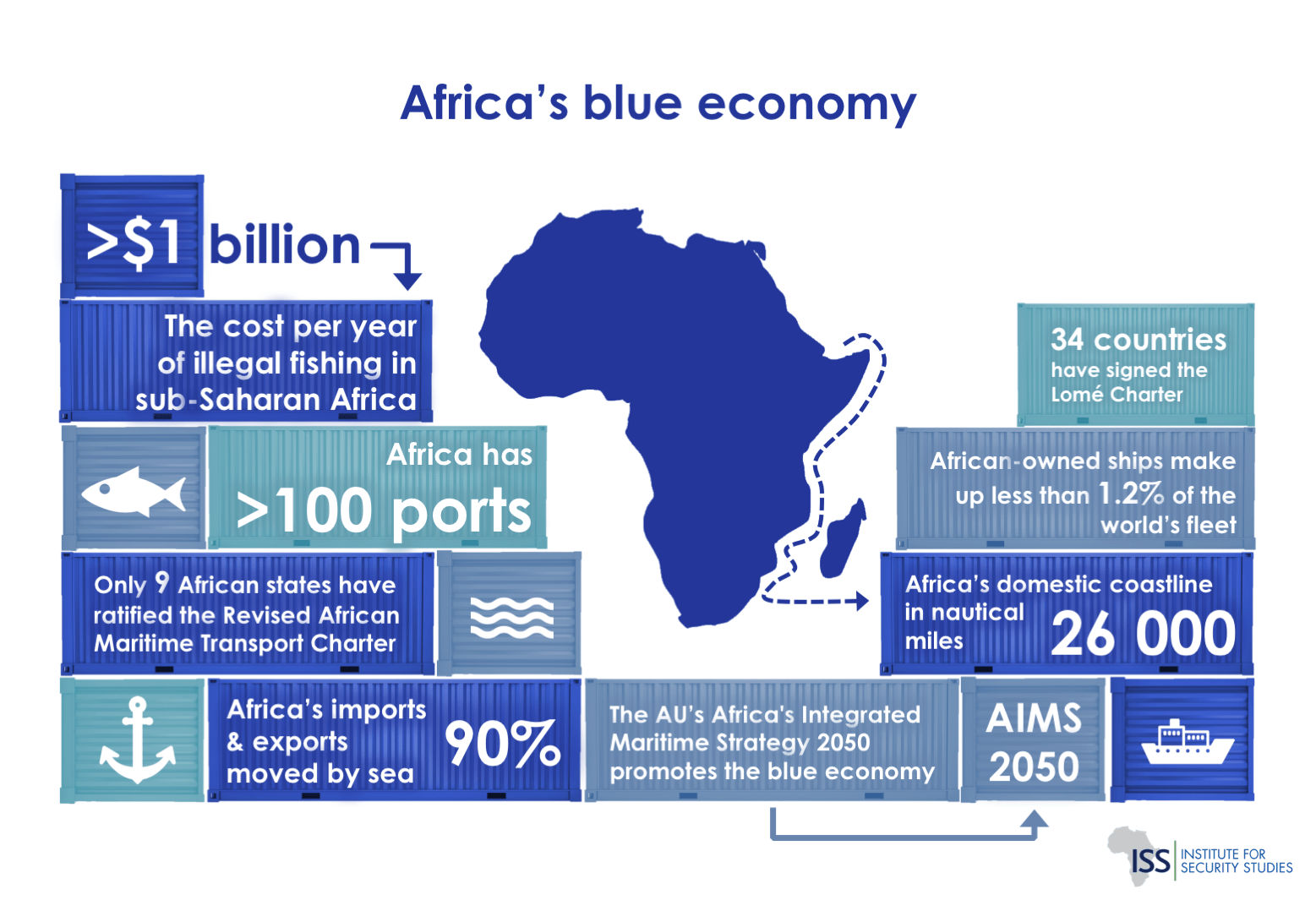

According to the African Union Blue Economy Strategy, 90% volume of imports and exports in the continent are conducted by sea, and the sector provides 49 million jobs. The estimated value generated by coastal tourism by 2030 is $100B whilst the projected value of the African blue economy is $405B.

Currently, Africa’s blue economy generates nearly $300B for the continent. This figure is set to increase as countries continue to develop their offshore hydrocarbon, energy, tourism, maritime transport, shipping and fishing sectors.

One of the key goals under Africa’s Agenda 2063, is harnessing the potential of the blue economy for accelerated economic growth. This aligns to goal 14 of the UN Sustainable Development Goals (SDGs) on ‘Life below water.’ Similarly, one of the key pillars of the Great Blue Wall Initiative (GBW), is to unlock the development of a regenerative blue economy to foster sustainable development.

Africa, as the rest of the world, is in its second year of the Ocean Decade, officially launched on 1 January 2021. The Ocean Decade is considered a tool which brings together ocean actors across the world to meet ocean-related SDGs. In addition, it was initiated to foster partnerships and generate the knowledge needed to support a well-functioning, productive, resilient, sustainable and inspiring ocean.

The Sustainable Blue Economy Conference held in November 2018 in Nairobi, Kenya which was the first global conference on the sustainable blue economy; served as an eye opener to many African nations, on how to navigate and promote sustainable blue economy development. Following the conference, leaders across the continent committed to developing Africa’s Blue Economy Strategy, encapsulated in the Nairobi Statement of Intent on Advancing the Global Sustainable Blue Economy.

Also Read: Africa’s perfect energy cocktail for power sufficiency

How 2022 Stirred up Investments in Africa’s Blue Economy Sector

2022 was a significant year that greatly championed and set the stage for the exploration of Africa’s blue economy, renewing the need for deepened investments in the sector to meet the continent’s developmental goals.

In March 2022, the Kigali Declaration of the African Regional Forum on Sustainable Development called on African countries to support the Great Blue Wall initiative. In June, at the annual World Environment Day, discussions on exploring the blue economy took centre stage with the World Oceans Day being marked three days later under the theme; ‘Revitalization: collective action for the ocean.’

As the month drew to an end, progressive discussions on the same took place at one of the side-events during the 2022 Commonwealth Heads of Government Meeting (CHOGM) in Kigali, Rwanda under the auspice of the Commonwealth Blue Charter. Member countries agreed to actively cooperate to meet commitments for sustainable ocean action, which largely included tapping into the blue economy. The month culminated with the ocean conference at Lisbon, Portugal co-hosted with the Republic of Kenya. The theme was ‘Shaping a Sustainable Blue Economy for Africa’ and discussions largely revolved around opportunities for the African continent, to leverage its blue resources to develop robust economies while meeting climate targets.

Three months down the line, the conversation picked momentum at the 2022 Blue Invest Africa held forum in Seychelles, hosted in partnership with the European Union (EU) making it the first ever Blue Invest edition to be held out of Europe. This was a B2B event for entrepreneurs and investors in the blue economy which aimed to showcase Africa’s potential on sustainable blue economy, foster entrepreneurship and innovation and promote public-private cooperation. The platform served as an exchange point for investment parties, pooled across Europe and Africa. The event saw the participation of over are 500 participants attending this business event both physically and online from 37 African countries.

Simultaneously, enthusiasm on the subject peaked at a seperate event during the 8th edition of the Tokyo International Conference on African Development (TICAD VIII) summit in Tunisia, dubbed ‘Africa Continental Investor Convening: Partnering for SDG Investments in the Green & Blue Economy in Pursuit of Agenda 2063′.

The event brought together the private and public sector, attracting some 300 participants to discuss investment opportunities in the green and blue economies, with the potential to drive inclusive growth and contribute to the achievement of SDGs on the African continent.

During Ocean Action Day at COP27, delegates called for unity, raised ambition, increased finance and ocean-based climate action to accelerate mitigation pathways and support ongoing resilience and adaptation needs. Furthermore, governments were called upon to build momentum for a sustainable blue economy, to help deliver on job creation, food and energy security.

It was declared that finance flows for ocean-climate solutions must substantially increase. It was recommended that access to different types of financial resources ought to be strengthened and made available to coastal States which includes the UNFCCC financial mechanisms, by involving the private sector and by building local economic capacities. The 2022 Zanzibar Trade and Investment Forum and the 2022 African Economic Conference in early December, wound double down the series of events bound to materialize in 2023 going forward.

Photo/ISS Africa

Understanding Blue Economy Financing in Africa

Many African countries have excelled at putting in place mechanisms to rapidly develop the ocean economy. The Blue Economy is at the core of the economic development and competitiveness of Africa’s coastal countries. The topic of blue financing is largely misconceived as opposed to green financing.

Just what exactly is blue finance and how does it work?

Blue Finance refers to investments dedicated to finance or refinance activities, which contribute to oceans protection and improved water management. Under this umbrella, we have blue loans and blue bonds. The latter refers to a loan that is aligned to the Green Loan Principles where the proceeds are exclusively dedicated to finance or refinance activities that contribute to oceans protection or improved water management. The former refers to a fixed income instrument that is also aligned to the Green Bond Principles for the same course. In addition, blue economy impact refers to the measurable variation in a physical, chemical, or biological variable of oceans ecosystems, or water related systems as expressed by a quantitative indicator.

One unique example we have on innovative financing mechanisms and the management of waters in Africa is the joint management area established by Mauritius and Seychelles on the continental shelf. This enables both countries to share their resources and capacities. It also avoids the situation where there is contention over boundaries, meaning they are able to effectively use their resources for development. The Republic of Seychelles launched the world’s first sovereign blue bond in 2018 to help finance the island nation’s transition to sustainable fishing and the protection of marine resources.

The blue bond which was part of an initiative that combined public and private investment to mobilize resources for empowering local communities and businesses raised US$ 15 million from international investors and has been greatly assisting Seychelles in safeguarding its oceans while sustainably developing its blue economy.

Other countries with promising blue economy projects and initiatives include: Madagascar, South Africa, Kenya, Nigeria, Guinea, Cameroon, Egypt, Algeria, Côte d’Ivoire, Morocco, the Gambia, Tunisia, Namibia and Ghana.

Undoubtedly, blue loans are bound to increase in 2023 going forward to tap into the potential of this profitable sector. However, the impact of blue bonds needs to be examined in order to track the progress of blue economic gains in the continent.