- Western Africa startups have received the highest funding since 2019 to date according to the latest report by Africa: The Big Deal.

- The report released on Tuesday indicates that Western Africa startups have received $5.1 billion from 2019 to October 2023.

- Eastern Africa came in second having received $3 billion in the period under review while Northern Africa followed with $2.5 billion worth of deals.

Western Africa startups have received the highest funding since 2019 to October 2023, according to the latest report by Africa: The Big Deal. The report, released on Tuesday, indicates that Western African startups have received . (Zolpidem) 1 billion from 2019 to October 2023.

Eastern Africa came in second, having received $3 billion in the period under review, while Northern Africa followed with $2.5 billion worth of deals. In East Africa, 84 per cent of all the funding raised since 2019 was raised by startups in Kenya.

“In 2023 so far, this percentage currently stands at 94 per cent (85 per cent if we only consider equity), its highest level since we’ve started recording data. This is much higher than Kenya’s share of the regional population or GDP (13 per cent and 26 per cent respectively),” the report shows.

Southern Africa came in fourth place with $2.3 billion worth of deals, while Central Africa startups received $150 million in the period under review.

Nigeria leads in attracting funds for Western Africa startups

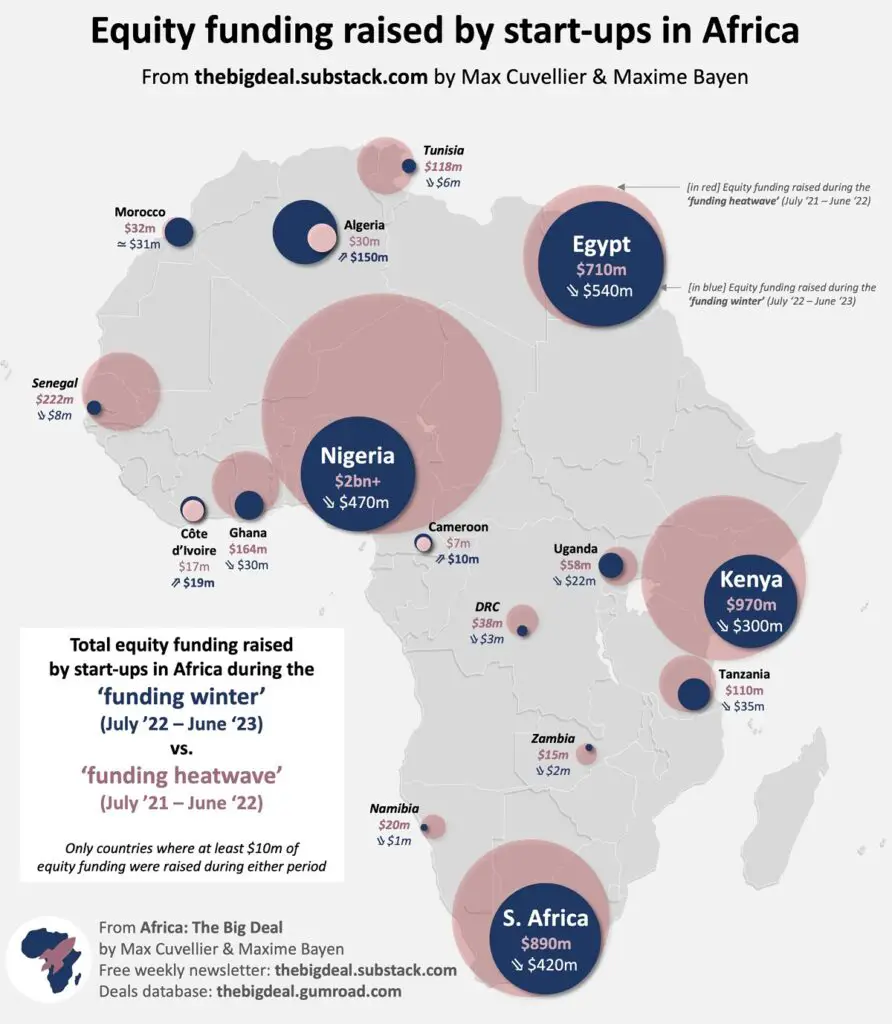

“The domination of the Big Four, and of Nigeria in particular, which has claimed more than a third of all funding since 2019 ($4.2 billion) and a staggering 300 $1 million+ deals. Kenya, South Africa, and Egypt are neck and neck, with around 200 $1 million+ deals each, quite behind the Nigerian giant,” the report reads.

According to the report, seven markets have claimed more than $100 million during the period: Senegal, Ghana, Algeria, Tanzania, Tunisia, Uganda, and DRC in this order.

“As often though, there is more than meets the eye. Indeed, while Ghana has been home to 42 $1m+ deals since 2019, some other markets’ performance relies heavily on a handful of deals, sometimes even a single venture,” the report added.

Yassir in Algeria raised $180 million, which constitutes 97 per cent of all the funding raised in the country, and to a lesser extent, Wave in Senegal, whose funding constitutes 78 percent of funding raised in that country.

“Another group of six countries does not quite reach the $100 million mark but claimed at least $500,000 of monthly funding on average over the period: Benin, Morocco, Cote d’Ivoire, Rwanda, Ethiopia, Cameroon, and Zambia,” the report indicates.

On this list, Morocco deserves a mention as it is not only one of the markets where a single deal/venture isn’t responsible for most of the fundraising, but also because the number of $1m+ deals since 2019 (22 in total) is higher than for most countries in the $100 million+ club above.

Read also: African startups’ resilience tested amid a financing dip

About 20 African countries fail to feature in startup survey

Eleven markets make up the rest of the list with less than $25 million raised since 2019, sometimes much less. Except for Zimbabwe (9), each of these markets only has one to three startups for whom we have tracked activities since 2019, though our thresholds might mean we have missed some $100,000+ deals in 2019 and 2020.

“A total of 20 countries are completely absent from this map, as we have recorded no funding activity since our tracking started in 2019,” the report concluded.

A previous report by the research firm indicates that Africa remains relatively underfunded compared to its demographic and economic potential: since 2019, $11.5 billion were invested in startups in Africa (equity only), compared to $42 billion in France (3.6x) and $81 billion in India (7x).

However, Africa has overall been following the same trends as France and India (except for the Q3’23 bounce, which might just be delayed for the continent). If anything, there is less of a gap between India and Africa since the beginning of the funding winter (4.5:1 since Q3’22) than there was at the height of the funding heatwave (7:1 between Q1’22 and Q2’22).