Zimbabwe’s dual economy, the formal and informal sectors, have become two distinct economies in Zimbabwe. With the former vulnerable to complex tax regimes and inconsistent monetary policies, the latter has no regard for both.

In some circles, the informal sector has been referred to as the grey economy, shadow economy, underground economy, parallel sector, and the cash economy.

- Econet Life, an EcoCash Holdings Zimbabwe insurance unit, has launched a unique micro-pension fund product that allows people in the informal sector to save for retirement

- The new product, called Dura/Isiphala Pension Fund, was launched in Kariba at the weekend and is expected to drive the uptake of pensions by workers in the informal sector

- Meanwhile, on March 27, 2019, President of Nigeria Muhammadu Buhari launched the Micro Pension Plan (MPP) as part of his administration’s efforts to ensure that Nigerians who worked hard during their active years in service of their fatherland live in dignity and retire without any cause for alarm

According to national statistics, the informal sector’s contribution to Gross Domestic Product (GDP) is estimated to be below 50 per cent. According to the World Bank, Zimbabwe’s economy grew by 5.8 per cent to US$19.2 billion in 2021 after contracting by 6.1 per cent in 2019 and 6.2 per cent in 2020.

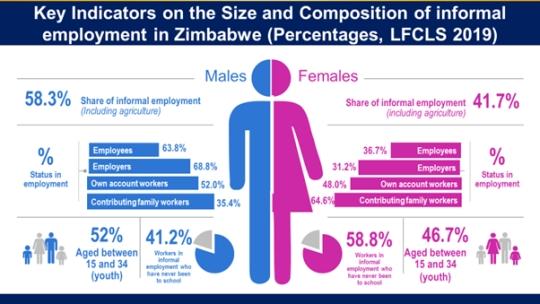

The 2022 Labour Force Survey published by the Zimbabwe National Statistics Agency (Zimstat) points out that 3.3 million people are employed locally, pointing out that over 2.8 million Zimbabweans derive their living from the informal sector as opposed to 495 000 in formal employment.

According to an article by The Independent dated July 22, 2022, the level of formalisation in the country is now estimated to be between 65 per cent and 70 per cent due to several push-and-pull factors such as high inflation, poor remuneration in the formal sector, punitive foreign exchange regulations, weak institutions and high levels of corruption, low tax morale, high levels of unemployment, overregulation, limited automation in tax collection and increase in poverty levels in the country.

Defining the informal sector The International Labour Organisation (ILO) defines the informal sector as all economic activities by workers and economic units that are not covered or sufficiently covered by formal arrangements at law.

Formal arrangements include adherence to contracts in business transactions, applying labour regulations, social security contributions, banking proceeds, paying requisite taxes and council levies, and following legal channels for importing and exporting goods.

Therefore, those employed in the informal sector are not subject to national labour legislation, income taxation, social protection, or entitlement to certain employment benefits such as maternity leave.

Econet Life, an EcoCash Holdings Zimbabwe insurance unit, has launched a unique micro-pension fund product that allows people in the informal sector to save for retirement. This is a game-changer since workers in the informal sector now have something to add as social protection.

EcoCash Holdings Zimbabwe is a diversified technology group that leverages digital solutions to make a social and economic impact on the lives of all Zimbabweans.

Read: Zimbabwe: EcoCash introduces AI-powered bot to improve customer experience

The new product, called Dura/Isiphala Pension Fund, was launched in Kariba at the weekend and is expected to drive the uptake of pensions by workers in the informal sector.

Dura/Isiphala positions Econet Life as the only innovative pension company using technology to drive financial inclusion. The new product is set to empower SMEs, co-operatives, civil servants, and individuals in formal and informal employment between the ages of 18 and 70.

Speaking at the Zimbabwe National Co-operatives Federation celebrations of the International Day of Co-operatives in Kariba, where the product was unveiled, Deputy Minister for Women’s Affairs, Community, Small and Medium Enterprises Development, Jennifer Mhlanga commended Econet Life for launching innovative products that offer ordinary people affordable products.

“We appreciate you (Econet Life) for your continued support and innovations centred around improving the lives of our SMEs,” the Deputy Minister said.

Econet Life’s chief life and principal officer, Godwin Mashiri, said Dura/Isiphala would leverage smart systems and technology to ensure broad-based inclusion of all workers.

“We continue to re-think efficient ways to serve our communities. Pension should never be a preserve of the formally employed; everyone should have access to equal opportunities that help them live a better life, whether they are formally or informally employed,” he said.

Emmanuel Pfupa, the Head of Econet Life Fund Business, said the micro-pension fund will promote inclusive growth in the pension industry by enabling individuals in the informal sector to open retirement savings accounts which, until now, were only available for employees in the formal sector.

“With Dura/Isiphala Pension Fund, the first of its kind in Zimbabwe, we want to ensure that every employee in the country enjoys a good life after retirement. With this product, anyone can make monthly contributions to their Dura/Isiphala. When the need arises after a year, two, or even 10 years, they will enjoy the benefits of their investment,” he said.

Although the informal sector accounts for a big proportion of Zimbabwe’s gross domestic product, players in the sector were largely excluded from financial service offerings.

However, with Dura/Isiphala, people in the informal sector can contribute anything from as low as US$10 towards their pension. They will also be able to use the investment as collateral to access short-term loans, earn interest and access a portion of their investment after 12 months.

Econet Life said registrations and contributions can be done at Econet Shops, AFC Bank, Steward Bank, or at any EcoSure touch points around the country. It added that contributions will soon be payable via the EcoCash FCA wallet.

Meanwhile, in a related article by This Day published on June 5, 2022, on March 27, 2019, President of Nigeria Muhammadu Buhari launched the Micro Pension Plan (MPP) as part of his administration’s efforts to ensure that Nigerians who worked hard during their active years in service of their fatherland live in dignity and retire without any cause for alarm.

The MPP was initiated by the National Pensions Commission (PenCom) and was also designed to incorporate workers in the economy’s informal sector.

Since the launch of the scheme by Buhari, a total of 72,846 contributors have been registered by Pension Fund Administrators (PFAs). The micro pension scheme targets the significant majority of Nigeria’s working population who, incidentally, operate in the economy’s informal sector.

At the launch, Buhari had said the scheme was part of his administration’s efforts at ensuring that Nigerians who worked hard during their active years in service of their fatherland live in dignity and retire without any cause for alarm.

He said the federal government understood the importance of the pension industry, adding that this was why the micro pension plan was conceived to afford operators in the informal sector something to fall back on when they retire from active service.

The president added that his administration had, within the past three years, provided grants, technical support, and loans to small businesses, thereby effecting positive changes in their lifestyle.

In Nigeria, the informal sector workers include market women, members of the road transport workers, textile, garment, and tailoring associations, tricycle operators and commercial motorcycle operators’ associations, butchers associations, workers in the movie and performing art industry, mechanics and workers in the automotive industry as well as single professionals like lawyers and accountants among others.

Before now, these categories of workers and those organizations that employ less than three employees were not captured under the Contributory Pension Scheme and as such, not mandatorily covered by any retirement benefits scheme.

But with the amended Pension Reform Act of 2014, Section 2(3) has now made provision for employees of organizations with less than three employees, self-employed persons, and persons operating in the informal sector to participate in the Contributory Pension Scheme under the Micro Pension Plan.