- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: African Development Bank (AfDB)

- The programme will be rolled out in Bahr el Ghazal in the north, Eastern Equatoria, Central Equatoria and Jonglei states, creating 179,200 new jobs.

- UN’s FAO and South Sudan’s Ministry of Agriculture and Food Security have been picked as the implementers.

- The initiative will boost productivity by an additional 350,000 tonnes of rice and sorghum and 2,450 tonnes of fish.

The African Development Bank (AfDB) has approved a $46.2 million grant for South Sudan’s agriculture sector. This grant is set to finance South Sudan’s Climate Resilient Agri-Food System Transformation Programme, which is set to run between September 2024 and December 2030.

Over these six years, the project aims to deploy climate-smart technologies and production systems on a large scale while also strengthening the priority value chains of businesses led by women and young people.

The project brief shows that the project seeks to promote digital agricultural and climate advisory solutions …

- ATIDI supports the 35MW greenfield geothermal project in Kenya with its Regional Liquidity Support Facility (RLSF).

- The project, the first to be considered for RLSF cover in Kenya, is set to benefit from ATIDI’s liquidity instrument which will cover the risk of payment default by public entities: Geothermal Development Corporation and Kenya Power.

- Kenya’s power sector benefits from an active private sector and boasts abundant renewable energy resources with hydro, wind, and geothermal projects dominating its energy mix.

Regional Liquidity Support Facility (RLSF)

The African Trade and Investment Development Insurance (ATIDI) and Globeleq Africa Limited, have jointly announced the former’s support for the 35MW Globeleq Menengai Geothermal Project with liquidity cover via the Regional Liquidity Support Facility (RLSF).

RLSF, a joint initiative of ATIDI, the KfW Development Bank and the Norwegian Agency for Development Cooperation (Norad), is a credit enhancement instrument available to renewable energy Independent Power Producers …

- The Eastern Africa Power Pool has made major inroads in increasing cross-border electrification.

- The system has the potential to connect 600 million people to clean energy.

- EAPP member countries are Burundi, Democratic Republic of Congo, Djibouti, Egypt, Ethiopia, Kenya, Libya, Rwanda, Somalia, South Sudan, Sudan, Tanzania, and Uganda.

The Eastern Africa Power Pool (EAPP) is targeting to go live on power auctioning (trading) by December this year, the secretariat now indicates, in what will allow the 13-member countries to sale excess electricity across borders.

This comes as countries continue to build a strong power connection network, amid huge investments in renewable energy mainly solar, wind, hydro and geothermal.

The EAPP member countries are Burundi, DRC, Djibouti, Egypt, Ethiopia, Kenya, Libya, Rwanda, Somalia, South Sudan, Sudan, Tanzania, and Uganda.

Council of Ministers and the EAPP Steering Committee met in Nairobi this week to deliberate on the future of the power pool …

- According to the African Development Bank’s Macroeconomic report, Africa will dominate the world’s 20 fastest growing economies 2024.

- According to the report, the medium-term growth outlook for the continent’s five regions is slowly improving.

- The report forecasts more substantial growth for Africa in 2024, outpacing the projected global average; the continent is the second-fastest-growing region after Asia.

Fastest Growing Economies 2024

The African Development Bank Group’s latest Macroeconomic Performance and Outlook (MEO) indicates real Gross Domestic Product (GDP) growth for the continecustom nfl football jerseys decathlon bmx luvme human hair wigs bouncing putty egg custom kings jersey dallas cowboys slippers mens johnny manziel jersey custom kings jersey custom youth hockey jerseys brock bowers jersey luvme human hair wigs black friday wig sale college football jerseys decathlon bmx uberlube luxury lubricant nt is expected to average 3.8 per cent and 4.2 per cent in 2024 and 2025, respectively. (https://unitedwepledge.org/…

- Central Africa’s economic performance was powered by the DRC, which grew at a jaw-dropping 8.5% in 2022.

- Central Africa growth rate was higher than the African average, which is estimated at 3.8% in 2022, down from 4.8% in 2021.

- The region id projected to settle at 4.9% in 2023 and 4.6% in 2024.

Central Africa achieved real GDP growth of 5.0 per cent in 2022 compared with 3.4 per cent in 2021, as the region posted the strongest performance compared to other regions in the continent.

This was in terms of growth, inflation and budget deficit, a new report by the African Development Bank (AfDB) indicates.

Central Africa oil, minerals and commodities’ wealth

The rebound in economic activity was driven by favourable prices for raw materials. Increasingly, Central Africa economies are turning out to be a net exporter of crude oil, minerals and other commodities.

In comparison, the region’s …

- Kenya is among countries that are heavily indebted with the loan stock at staggering 67.3 per cent of GDP.

- Total debt stood at $67.7 billion (Ksh9.6 trillion) as of April, Central Bank of Kenya data shows.

- This comprised $35.9 billion external debt and $24.6 billion borrowed from the domestic market.

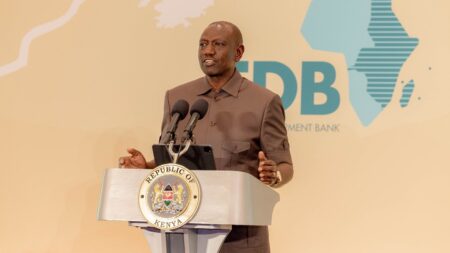

President William Ruto is calling for “urgent” redesigning of global financial institutions to ensure fairness in financing of economies, as he continues to lash out at the West over debt traps in poor states.

In what seems to be a swing at the International Monetary Fund and the World Bank, Dr Ruto is pointing to a post-colonial Africa where development has stalled due to limited resources to liberate economies.

Lenders placing debt traps in poor States

This is from what Dr Ruto terms institutions that were extractive by design; only placing debt traps in poor states. Over the years, Kenya’s …

- Kenya’s Nairobi Securities Exchange posted drop in capitalization in April due to investor flight.

- Other poorly performing bourses were Uganda, Mauritius, Namibia, Morocco, Tanzania, Rwanda and Tunisia.

- Zambia, South Africa, Ghana and Egypt remained positive railing Zimbabwe and Malawi.

Zimbabwe has maintained the lead in the African equity markets returns by recording the highest gains at 112.33 percent year-to-date, the latest data shows. In the period under review, Malawi recorded the highest month-on-month value of 10.96 percent.

At the same time Kenya posted the highest drops both on year-to-date and month-on-month, Nairobi Securities Exchange (NSE) monthly barometer indicates, which stood at negative 15.56 percent and minus 3.52 percent, respectively.

Other poor performers across Africa were Uganda, Mauritius, Namibia, Morocco, Tanzania, Rwanda and Tunisia. In West Africa, Nigeria performed poorly on the month-on-month index but remained positive year-to-date. Zambia, South Africa, Ghana and Egypt remained positive railing Zimbabwe and Malawi.

Kenya’s …

- Kenya is among the top three countries receiving the most international remittances across sub-Saharan Africa, after Nigeria and Ghana. Overall, the US, Saudi Arabia and UK account for nearly three-quarters of total annual inflows into Kenya.

- Kenyans living abroad sent home $357 million in March 2023, a 15.5 percent increase compared to February.

- As a whole remittances from the African diaspora are estimated at $95.6 billion annually, making it a key foreign exchange earner.

Diaspora remittances have risen to become Kenya’s largest foreign exchange earner, surpassing the country’s key exports such as tourism, tea, coffee and horticulture. According to Central Bank of Kenya (CBK) data, diaspora remittances rose by 8.34 percent to $4.027 billion in 2022. In the same period under review, tea exports earned the country $1.2 billion, horticulture $901 million, chemicals $521 million, coffee $301 million and petroleum products $77 million. The widening disparity highlights the crucial role …

- Kenya’s President William Ruto says the free movement was necessary for sustainable growth in the Horn of Africa.

- Dr Ruto calls on member states in the region to eliminate national boundaries that are chocking growth.

- EAC Secretary General Peter Mathuki notes EAC can address challenges in advancing movement of goods and labour.

Barriers to free movement of goods and people are chocking East Africa’s regional integration. To unlock the bloc’s trade potential, Kenya’s President William Ruto is calling in the East African Community (EAC) and the Intergovernmental Authority on Development (IGAD) to remove barriers to free movement. Dr Ruto urges that free movement of people, goods and services can significantly enhance East Africa’s regional integration.

The Kenyan President notes the free flow of goods and capital was necessary for sustainable growth across East Africa.

The President is now challenging regional member states to eliminate national boundaries that have since become …

- Africa’s green bonds market is growing rapidly as the continent increases issuances to power transition to green energy.

- The Green and Resilience Debt Platform (GRDP) has been established to address climate financing gaps in Africa.

- Countries will now have access to $2B in green debt capital markets via the Platform, thereby bolstering resilience against climate change shocks.

The green bonds market in Africa is showing strong signs of growth as countries move to tackle climate change. The sector is registering a renewed momentum attracting investments in response to the continent’s vulnerability to climate change crisis. For instance, the Nordic Development Fund (NDF) has granted EUR 500,000 to the Green and Resilience Debt Platform (GRDP).

The Fund was established by the UNDP in partnership with UNCDF, European Investment Bank (EIB), Green Climate Fund (GCF) and the European Union’s Global Green Bond Initiative (GGBI). The platform is working with various stakeholders to …