- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: AZA Finance

- Businesses in Kenya are facing the impact of tightened monetary policy that is resulting in high lending rates.

- The government is under increasing pressure from investors to settle huge pending bills.

- At the same time, the Kenya Shilling is steadily losing ground against major world currencies, piling pressure on external debt obligations.

In the second half of the year, business optimism for companies and sectoral growth prospects in Kenya appears to be subdued, largely influenced by the dual challenges of high taxes and a weakening Shilling.

The government’s task of balancing rising debt levels with tax revenue generation is taking center stage in a scenario complicated by other economic factors.

A confluence of high-interest rates within the banking sector, a politically sensitive environment, the accumulation of pending bills that impact private sector cash flow, and the depreciation of the Kenyan Shilling is painting a complex business environment.

The Shilling has …

- Kenya’s inflation has eased for the second month in a row since hitting 8% in May.

- The drop in the cost of living came despite increased taxes on pump prices that is manifesting in higher transport costs.

- Previously, Central Bank Governor Kamau Thugge projected Kenya’s inflation to fall within the target band of 2.5% to 7.5% by October.

Kenya’s inflation eased in the month of July, going below the Central Bank of Kenya’s target range of between 2.5 per cent and 7.5 per cent for the first time in over a year. In the month under focus, Kenya’s inflation dropped to 7.3 per cent down from 7.9 per cent in June. The drop in the cost of living came despite increased taxes on pump prices that is manifesting in higher transport costs.

Consumer prices went up by 7.3 percent annually in July, marking the slowest rate in 14 months. This …

- Central Bank of Kenya (CBK) data shows remittance inflows in March hit $357.0 million compared to $309.2 million in February, an increase of 15.5 percent.

- Kenyans living and working abroad sent home $349.4 million in January, with the February figure being the lowest receipt since July last year.

- The cumulative inflows for the 12 months to March 2023 totaled $4 billion compared to $3.9 billion in a similar period in 2022.

Kenyans in the diaspora sent home more money in the month of March compared to February and January, defying inflationary pressures being felt by households across the globe.

Central Bank of Kenya (CBK) data shows remittance inflows in March totaled $357.0 million compared to $309.2 million in February, an increase of 15.5 percent.

The inflows were $349.4 million in January, with the February figure being the lowest receipt since July last year.

The cumulative inflows for the 12 months …

- Governor Patrick Njoroge has written to Janet Yellen seeking audience with her during this year’s Spring Meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF).

- The meetings are set to take place in Washington DC from April 10 –16.

- In January, the World Bank revised downwards Kenya’s growth projection for 2023 to five per cent from 5.2 per cent.

The Central Bank of Kenya (CBK) governor is keen to meet the US Secretary of the Treasury, as the East African country navigates through tough economic times occasioned by both global and domestic factors.

Governor Patrick Njoroge has written to Janet Yellen seeking audience with her during this year’s Spring Meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF), set to take place in Washington DC from April 10 –16.

This is after failing to meet Yellen last October.

“I would greatly appreciate …

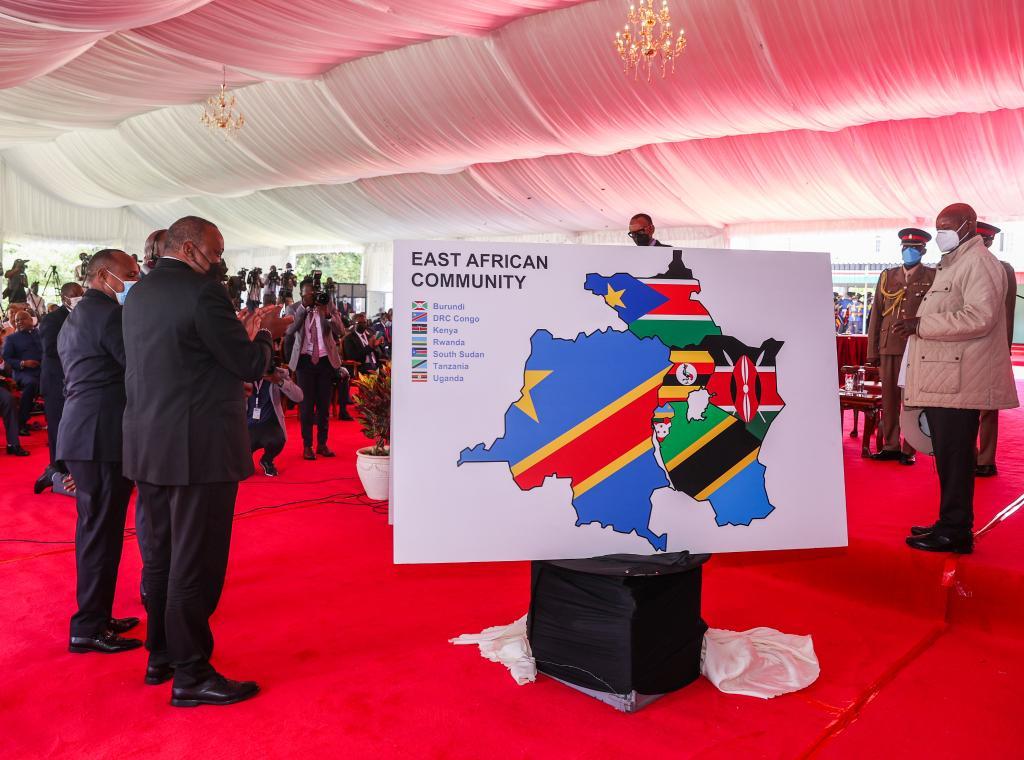

Most of the countries have no choice but borrow to bridge budget deficits. According to the IMF, the major EAC nations, namely Kenya, Uganda, Tanzania, Burundi and Rwanda, together, had borrowed more than $100 billion in both external and domestic borrowing.

With the global economy in teeters post Covid-19 and the impact of the Ukraine-Russia conflict, economies worldwide are contracting, leaving East African nations in a perilous situation.

According to the IMF, about