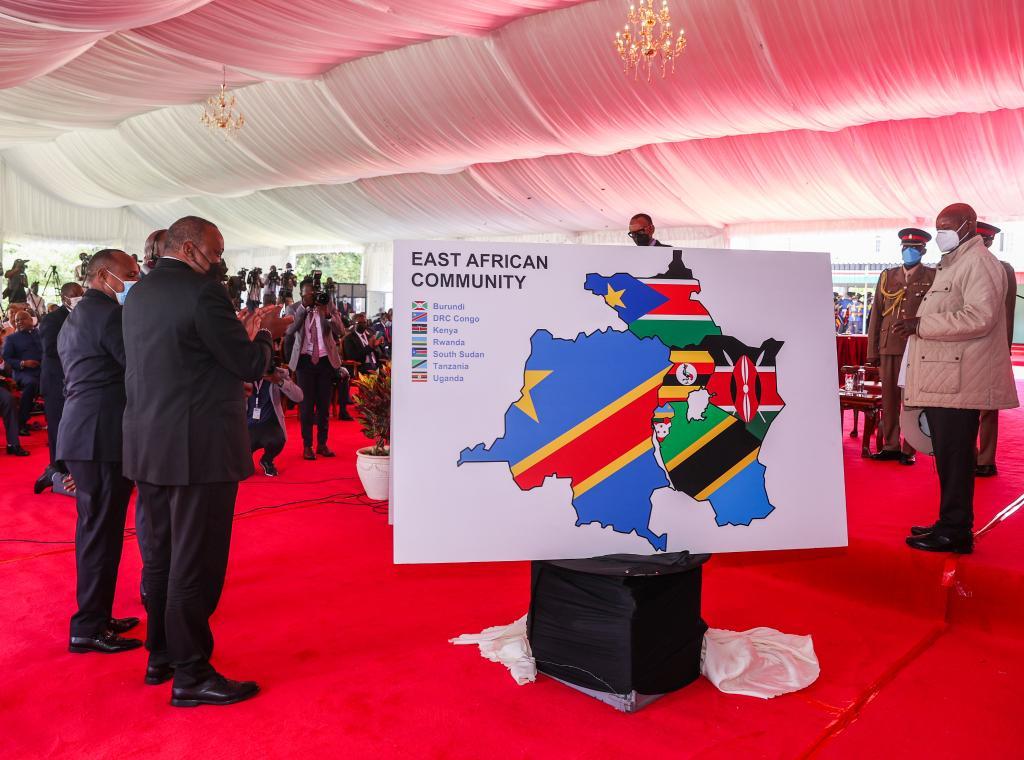

Before the Covid-19 Pandemic struck, East African countries had a common agenda to invest in infrastructure development. As the three main economies of Kenya, Tanzania and Uganda they sought to become competitive and attractive investment destinations, the issue of borrowing in foreign currencies created the debt burden they face today. The mega investments in roads,

[elementor-template id="94265"]