- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Central Bank Rate (CBR)

-

- (CBK) retained its base lending rate at a high of 13 per cent for the second time.

- This is the highest rate in 12 years, as the apex bank continues implementing monetary policies to manage stubborn inflation.

- According to CBK data, the country’s borrowers had defaulted on about $4.8 billion as of April, the highest in 18 years, due to the tough credit market.

Central Bank of Kenya (CBK) retains high interest rates

Central Bank of Kenya (CBK) retained its base lending rate at a high of 13 per cent for the second time driving the borrowing costs in Kenya to remain high for at least the next two months.This is the highest rate in 12 years, as the apex bank continues to implement monetary policies intended to manage the stubborn inflation, which slightly increased to 5.1 per cent last month from five per cent in April.

- The base-lending

- The Central Bank of Kenya benchmark rate has gone up to 12.5 per cent from 10.5 per cent.

- Developing economies including Kenya are paying dearly for geopolitical tensions.

- The current US policy rate at 5.25 per cent -5.5 per cent is the highest in 22 years, exerting pressure on economies.

Borrowers in Kenya are facing the prospect of more expensive loans following the country’s central bank’s decision to raise its base lending rate to a near 11-year high of 12.50 per cent. This marks an increase from the 10.50 per cent rate that has been in place since June this year, when it rose from 9.50 per cent due to a rise in non-performing loans in the banking sector.

The hike in rates occurs as Kenya, along with other economies in the region, continues to grapple with the impact of global factors, including elevated interest rates in the United States. …

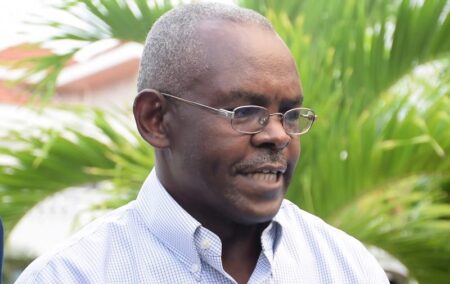

- Dr Kamau Thugge, who is President Ruto’s advisor on fiscal affairs, is set to take over from Dr Patrick Njoroge.

- Previously, Dr Thugge served as the Permanent Secretary at Kenya’s National Treasury between 2013 and 2019.

- Prior to his nomination as Principal Secretary, he worked as a senior economic adviser in the Ministry of Finance since 2010.

President William Ruto has nominated former IMF economist Dr Kamau Thugge for appointment to head the Central Bank of Kenya. Dr Ruto picked Dr Thugge out of a list of six candidates who were interviewed on May 9th for the job that helps define Kenya’s fiscal policy.

Dr Thugge is not a stranger at Kenya’s financial industry. For close to 10 years, between 2013 and 2019, he served as the Principal Secretary, National Treasury under former President Uhuru Kenyatta. He was, however, hounded out of office over allegations of corruption. The scandal, which …

- The Monetary Policy Committee (MPC) on Wednesday noted the sustained inflationary pressures, the elevated global risks and their potential impact on the domestic economy.

- CBK sees a scope for a further tightening of the monetary policy in order to anchor inflation expectations.

- Overall inflation in Kenya increased to 9.2 percent in February 2023 from 9.0 percent in January, mainly driven by higher food prices.

The Central Bank of Kenya (CBK) has revised upwards the benchmark rate by 75.0 basis points to 9.50 per cent, in its latest move to try and tame the rising inflation in the country.

This is up from 8.75, signaling a higher cost of borrowing in the market.

Its decision making organ–the Monetary Policy Committee (MPC) on Wednesday noted the sustained inflationary pressures, the elevated global risks and their potential impact on the domestic economy, and concluded that there was scope for a further tightening of …

The Bank of Uganda held its benchmark interest rate yet in an effort to keep inflation down and below target and to support economic growth.

The central bank rate (CBR) was kept unchanged at 9 per cent, initially set in October 2019 and maintained in December. The band on the CBR was maintained at positive or negative 3 percentage points while the rediscount rate remained at 13 per cent and the bank rate remained 14 per cent.

“The evaluation of the macroeconomic developments and outlook based on the available information set suggests that, at the current CBR, the monetary policy stance is accommodative and that inflation will converge to target in the medium term while supporting economic growth,” said the monetary policy statement explaining the decision.

The Bank said that Uganda’s economy is expected to expand at between 5.5 and 6 per cent in the 2019 fiscal year, which runs …

Kenyan listed banks had an improved performance on aggregate in the first quarter of 2019 as they recorded improved profitability in a relatively tough operating environment, a survey by Cytonn Investment has revealed.

During the quarter, return on equity rose to 19.2 per cent from 18.4 per cent in Q1 2018, with equity group having the highest at 22.8 per cent, Cytonn’s Q1’2019 Banking Sector Review indicates.

The report, themed ‘Consolidation and Diversification to drive Growth’, analyzed the Q1’2019 results of the listed banks.

“We note that the increased emphasis on operating efficiency by banks seems to be bearing fruit, with the listed banking sector’s operating efficiency improving year-on-year, which was further supported by a recovery in interest revenue, largely supported by the asset re-allocation to government securities, and increased lending to specific segments”, said Caleb Mugendi, investment Associate at Cytonn Investments.

“The continued focus on alternative banking …