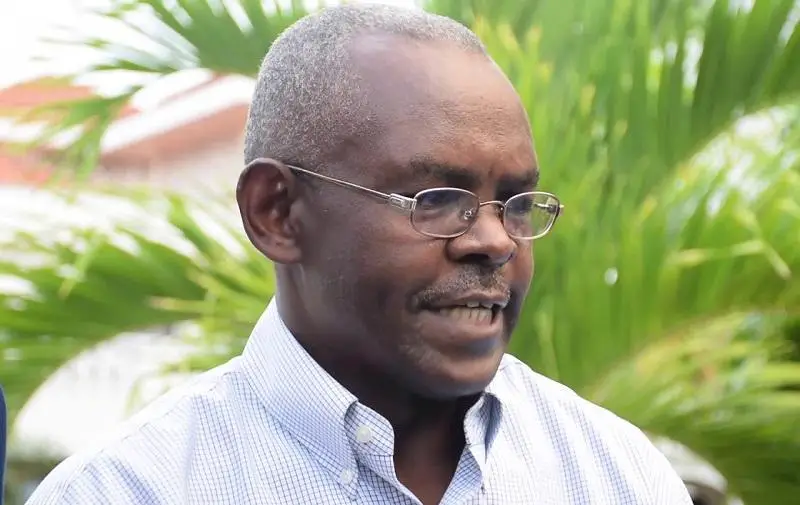

- Dr Kamau Thugge, who is President Ruto’s advisor on fiscal affairs, is set to take over from Dr Patrick Njoroge.

- Previously, Dr Thugge served as the Permanent Secretary at Kenya’s National Treasury between 2013 and 2019.

- Prior to his nomination as Principal Secretary, he worked as a senior economic adviser in the Ministry of Finance since 2010.

President William Ruto has nominated former IMF economist Dr Kamau Thugge for appointment to head the Central Bank of Kenya. Dr Ruto picked Dr Thugge out of a list of six candidates who were interviewed on May 9th for the job that helps define Kenya’s fiscal policy.

Dr Thugge is not a stranger at Kenya’s financial industry. For close to 10 years, between 2013 and 2019, he served as the Principal Secretary, National Treasury under former President Uhuru Kenyatta. He was, however, hounded out of office over allegations of corruption. The scandal, which also edged out his boss, former Treasury Cabinet Secretary Henry Rotich involved suspect payment to Arror and Kimwarer dams projects worth billions of shillings.

Prior to his appointment as PS, he worked as a senior economic adviser in the Ministry of Finance from 2010. He also worked as the head of the Fiscal and Monetary Affairs Department, Treasury between 2004 to 2005. His time at the ministry also saw him serve as the Economic Secretary and Head of the Economic Affairs Department, Treasury, between 2005 and 2008.

The Presidential nomination comes ahead of June retirement of current CBK governor, Dr Patrick Njoroge. Dr Njoroge has served two terms as Kenya’s ninth CBK governor from June 2015.

Dr Thugge worked with IMF between 1985 and 2010

Should Dr Thugge receive the seal of approval from the National Assembly, he will become Kenya’s 10th CBK governor.

“The nomination follows a competitive recruitment process carried out by the Public Service Commission,” chief of staff and head of the public service, Felix Koskei, said.

Dr Thugge is a career economist, who has served in senior positions within fiscal, monetary and economic policy-making positions in Kenya and abroad. He cut his teeth as an economist working with the IMF between 1985 and 2010.

At the Washington-based global lender, Dr Thugge served as economist, senior economist and deputy division chief. He holds a Doctorate Degree in Economics from John Hopkins University in Maryland, USA.

He was instrumental in designing Kenya’s current fiscal decentralization system following the advent of devolution. Currently, he is serving as a Senior Advisor and Head of Fiscal and Budget Policy within the Presidency, in addition to serving as a member of the President’s Economic Council.

What awaits the new CBK boss

Dr Thugge will be expected to steer CBK and guide Kenya’s monetary policies at a time the economy is facing headwinds occasioned by both domestic and external factors.

The East Africa economic powerhouse is navigating some of the toughest economic times. High inflation, rising debt, a weakening shilling, falling forex reserves and a slowdown in economic growth are headache for the government.

Read also: Why Kenya’s Central Bank governor wants to meet US Secretary of Treasury

Like many economies across the globe, fears of a global recessions remain a threat to Kenya. This as the country navigates the post-Covid pandemic road and the impact of the Russia-Ukraine war.

Kenya struggling with falling forex

In January, the World Bank revised downwards Kenya’s growth projection for 2023 to five percent from 5.2 percent. It is, however, expected to pick to 5.3 percent next year but the country is lagging behind its East African peers Tanzania and Uganda, which have stronger forecasts.

For over a year now, Kenya has been struggling with falling forex reserves. CBK data shows usable reserves stood $6.4 billion as of Friday, May 12, which is only 3.6 months of import cover.

The depletion has mainly been as a result of dollar-denominated loan repayments, reduced exports, low diaspora remittances and a high import bill mainly on fuel and fertilizers.

Kenya’s debt is currently at $68.6 billion at a time when the shilling is trading at 136.97 on average to the dollar. In the past, CBK has been forced to mop up dollars in the market to shore up the local currency.

Going forward, eyes will be on Dr Thugge on how he handles the weakening shilling and the dollar shortage. Kenya is also struggling with a widening trade deficit. This is because the country remains a net importer, a situation has has seen banks make a kill due to huge dollar demand.

Formulating monetary policies

According to Economic Survey 2023, Kenya’s import expenditure went up by 17.5 percent to $18.2 billion in 2022. This left the country with a trade deficit of about $11.8 billion.

Once he get’s a nod from Parliament Dr Thugge will be instrumental in leading the CBK’s Monetary Policy Committee. This is the policymaking organ of the apex bank responsible for formulating monetary policies.

Dr Njoroge has been leading the MPC in major decisions including back-to-back increases in the Central Bank Rate (CBR). In the latest review, the MPC increased benchmark rate to 9.50 percent from 8.75 percent.

The move is among measures taken by CBK to tame the high inflation in the country. Inflation dropped to a 10-month low of 7.9 percent in April from 9.2 percent in March. The drop was, however, below market estimates of nine percent.

Read also: Kenya’s economy slowed down in 2022 but created more jobs

“The MPC noted the sustained inflationary pressures, the elevated global risks and their potential impact on the domestic economy, and concluded that there was scope for a further tightening of the monetary policy in order to anchor inflation expectations,” CBK says in a statement.

Kenya’s banking sector remains stable

Overall, the country’s banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans stood at 14.0 percent in February 2023, compared to 13.3 percent in December 2022.

Increases in NPLs were noted in the trade, personal and household, manufacturing and building and construction sectors. Banks have however continued to make adequate provisions for the NPLs.

Growth in private sector credit stood at 11.7 percent in February 2023 compared to 12.7 per cent in December 2022. Strong credit growth was observed in manufacturing (15.2 percent), transport and communication (16.5 percent), trade (11.8 percent), and consumer durables (12.4 percent).