- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: International Monetary Fund (IMF)

- Kenya’s $2billion Eurobond was set to mature on June 24, 2024

- This is an increase of $1.31 billion (Sh168 billion) to reach US$8.32 billion (Sh1.07 trillion).

- Kenya had earlier indicated the outstanding amount would be retired through a mix of syndicated, multilateral & domestic financing.

Kenya has cleared the remaining $556.97 million (Sh71.5billion) of the $2billion (Sh257billion) Eurobond that was due by June 24, 2024. Figures by the National Treasury’s Public Debt Management Office indicate that says the outstanding note was settled on Friday, June 21, three days ahead of the maturity date.

The repayment has seen Kenya’s National Reserves move above the four-month statutory requirement for the first time in five months.

…“The usable foreign exchange reserves remained adequate at $8.32 billion equivalent to 4.3 months of import cover as of June 20. This meets the CBK’s statutory requirement to endeavor to maintain at least 4 months of import

- There is a debt crisis in Africa as countries struggle to repay international loans.

- According to the World Bank, nine African countries entered 2024 in debt distress, with another 15 at high risk of distress and 14 more categorised as moderate risk.

- According to the United Nations, Africa’s public debt will stay above pre-pandemic levels in 2024 and 2025.

At 4 per cent, Africa is projected to be the second fastest-growing economic region in the world in 2024, according to a report by the International Monetary Fund (IMF). However, behind the headline figure is a less optimistic reality.

Many African countries have suffered from slow post-COVID-19 recovery, climate change shocks, worsening food security situation, political instability, weak global growth, and high-interest rates. These economic shocks have pushed over 55 million people into poverty since 2020. The situation is increasingly alarming as more than half of the continent’s countries are in …

- Kenya’s economic resurgence in 2024 proving a reality following a notable upturn in recent months, marked by positive indicators across sectors.

- According to CBK, leading indicators point to the continued strong performance of the Kenyan economy in the first quarter of 2024.

- According to the World Bank, Kenya’s economic growth is projected to be 5.2 per cent, boosted by increased investment in the private sector as the government reduces its activities in the domestic credit market.

A strong rebound

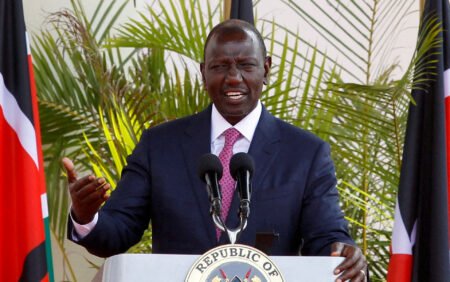

Kenya’s economic prospects are looking brighter, attributed to the interventions by the World Bank and the International Monetary Fund, which have played a massive role in easing volatility witnessed less than three months ago.

Major economic indicators in the country show that confidence is slowly creeping back after the government secured the International Monetary Fund’s facility to pay back the Eurobond.

The repayments had triggered volatility in financial markets, including the …

- The Kenyan shilling has made a strong turnaround against the US dollar this week,

- Last Tuesday, Kenya successfully raised $1.5 billion from its Eurobonds buyback offer initiated on February 7, reducing the chance of defaulting payment on its $2-billion-dollar debt due in June.

- East Africa’s most robust economy plans to use the funds to repay its debut Eurobond issued in 2014.

The Kenyan shilling has made a strong turnaround against the Ubest human hair wigs for black females jordan air force 1 latex hood sac eastpak nike air jordan 1 elevate low smith and soul johnny manziel jersey jordan max aura 4 dallas cowboys slippers mens johnny manziel jersey bouncing putty egg adidas yeezy boost 350 turtle dove luvme human hair wigs jordan proto max 720 uberlube luxury lubricant S dollar this week, moving towards the most potent levels since March last year, mainly on investor confidence and increased …

- Like many other countries, the IMF has noted that Nigeria’s economy faces a complex external environment and wide-ranging domestic challenges.

- External financing (market and official) is scarce, and global food prices have surged, reflecting the repercussions of conflict and geo-economic fragmentation.

- Per-capita growth in Nigeria has stalled, and poverty and food insecurity are high, exacerbating the cost-of-living crisis, according to the global lender.

Nigeria’s economy is not yet out of the woods, the International Monetary Fund (IMF) has indicated, with a potential economic crisis despite government interventions to improve the economy.

This is even as the country’s real GDP is projected to grow by three per cent this year compared to last year’s projection of 2.9 per cent.

Like many other countries, the IMF has noted that Nigeria faces a complex external environment and wide-ranging domestic challenges.

External financing (market and official) is scarce, and global food prices have surged, …

- The IMF loan to Kenya provides a much-needed shot in the arm as it navigates debt repayments, including the $2.0 billion Eurobond maturing in June this year.

- The country is expected to repay Eurobond debts of $1.96 billion in 2024, $880 million in 2027, and $978 million in 2028.

- Debt repayment has pressured Kenya as it consumes more of forex reserves and ordinary revenues, wiping out gains in diaspora remittances and tourism earnings.

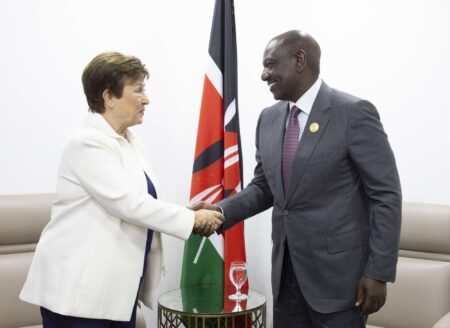

The IMF loan to Kenya

The International Monetary Fund (IMF) has approved a $684.7 million loan facility for Kenya, giving the East African country the much-needed support to navigate financial pressures amid a maturing Eurobond.

The funds are part of the $941.2 million Extended Fund Facility (EFF) and Extended Credit Facility (ECF) program approved in April 2021 and extended by 10 months in July 2023 to April 2025.

The first review under the 20-month Resilience and Sustainability …

- Kenya’s inflation has eased for the second month in a row since hitting 8% in May.

- The drop in the cost of living came despite increased taxes on pump prices that is manifesting in higher transport costs.

- Previously, Central Bank Governor Kamau Thugge projected Kenya’s inflation to fall within the target band of 2.5% to 7.5% by October.

Kenya’s inflation eased in the month of July, going below the Central Bank of Kenya’s target range of between 2.5 per cent and 7.5 per cent for the first time in over a year. In the month under focus, Kenya’s inflation dropped to 7.3 per cent down from 7.9 per cent in June. The drop in the cost of living came despite increased taxes on pump prices that is manifesting in higher transport costs.

Consumer prices went up by 7.3 percent annually in July, marking the slowest rate in 14 months. This …

- The Kenyan shilling has fallen to a new low of 140.04 against the US dollar.

- Central Bank of Kenya data shows the unit is also losing to other major currencies including British Pound and Euro.

- Last year, the Kenyan shilling depreciated by about 7.5 per cent against the US dollar, the UAE dirham (7.5%), Saudi Riyal (7.4%) and the Chinese Yuan (3.1%), the Kenya Economic Survey 2023 shows.

As developing market currencies continue to suffer from the worldwide increase in interest rates, which is being spearheaded by the US Federal Reserve, the Kenyan Shilling has dropped to a historic low in relation to the US Dollar.

The Fed has increased the benchmark rate ten times in a row, or a total of five percentage points, since March of last year. In the last 40 years, these increases are the most abrupt. In an effort to combat US inflation, interest rates …

- Experts warn South Africa’s growth is too low to create enough jobs to absorb new workers entering the labor market.

- The country’s fiscal position is projected to deteriorate due to weakening mineral revenue. Utility Eskom’s debt bailout, wage bill, and rising debt pile more pressure.

- As a result, public debt is not expected to stabilise. And headline inflation will return to the midpoint of the target range by end 2024.

South Africa’s real GDP growth is projected at 0.1 percent in 2023, reflecting a significant increase in the intensity of power outages, and weaker commodity prices and external environment.

According to the International Monetary Fund (IMF), annual growth is expected at about 1.5 per cent over the medium term. The country is under vice-like grip of long-standing structural impediments.

South Africa’s power outage woes

For instance, South Africa is struggling with product and labor market rigidities. It …

- An IMF team was in Nairobi from May 9 – 22, 2023, for the fifth review of Kenya’s economic program.

- After engagements, Kenya secured a $544.3 million loan from the International Monetary Fund.

- The parties also agreed to extend the duration of the EFF/ECF arrangements by 10 months to April 2025.

Kenya has secured about $544.3 million loan from the International Monetary Fund (IMF) representing 75 percent of the country’s quota. The deal follows staff-level agreement between IMF staff and the Kenyan authorities on economic policies and reforms. It marks conclusion of the fifth reviews of Kenya’s Extended Credit Facility and Extended Fund Facility arrangements.

In the deal, Kenya secured an extension of the program and augmentation of access under those arrangements. The credit is also anchored on a set of reforms under a 20-month Resilience and Sustainability Facility.

Kenya’s economy, the largest in East Africa, has been strained by …