- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: International Monetary Fund (IMF)

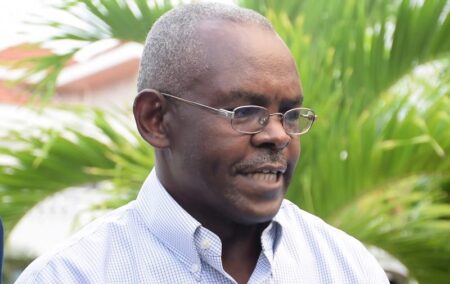

- Dr Kamau Thugge, who is President Ruto’s advisor on fiscal affairs, is set to take over from Dr Patrick Njoroge.

- Previously, Dr Thugge served as the Permanent Secretary at Kenya’s National Treasury between 2013 and 2019.

- Prior to his nomination as Principal Secretary, he worked as a senior economic adviser in the Ministry of Finance since 2010.

President William Ruto has nominated former IMF economist Dr Kamau Thugge for appointment to head the Central Bank of Kenya. Dr Ruto picked Dr Thugge out of a list of six candidates who were interviewed on May 9th for the job that helps define Kenya’s fiscal policy.

Dr Thugge is not a stranger at Kenya’s financial industry. For close to 10 years, between 2013 and 2019, he served as the Principal Secretary, National Treasury under former President Uhuru Kenyatta. He was, however, hounded out of office over allegations of corruption. The scandal, which …

- DRC’s economy is rising with real GDP growth at 8.9 percent in 2022 and projected to 6.8 percent in 2023.

- Macroeconomic imbalances have, however, emerged piling inflationary pressures.

- The roiling conflict in the East and upcoming elections complicate macroeconomic management.

The International Monetary Fund (IMF) has outlined a number of tough measures for war-tone DRC as it seeks $200 million financing. The funds are part of the country’s Special Drawing Rights (SDR), the supplementary forex reserves maintained by the IMF. They are units of account for the IMF, and not a currency per se. What’s more, they represent a claim to currency held by IMF member countries and DR Congo can access about $200 million.

An IMF team led by Mercedes Vera Martin met with the authorities in Kinshasa between April 19–May 3. This was on the fourth review of the three-year arrangement under DRC’s Extended Credit Facility (ECF).

Macroeconomic

…- The credit seeks to restore external sustainability, and strengthen debt management while creating fiscal space for accelerated and inclusive growth.

- The staff-level agreement is subject to IMF management approval and consideration by the Executive Board.

- Burundi’s reform program aims to support economic recovery from shocks.

The International Monetary Fund (IMF) has agreed to dispatch a $261.7 million loan to crisis-saddled Burundi, its first in nearly a decade, as the country moves to bolster economic recovery and reforms.

The IMF boost to the poverty-stricken nation follows “a staff-level agreement on economic policies and reforms” that was struck for a new 40-month arrangement under the Extended Credit Facility (ECF) after the lender’s Mission Chief for Burundi, Mame Astou Diouf, visited Bujumbura in February.

Burundi’s reform program aims to support economic recovery from shocks, restore external sustainability, and strengthen debt management while creating fiscal space for accelerated and inclusive growth.

Since 2015, Burundi…

- Governor Patrick Njoroge has written to Janet Yellen seeking audience with her during this year’s Spring Meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF).

- The meetings are set to take place in Washington DC from April 10 –16.

- In January, the World Bank revised downwards Kenya’s growth projection for 2023 to five per cent from 5.2 per cent.

The Central Bank of Kenya (CBK) governor is keen to meet the US Secretary of the Treasury, as the East African country navigates through tough economic times occasioned by both global and domestic factors.

Governor Patrick Njoroge has written to Janet Yellen seeking audience with her during this year’s Spring Meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF), set to take place in Washington DC from April 10 –16.

This is after failing to meet Yellen last October.

“I would greatly appreciate …

The creditor committee for Zambia stated that the conditions of the reorganisation would be finalised in a memorandum of understanding, but they did not provide any other specifics.

Additionally, it requested that private creditors “commit without delay” to the process of negotiating debt relief on conditions at least as favourable as those proposed by the government.

Kevin Daly, who is in charge of a group of Zambian Eurobond holders, praised the bilateral creditors’ statement but reiterated the need for access to the Debt Sustainability Analysis (DSA) of the IMF, which serves as the negotiation’s starting point.

The World Bank’s president, David Malpass, reiterated such sentiments, saying, “I implore official bilateral and private sector creditors to participate on equal terms, granting Zambia a considerable net-present-value debt reduction.”…

- The Nigeria Country Risk report by Fitch Solutions projects Nigeria’s economy to grow by 2.8% in 2022.

- According to data published by the National Bureau of Statistics, the real GDP growth accelerated for a third consecutive quarter to 5.0% y-o-y in Q221, from 0.5% Q121.

- This is on the back of stronger household spending and an increase in crude oil export value.

The Nigeria Country Risk report which has been released by Fitch Solutions has projected the West African country’s economy to grow by 2.8% in 2022.

This is on the back of stronger household spending and an increase in crude oil export value.

The projections were made following expected growth of 2.1% in 2021 from the 1.9% contraction recorded in the previous year, which was affected by the covid-19 lockdown measures.

Government consumption

According to the report, government consumption is expected to rise in the coming year, based on …

The International Monetary Fund (IMF) which has so far lent about $491.5 million to Uganda said that it is a misconception to assume that Uganda’s debt is unsustainable.

Uganda’s public debt levels are within a manageable threshold in the long term, noted Izabela Karpowicz the IMF Resident Representative for Uganda.

“We used to rate Uganda at low risk and now it will be moving to medium risk and this is due to Covid-19. It is not correct to say the debt is not sustainable over the medium and long term.” Ms Karpowicz said on the sidelines of a policy dialogue on Uganda’s economy, which was organised by the Civil Society Budget Advocacy Group (CSBAG) and the Advocates Coalition for Development and Environment (ACODE).

She noted that how resources that are being borrowed now and in the future will be deployed productively should be what Ugandans should be worried about and …

The International Monetary Fund (IMF) picked 28 countries that are to benefit from the $142.7 million debt relief program and Rwanda and Tanzania are drawing benefits.

In the East Africa region, Rwanda led the as the country that enjoyed the highest debt relief of $71.23 million while Tanzania followed at $26.43 million, Burundi at $25.42 million and Ethiopia at $19.71 million. South Sudan, Kenya and Uganda were not part of the selected 28 countries.

This comes after Bretton Woods institution which now plays a central role in the management of balance of payments difficulties and international financial crises, approved the third tranche of grants for debt service relief for 28 member countries under the Catastrophe Containment and Relief Trust (CCRT).

In April and October last year, two tranches were approved which now facilitates the disbursement of grants under the CCRT for payments of all eligible debt service totalling $238 million …

The Boards of Directors of the African Development Bank (www.AfDB.org) Group on Friday approved a proposal for the clearance of about $413 million in arrears on loans owed by Sudan to the institution, marking a major milestone in the country’s re-engagement with international financial institutions and the global economy.

The proposal enables the Bank to proceed with clearing Sudan’s arrears with the African Development Bank Group, with the support of the United Kingdom and Sweden. The U.K will provide bridge financing to clear Sudan’s arrears to the African Development Fund, while Sweden has committed to providing grant financing of about $4.2 million to meet Sudan’s burden-share for the operation.

Upon full clearance of the arrears to the Bank group, sanctions on Sudan will be lifted and a Policy-Based Operation (PBO) will be provided to the country as part of the Bank’s full re-engagement, to complement on-going Bank operations.

Clearing of …

The International Monitory Fund (IMF) predicts that the economic growth for Ethiopia in 2020 is 1.9 per cent while its growth in 2021 will be at zero.

This is from IMF’s Regional Economic Outlook of Sub Saharan Africa under the title, ‘A Difficult Road to Recovery.’ The report shows how African countries’ economies have been hit severely by the covid-19 pandemic.

According to the report, the economic growth of African countries in 2020 has significantly dropped due to the pandemic and estimates a worse forecast than the ones in its April reports.

The report further states that this year very few countries have has positive improvements in terms of growth while the rest are below zero and the majority are in negative performance.

According to the report, in the Ethiopia budget for the year that ended on July 7, 2020, the county’s economic growth has shown a massive drop in …