- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Burundi

- The credit seeks to restore external sustainability, and strengthen debt management while creating fiscal space for accelerated and inclusive growth.

- The staff-level agreement is subject to IMF management approval and consideration by the Executive Board.

- Burundi’s reform program aims to support economic recovery from shocks.

The International Monetary Fund (IMF) has agreed to dispatch a $261.7 million loan to crisis-saddled Burundi, its first in nearly a decade, as the country moves to bolster economic recovery and reforms.

The IMF boost to the poverty-stricken nation follows “a staff-level agreement on economic policies and reforms” that was struck for a new 40-month arrangement under the Extended Credit Facility (ECF) after the lender’s Mission Chief for Burundi, Mame Astou Diouf, visited Bujumbura in February.

Burundi’s reform program aims to support economic recovery from shocks, restore external sustainability, and strengthen debt management while creating fiscal space for accelerated and inclusive growth.

Since 2015, Burundi…

Burundi’s future is bringing optimism via the change of the country’s health care system, despite a country that has been marred by a lack of suitable facilities as well as human resources in the health arena.

Since the civil war in 2003 that broke out in Burundi, there has been a pressing need for a strategy that is both long-term and forward-thinking in order to guarantee that the most vulnerable children and youth are not abandoned. In this light, and bearing in mind that access to health is a fundamental human right, essential to the future of the country.

Even though a truce was finally reached at the end of 2003, peace in certain parts of Burundi is more of a dream than a reality, and the aftereffects of the conflict are still very much felt. The country’s civil conflict has made the already dire economic situation much worse and …

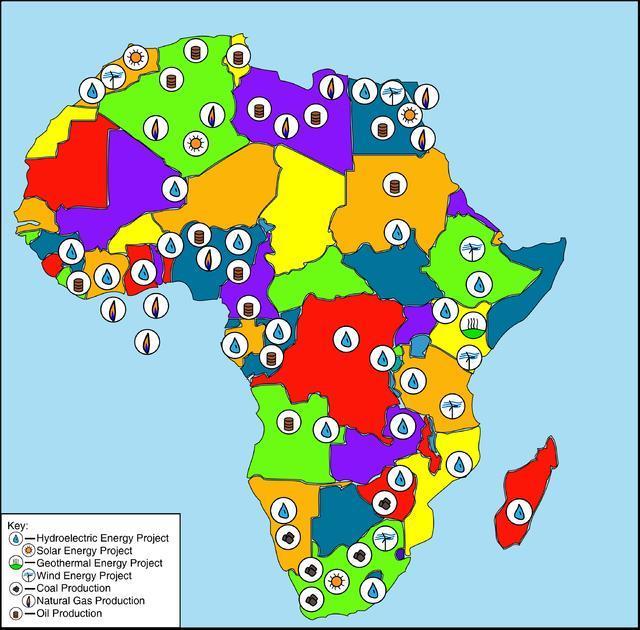

Africa has been hailed as the next frontier in the provision of global oil and natural gas resources, especially now in the wake of the ongoing Russia-Ukraine war.

This crisis has not only altered the global energy landscape, but also instigated an inflation in gas prices, given the former’s position in the hierarchy of major global producers. As sanctions continue to soar, Europe has embarked on a quest to find contingency energy supplies, as it seeks to minimize its dependency on Russia; which has already cut off gas supplies to countries like Finland, Poland and Bulgaria, over energy payment disputes.

Consequently, Africa’s gas resources have gained a newly found prominence, pertinently by the European Union (EU); owing to the continent’s rich endowment of oil and deep gas reserves. The mounting global demand for gas, has been pushing international energy companies to reconsider African projects. The numerous ongoing and upcoming oil …

The African Development Bank through managed Sustainable Energy Fund for Africa (SEFA) approved a $990,000 grant to support the preparation of a 9-MW solar-hydro hybrid project in Burundi.

The project consists of two plants, each consisting a solar and a hydro component, a local distribution network and interconnection to the national power grid. The innovative hybrid design is seen to regularize the output of power during the dry and wet season and mitigate power shortfalls caused by climate change.

Also Read: African Development Bank launches AFAWA Risk Sharing Facility

The SEFA grant is instrumental in assuring project bankability it will support technical feasibility, social impact and environmental assessment and financial advisory for the solar-hydro hybrid project.

The project will electrify about 20,000 households in surrounding communities through a local distribution network upon completion.

As a result of more electricity access the project will further generate socio-economic benefits especially for women …

Burundi’s central bank cracks down forex bureaus that have been selling dollars at twice the official rate.

This has led to small scale traders finding it difficult to find the foreign currency in the country to trade which is affecting their businesses.

In 2015 when the political crisis erupted, the forex rate almost doubled, with the dollar exchanging at Bfi3,050 ($1.65) against an official rate of between Bfi1,700 ($0.92) and Bfi1,800 ($0.97).

According to a trader in Bujumbura, the central bank’s move means that forex bureaus will not be readily selling dollars which will be creating scarcity leading to a higher black market rate.

In September, Bank of the Republic of Burundi (BRB) asked all forex bureau operators to purchase software worth $ 1,08. Which according to the central bank governor Jean Ciza,was supposed to help the central bank to follow closely the bureau’s activities in efforts to comply with …