- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Common Market for Eastern and Southern Africa (COMESA)

- Sugar consumption in Kenya is also expected to increase by 3.2 per cent this year driven by tourism and bakery

- Following the expiration of the ban in November 2023, production is expected to rebound significantly in 2024/25

- The survey also says that the growth in Kenya’s tourism sector will continue to create demand for sugar.

Kenya is expected to record a rise in sugar imports, as the effects of a ban on immature sugarcane processing kicks in, new findings have revealed. This is however expected to ease as millers ramp up their production

A report released by Fitch Solutions Company BMI and the United States Department of Agriculture shows that, the country should expect production to decrease by 32.9 per cent year on year in 2023/24 down to 530,000 tonnes from 790,000 tonnes in 2022/23.

This has majorly been attributed to the ban on sugarcane harvesting that was implemented in …

- Under a new COMESA programme, farmers in the five East African countries are expected to access quality seeds, and training on how to improve production and distribution.

- The five-year programme is expected to help the countries cut post-harvest losses in horticulture to 40 per cent or lower, from highs of 60 per cent, for instance in Kenya.

- Agriculture is estimated to contribute on average 27% of the gross domestic product (GDP) in the EAC and accounts for the highest share of employment not only in the region but across Africa.

Agriculture is the backbone of nearly all East Africa region’s economies and the main economic activity for more than 70 per cent of the population. It is estimated to contribute on average 27 per cent of the gross domestic product (GDP) in the EAC and accounts for the highest share of employment not only in the region, but the African.…

- Kenya is among countries that are heavily indebted with the loan stock at staggering 67.3 per cent of GDP.

- Total debt stood at $67.7 billion (Ksh9.6 trillion) as of April, Central Bank of Kenya data shows.

- This comprised $35.9 billion external debt and $24.6 billion borrowed from the domestic market.

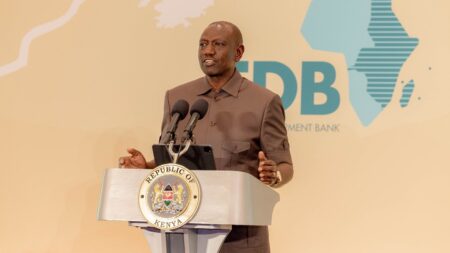

President William Ruto is calling for “urgent” redesigning of global financial institutions to ensure fairness in financing of economies, as he continues to lash out at the West over debt traps in poor states.

In what seems to be a swing at the International Monetary Fund and the World Bank, Dr Ruto is pointing to a post-colonial Africa where development has stalled due to limited resources to liberate economies.

Lenders placing debt traps in poor States

This is from what Dr Ruto terms institutions that were extractive by design; only placing debt traps in poor states. Over the years, Kenya’s …

- The country is considered East Africa’s strongest economy.

- It is among countries facing a huge challenge of illicit trade, estimated to be valued at above USD6.34 billion (Ksh800 billion).

- According to official government data, up to 70% of imported goods are counterfeits.

Kenya has a domestic market of over 50 million people and is among the leading economies in sub-Saharan Africa.

The country is considered East Africa’s strongest economy, with the region having a GDP of about USD163.4 billion (at purchasing power parity, about USD$473 billion), and the average GDP per capita is about USD941 (at purchasing power parity, $2,722).

In addition to the EAC market, investors in the partner States have access to other African markets such as COMESA, SADC and AfCFTA, as well as international markets through preferential trade arrangements.

The Common Market for Eastern and Southern Africa (COMESA) comprises 21 Member States with a population of 560 …

It is hard to see how African economies will bounce back to the vibrant fast growing hubs that they were over the past two decades, the pre-corona era. Countries like Rwanda that led East Africa (and most of the World) with annual economic growth averaging 9.4 percent now looks at annual growth rates of a mere 2 percent.

When the tourism and hospitality industries reopen their doors, will tourists and holiday maker flock in triple and quadruple their previous numbers and will they do so long enough for the industries to stabilize and resume growth? Will air travel shake off the blow it has taken, will it be willing to pocket less profit to attract business or will it hike prices to capitalize the anticipated initial high demand post the pandemic?

How individual industries will raise from the ashes of the pandemic is anyone’s guess but should recovery of global …

The European Investment Bank (EIB) recently partnered with the Eastern and Southern African Trade and Development Bank (TDB) to open a $120 million credit line to finance renewable energy projects for small and medium-sized enterprises (SMEs).

The agreement was signed between the European Investment Bank (EIB) and the Trade and Development Bank of Eastern and Southern Africa (TDB), a commercial bank owned by the Member States of COMESA, the World Bank (AfDB) and China on the sidelines of the 9th Summit of Heads of State and Government of African, Caribbean and Pacific (ACP) Countries

The partnership agreement was signed by EIB Vice-President, Ambroise Fayolle and Admassu Tadesse, President and CEO of TDB. The agreement provides a line of credit to support small and medium-sized enterprises (SMEs) investing in renewable energy and energy efficiency.

Also Read: French Development Agency provides $30 million for African SMEs

Companies have the means to bypass …