- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Digital Money

Amid Africa’s digital transformation, several sectors have pioneered and dominated this move. The continent’s digital money adoption has become one of its most highlighted features since 2002. From Mpesa to Luno and Flutterwave, the era of new payment services has overhauled the continent’s progress. In recent developments, Stitch fintech, a South African payment service, secures $25 million Series A extension funding led by Ribbit Capital.…

- The Africa Fintech Accelerator program will remain open until August 25th, and the first cohort will debut in September.

- Plug and Play, the world’s leading innovative platform will partner with Visa to ensure the program’s success.

- Visa committed to invest $1 billion in Africa by 2027.

Africa’s fintech Industry is the continent’s most rapidly growing economic activity. Its growth to fame has attracted plenty of investors and international organizations, each trying to promote the adoption of digital money globally. In recent news, Visa is accepting applications to its Africa Fintech Accelerator Program, urging blockchain-based and fintech startups to sign up. (Alprazolam)

Africa’s fintech accelerator program

To further the continent’s digital transformation, Visa took an active role in supporting Africa’s fintech industry. This global payment technology company has officially opened applications for the Africa Fintech Accelerator Program. The main aim of this endeavour is to revive the adoption rate …

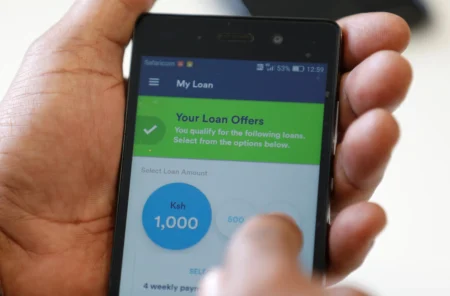

- After over a decade since launching, Mpesa has 54.4 million users in Africa.

- Safaricom has increased its Group Service Revenue by 5.2 percent to $2.159 billion, while the Group net income declined by 10.6 percent within Ethiopia.

- Safaricom Telecommunications Ethiopia added close to 3 million customers.

Safaricom, one of Africa’s top telecommunication services in Africa, finally acquired a license to operate M-PESA within Ethiopia. This new milestone will open doors for the East African country by ushering in a new age of mobile money.

This new initiative is what the Ethiopian economy requires as it struggles to regain stability within its borders.

The power of Mobile Money provider M-PESA

M-PESA first debuted in 2007 and sent Africa into a wave of digital money before any government perceived digital transformation. Its primary mechanism allows users to send and receive currency by clicking a button. This new initiative ushered in a …

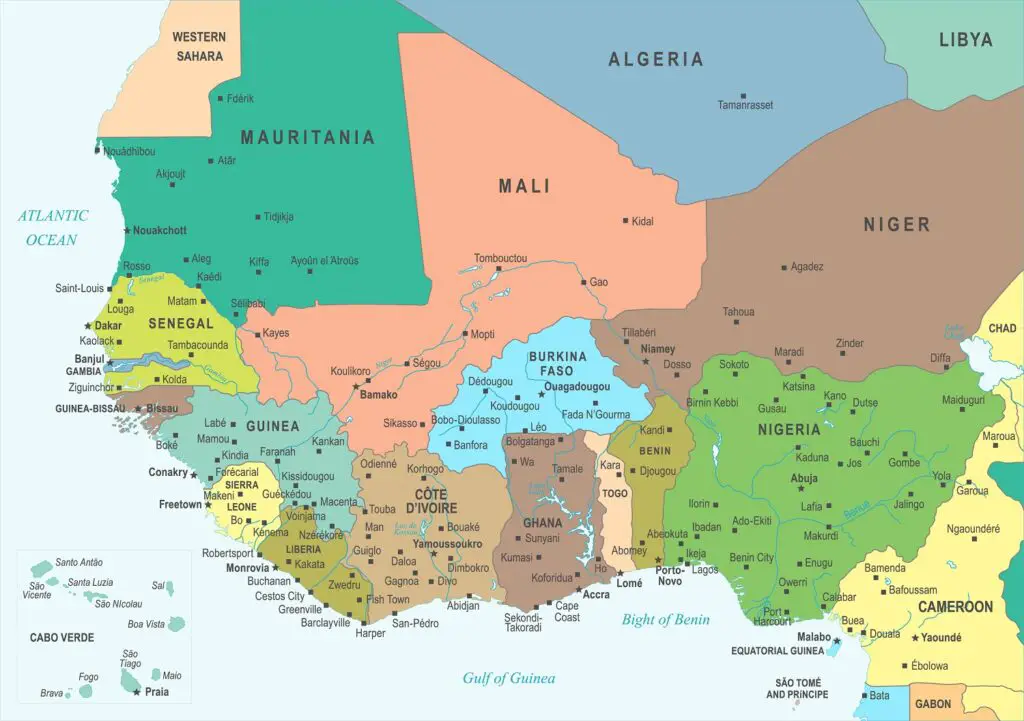

Whether Nigeria and Ghana will abandon their digital currencies and jump on the Eco train is an unclear narrative, but it appears unlikely because of the significant investments put into them and the optimism by the governments to embrace digital transformations.

Nigeria had banned cryptocurrency transactions in February last year which increased the popularity of the eNaira as an alternative for cross-border trade and remittance inflows.

eNaira critics say that the solutions being offered by the digital currency are already existing in online banking and bank card transactions. …

Co-operatives in Africa have played an integral role to make an indelible footprint in the lives of millions of members across the continent. They have been identified as key vehicles in the ultimate realization and achievement of Africa’s Agenda 2063 and the United Nations Sustainable Development Goals (SDGs).

The era of digital disruption together with the introduction of challenge 2025, has birthed the 21st century African co-operative, swiftly reinventing it from the traditional analogue model.

Most Co-operatives have been at the forefront of eradicating poverty, by creating employment to millions of people, directly or indirectly across the continent. In addition, many have been been entirely responsible for transforming national economies inculcating modern agricultural methods to increase productivity, and enabling the continent to feed itself whilst exporting; boosting industrialization, manufacturing and value addition; bolstering education, health and nutrition to name a few of …

Tanzania has moved to look into a possible profitable venture in Cryptocurrency.

A circular purported to be coming from the Directorate of Economic Research and Policy at the Central Bank of Tanzania (BoT) shows that the bank is conducting a study to assess the extent of cryptocurrency impact on the Tanzanian economy with a view to registering brokers for the business.The circular, in part, reads:

“Please be informed that the Bank of Tanzania is conducting a study to assess the extent of Cryptocurrency and Online Forex Trading and its implication to the economy in Tanzania. The result of this survey will determine whether or not there is any need to register brokers for this business in the country. (Valium) ”

The letter goes on to further state that BoT will conduct the survey by visiting various parts of Tanzania and interview selected individuals to gather the needed …