Trending

- Pharma Julphar announced as lead partner for AIM Congress 2025

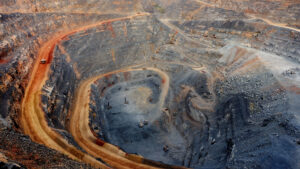

- Copper: Balancing mineral needs and environmental care

- Rethinking waste: Can Uganda’s textile upcycling inspire an EAC-wide shift?

- The hidden cost of Uganda’s love for second-hand clothing

- AIM Congress 2025 to host forums tackling global market challenges and investment trends

- Saudi Arabia’s Neom: Lessons for Africa’s tourism and smart cities

- Tanzania to import 100MW of electricity from Ethiopia via Kenya

- Power play: Can the green energy push ever outpace big oil?