- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Eurobond

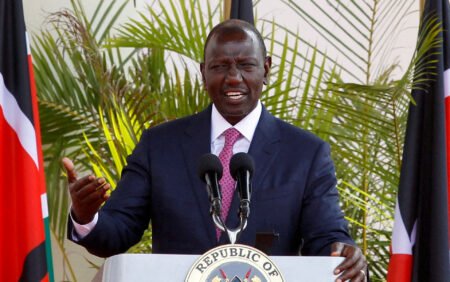

- Kenya’s economic resurgence in 2024 proving a reality following a notable upturn in recent months, marked by positive indicators across sectors.

- According to CBK, leading indicators point to the continued strong performance of the Kenyan economy in the first quarter of 2024.

- According to the World Bank, Kenya’s economic growth is projected to be 5.2 per cent, boosted by increased investment in the private sector as the government reduces its activities in the domestic credit market.

A strong rebound

Kenya’s economic prospects are looking brighter, attributed to the interventions by the World Bank and the International Monetary Fund, which have played a massive role in easing volatility witnessed less than three months ago.

Major economic indicators in the country show that confidence is slowly creeping back after the government secured the International Monetary Fund’s facility to pay back the Eurobond.

The repayments had triggered volatility in financial markets, including the …

- Remittance inflows for March grew to $407.8 million, up from $385.9 million in February, with the US maintaining its lead as the top source for Kenya’s remittances.

- This was also higher by 14.2 percent compared to the $357.0 million sent in the same month last year (March 2023), according to official data by the Central Bank of Kenya (CBK).

- The cumulative inflows for the 12 months to March 2024 totaled $4.4 billion compared to USD 4 billion in a similar period in 2023, an increase of 10 percent.

Kenyans living and working abroad sent home more money in March, boosting the country’s forex reserves and supporting families and friends.

Remittance inflows for March grew to $407.8 million, up from $385.9 million in February, with the US maintaining its lead as the top source for Kenya’s remittances.

This was also higher by 14.2 per cent compared to the $357.0 million sent …

- The Kenyan shilling has made a strong turnaround against the US dollar this week,

- Last Tuesday, Kenya successfully raised $1.5 billion from its Eurobonds buyback offer initiated on February 7, reducing the chance of defaulting payment on its $2-billion-dollar debt due in June.

- East Africa’s most robust economy plans to use the funds to repay its debut Eurobond issued in 2014.

The Kenyan shilling has made a strong turnaround against the Ubest human hair wigs for black females jordan air force 1 latex hood sac eastpak nike air jordan 1 elevate low smith and soul johnny manziel jersey jordan max aura 4 dallas cowboys slippers mens johnny manziel jersey bouncing putty egg adidas yeezy boost 350 turtle dove luvme human hair wigs jordan proto max 720 uberlube luxury lubricant S dollar this week, moving towards the most potent levels since March last year, mainly on investor confidence and increased …

- World Bank foresees $12 billion in support for Kenya between 2023 and 2026.

- This financing is subject to approval as East Africa’s economic powerhouse continues to depend on borrowing to bridge budget gaps in the wake of high recurrent expenditures and revenue shortfalls.

- The World Bank said it is fully committed to support Kenya in its journey to become an upper-middle-income country by 2030.

Kenya stands to benefit from up to $12 billion in financing from the World Bank over the next three years, as indicated by the global lender, ensuring continued support for the debt-saddled country.

This is subject to approval, the World Bank noted on Monday, as East Africa’s economic powerhouse continues to depend on borrowing to bridge budget gaps in the wake of high recurrent expenditures and revenue shortfalls. The World Bank stated that it is fully committed to supporting Kenya in its journey to become an …

The International Monetary Fund (IMF) has committed an additional $938 million to Kenya as part of a strategy to stabilise the country’s economy.…

- Kenya’s forex reserves dipped to $6.2 billion on May 19, an eight-year low, before a slight improvement to $6.4 billion on May 26.

- At $6.4 billion, Kenya’s reserves are just 3.60 months of import cover, which is below the Central Bank of Kenya’s desired target.

- What’s more, the reserves are below the East Africa Community preferred threshold of 4.5 months of import cover, hence exposing the country to high volatilities in the global market.

A dip in export earnings, coupled with reducing diaspora inflows at a time of huge debt repayments have left Kenya grappling with low forex reserves, raising concerns on the health of East Africa’s economic powerhouse.

The low forex reserves are further compounding the dollar shortage problem that has been gripping importers for months. Importers, mainly in the manufacturing and the energy sectors, have been struggling to secure the greenback to replenish their suppliers.

Kenya’s forex reserves

…- Ghana, a top gold and cocoa exporter rich in oil and gas deposits, is struggling with a $55 billion debt burden.

- About 70 percent to 100 percent of the government revenue currently goes toward servicing the country’s debt.

- It is estimated that Ghana’s debt-to-GDP will reach 98.7 percent by the end of 2023.

Crisis-saddled Ghana is seeing about $15 billion in external debt relief by 2026, the International Monetary Fund has said even as the country pursues debt restructuring plan with investors. In December 2022, Ghana suspended payments on most of its foreign debts effectively defaulting as policymakers started restructuring plans as part of a bailout deal with the IMF.

Initial plan was an agreement to suspend service payments of its Eurobonds, commercial loans and most bilateral loans. Further, as an interim emergency measure, the government moved to engage its external creditors in what it thought was best in making …

- Central Bank of Kenya (CBK) data shows remittance inflows in March hit $357.0 million compared to $309.2 million in February, an increase of 15.5 percent.

- Kenyans living and working abroad sent home $349.4 million in January, with the February figure being the lowest receipt since July last year.

- The cumulative inflows for the 12 months to March 2023 totaled $4 billion compared to $3.9 billion in a similar period in 2022.

Kenyans in the diaspora sent home more money in the month of March compared to February and January, defying inflationary pressures being felt by households across the globe.

Central Bank of Kenya (CBK) data shows remittance inflows in March totaled $357.0 million compared to $309.2 million in February, an increase of 15.5 percent.

The inflows were $349.4 million in January, with the February figure being the lowest receipt since July last year.

The cumulative inflows for the 12 months …

Indeed, African governments are reaping a plethora of benefits from the inclusion by international financial markets to broaden the scope of their funding sources, swiftly abandoning foreign aid and traditional multilateral institutions.

International financial markets have opened a window thereby providing a suitable platform for African governments to borrow, chiefly for capital spending through Eurobonds issuance. However, this opportunity has been watered down by overexploitation through excessive borrowing. Consequently, debt has been accumulating devoid of a meticulous assessment of risks posed and the consequences thereof, such as exchange rates and the real repayment costs for the piling debt.

The International Monetary Fund (IMF) has pinpointed a total of 17 African countries, with outstanding Eurobonds as near or under debt distress. African governments have been borrowing through issuing Eurobonds which are international bonds supplied by a country in a foreign currency, commonly in US dollars and euros which allows them …

Kenya’s first Eurobond valued at US$2 billion was issued in June 2014 and it matures in less than five years in 2024.

According to PwC Kenya Senior Manager, Francis Nzau, Kenya’s public debt has been swelling and the risk of a debt crisis (where the Government is unable to repay what it owes) continues to increase every day.…