- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: FinTech

- Nala Money has Payment Service Provider licenses in several countries, including its founder’s home, Tanzania.

- In 2020, Africa’s e-payments industry, across domestic and cross-border payments, generated approximately $24 billion in revenues, of which about $15 billion was domestic electronic payments.

- Africa’s domestic e-payments market is expected to see revenues grow by approximately 20 per cent per year, reaching around $40 billion by 2025

“Little did I know that if a European-based client of mine could have subscribed to Nala Money, I would have received $100 more to my fee. Unlike Nala, the money order service I use has a low exchange rate and is somehow unconventional.”

This testament is not a promotion or a boost for the latter but an admission of facts and experiences Tanzanians who might receive remittance often or once could face.

Nala, started by Tanzanian youth Benjamin Fernandes in 2017, aimed to increase economic opportunities for …

Kenya will host the second Canada-Africa Business Conference early next year, bringing together investors from the two regions to explore key investment opportunities. Some of the target industries that the 19-20 February 2024 conference will focus on are medical care, infrastructure, energy, financing for Canada-Africa projects, and FinTech.

The two-day meeting in Nairobi’s Muthaiga Country Club follows the two regions’ first-ever program at Botswana’s Gaborone International Convention Centre in 2019.

In partnership with the Kenya Private Sector Alliance (KEPSA), the Canada-Africa Business Conference will bring together key players who will also visit select locations.…

In a recent announcement during the US-Africa Business Roundtable in the United States, Kenya’s President William Ruto revealed that Safaricom, a leading telecommunications company, is establishing a strategic partnership with Apple Inc. The Safaricom-Apple partnership will integrate the widely-used mobile money platform, M-Pesa, with Apple’s ecosystem. This integration will expand M-Pesa’s mobile financial services globally.

President William Ruto announced the deal after he toured Silicon Valley in San Francisco Bay, United States, on 16 September. The Kenyan leader is fast gaining popularity across Africa and globally. He has led from the front in marketing Kenya as a conducive ground for foreign business to thrive.…

Currently, financial inclusion is a target that all African countries must achieve. Boosting Africa’s financial inclusion will have a positive impact on economic growth and the prosperity of society. Through financial inclusion, everyone has access to a variety of quality, effective, and efficient financial services. Increasing public accessibility to financial service products will further reduce the level of economic and social inequality which in turn will improve the welfare of the community.

One of the efforts to achieve this financial inclusion target is through technology in the form of digital finance. When financial products and services use internet technology, it makes it easier for people to directly access various kinds of payments, shopping, savings, and investments, including loan and credit facilities. Among these digital financial elements, the payment facility is the service that is experiencing the fastest development and contributes greatly to the achievement of Africa’s financial inclusion targets.…

- The use of digital solutions is revolutionizing all kinds of financial transactions from making simple payments to borrowing and lending.

- With mobile phone and internet penetration rising at a phenomenal phase, even the remotest parts of Africa can now access financial services through their mobile phones.

- The World Bank: It is time for policymakers to embrace fintech opportunities and implement policies that enable and encourage safe financial innovation and adoption.

Financial technology or the application of digital tools to streamline financial services more commonly known in the short form Fintech, is reshaping the future of financial services and creating a boom for investors in the fast-growing segment.

The use of digital solutions is revolutionizing all kinds of financial transactions from making simple payments to borrowing and lending. Be it your next investment portfolio or your insurance, you name it, almost any financial service you can think of can now be …

- The hub is a digital platform that will enable fintech associations across Africa to pool resources and knowledge, strengthen relationships and partnerships, as well as showcase the work of fintech on the continent, including those which are female-led or owned.

- The one-stop shop will be delivered through a strategic partnership between AFN and the Centre for Financial Regulation and Inclusion (Cenfri), which will provide technical support in the development of the Hub, as well as promote research, knowledge creation and other innovative initiatives.

- Although fintechs have great potential to contribute to digital financial inclusion across the continent, the African fintech sector significantly lags behind those in other regions such as Latin America and South-East Asia.

Financial Technology (Fintech) firms in Africa are set for a major boost as the African Development Bank (AfDB) and the Africa Fintech Network agreed to develop a one-stop shop for all fintech activities across the …

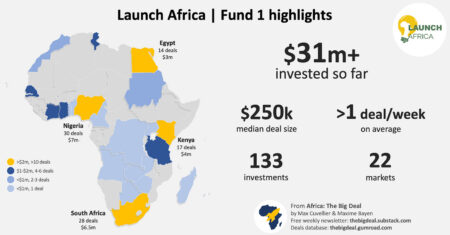

- Launch Africa has been the most active investor in African startups according to research firm Africa: The Big Deal.

- Since its launch in mid-2020, the firm has invested over $31 million through 133 deals, at a rate of more than a deal a week on average. All but four of these deals (97 percent) were between $100,000 and $300,000, with a median cheque of $250,000.

- Launch Africa has been investing heavily in fintech with 42 deals (32 percent) totaling $11 million across 13 markets, including 13 fintech transactions in Nigeria alone.

Launch Africa has been the most active investor in African startups according to research firm Africa: The Big Deal.

Since their launch in mid-2020, the company has invested over $31 million through 133 deals, at a rate of more than a deal a week on average. All but four of these deals (97 percent) were between $100,000 and $300,000, …

- The fintech industry is Africa’s financial inclusion solution for all vulnerable groups including women.

- Sub-Sahara Africa, fintech startups recorded 894% year-on-year growth in funding in 2021

- More than 400 million new mobile subscribers expected to sign up globally by 2025

A report published by McKinsey claims that the number of tech start-ups in Africa tripled to around 5,200 companies between 2020 and 2021 and just under half of these are fintech startups.

In the report titled ‘Fintech in Africa:The end of the beginning’ McKinsey shows that in line with global market leaders, the African fintech industry enjoyed revenues of between US$4 billion and US$6 billion in 2020 and average penetration levels of between 3 and 5 percent.

The fintech industry is Africa’s financial inclusion solution for all vulnerable groups including women, the elderly, and the larger section of the population in remote rural settings.

“What you have here is not …

- IFC and Viva Technology have announced the second edition of the AfricaTech Awards.

- Founders are invited to apply for the awards in three categories – climate tech, fintech, and health tech

- The winners of the awards will gain access to leaders and top executives in the tech industry and increased visibility among global investors.

IFC and Viva Technology have announced the second edition of the AfricaTech Awards, an initiative to spotlight Africa-focused companies with innovative solutions addressing key development challenges linked to climate change, health care, and financial inclusion.

Founders are invited to apply for the awards in three categories – climate tech, fintech, and health tech – on the awards’ website from February 27 to March 12, 2023.

The winners of the awards will gain access to leaders and top executives in the tech industry and increased visibility among global investors, including IFC, one of the largest venture capital …

According to Refinitiv Data, the value of South African mergers and acquisitions increased by 958 per cent from the same period in 2020 to US$52 billion in the first half of 2021, from a total of 169 deals. When compared to the same period in 2020, deals involving tech businesses soared by US$160 million, or about 2000 per cent.

According to an article by Tech Cabal, acquisitions in South Africa can broadly be categorized into three:

Inbound inter-country acquisitions of South African startups by international companies (mostly US-based),

Domestic intra-country acquisitions of South African startups by well-established South African companies, and

Domestic intra-country acquisitions of South African startups by other South African startups.…