- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: inflation

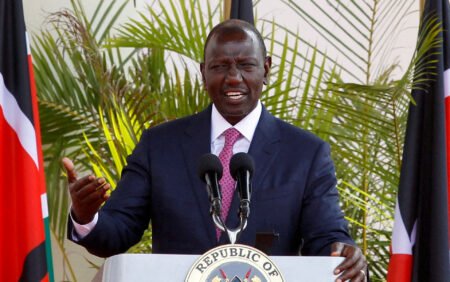

- Kenya’s economic resurgence in 2024 proving a reality following a notable upturn in recent months, marked by positive indicators across sectors.

- According to CBK, leading indicators point to the continued strong performance of the Kenyan economy in the first quarter of 2024.

- According to the World Bank, Kenya’s economic growth is projected to be 5.2 per cent, boosted by increased investment in the private sector as the government reduces its activities in the domestic credit market.

A strong rebound

Kenya’s economic prospects are looking brighter, attributed to the interventions by the World Bank and the International Monetary Fund, which have played a massive role in easing volatility witnessed less than three months ago.

Major economic indicators in the country show that confidence is slowly creeping back after the government secured the International Monetary Fund’s facility to pay back the Eurobond.

The repayments had triggered volatility in financial markets, including the …

- The increasing food prices have majorly occasioned the rise in consumer expenditure.

- In the review period, 50 per cent of the Kenyans polled indicated static income levels over the last year

- 53 per cent of Kenyans polled allocated less than 10 per cent of their income to travel and leisure expenditures.

The slight drop in inflation in Kenya has failed to soften the impact of Increased consumer spending after posting a 42 per cent rise in spending in the past six months. This is after a new survey showed that the country posted a six per cent rise in Kenyan expenditures compared to the preceding three months, which ended December 2023.

According to the latest spending index from ICEA LION Group, Kenyans’ spending escalated by 6 per cent from January to March this year. However, this growth was more subdued than the previous quarter, which witnessed a 36 per

- Following a slow recovery from the debilitating impact of COVID-19, Africa’s economic growth declined to an estimated 3.8 per cent in 2022 and later deteriorated to 3. (https://rescueresponse.com) 3 per cent in 2023.

- Africa is not immune to economic shocks and has recently faced a multi-crisis situation.

- African countries have posted more than 5 per cent output expansions in 2024.

Africas economic outlook

Before COVID-19, Africa experienced 20 years of solid growth and made tangible economic and social progress. However, the COVID crisis brought this progress to an abrupt halt, and many countries, which are under increasingly tight budget constraints, struggled to invest in essential sectors amidst recovering from the aftermath of the health crisis.

Following a slow recovery from the debilitating impact of COVID-19, Africa’s economic growth declined to an estimated 3.8 per cent in 2022 and later deteriorated to 3.3 per cent in 2023.

However, according …

- The Central Bank of Nigeria has decided to increase the minimum capital requirement for lenders to bolster the country’s economy.

- Nigerian banks now face weaker capital ratios and higher impaired loans.

- The last time Nigeria recapitalised its banking sector dates back to 2004.

Minimum capital requirement for lenders

Following the surge in inflation levels, a deteriorating economy, and the plummeting of the Naira, the CBN has decided to increase the minimum capital requirement for lenders to bolster the country’s economy.

asu football jersey

detroit lions jersey

asu football jersey

Florida state seminars jerseys

custom made football jerseys

asu football jersey

College Football Jerseys

Florida state seminars jerseys

asu football jersey

Iowa State Football Uniforms

asu football jersey

Iowa State Football Uniforms

ohio state jersey

asu football jersey

Under the new regulations, the Central Bank of Nigeria has raised the capital threshold for international banks to $359 million …

- Nigeria’s cost of living crisis has been the worst in decades, exacerbated by worsening food insecurity and record inflation.

- The lack of enough resources has led to insecurity in Nigeria as people fight for scarce resources and food.

- In response to Nigeria’s cost of living crisis, Tinubu announced a state of emergency in July and intends to begin grain distribution in the coming weeks.

Tinubu’s Reforms worsen Nigeria’s cost of living crisis

Nigeria, Africa’s largest economy, is grappling with the worst cost of living crisis in decades and a worsening food security situation. A significant portion of the population is experiencing extreme food insecurity. After assuming power in May 2023, Bola Tinubu’s administration adopted bold but unpopular reforms that further strained the already-battered economy.

Nigeria imports food and fuel and was buffeted by rising commodity prices due to a glim global economic situation in the last two years. President Tinubu …

- Egypt’s economy has recently been on life support as the national debt continued to mount.

- The investments from Saudi Arabia and further funds anticipated from the World Bank and IMF will give Egypt enough cash to meet its debt obligations and maintain stability in its recently floated currency.

- The significant official and bilateral support announced and marked policy steps that Egypt has taken will, if maintained, support macroeconomic balancing.

Egypt’s economy on life support

Egypt’s economy has recently been on life support as the national debt continued to mount. The Egyptian currency has weakened against the US dollar, with rising inflation rates close to 30 per cent, occasioning a capital flight. Moreover, the overlapping global shocks and the domestic supply of bottlenecks have adversely impacted the country’s economic activity.

Egypt has also suffered from rising global interest rates and soaring commodity prices in international markets. These overlapping factors widen the …

- Non-performing loans in Kenya surged to a 16-year high of 15 per cent in August 2023.

- The Kenya Bankers Association had called for further monetary policy tightening by the CBK, terming it a cure to elevated non-performing loans.

- According to the CBK data, forex pressure cut lending to the private sector to 8.3 per cent during the review period.

The banking sector regulator has said that Kenya’s private sector players resorted to alternative funding sources to avoid the high lending rates, leading to a drop in non-performing loans during the holiday season.

The continued surge in bank interest rates has hit individuals and businesses hard on the back of the Central Bank of Kenya’s (CBK) elevated benchmark interest rate. This has happened thrice since Governor Kamau Thugge took office, citing the need to support the country’s struggling shilling.

On Tuesday this week, the Central Bank of Kenya increased the benchmark …

- The cost of borrowing in Kenya has been going up since October last year, when it was at 10.50 per cent, before two consecutive raises.

- This means banks are likely to adjust their interest rates upwards, pushing the cost of borrowing beyond the reach of many.

- The majority of bank rates are currently above 20 per cent, amid a high default rate as banks struggle with Non-Performing Loans (NPLs).

Higher interest rates to raise the cost of borrowing in Kenya

The cost of borrowing in Kenya is set for yet another rise if banks are to factor in the latest Central Bank of Kenya increase in the base-lending rate.

The Central Bank of Kenya (CBK) has raised borrowing costs to highs last seen nearly 12 years ago, as it moves to try and contain the country’s inflation, which has started to pick.

On Tuesday, the Monetary Policy Committee, CBK’s top …

- The rising fed rates have led to expensive loans as Kenya struggles to curb inflation

- Although global inflation has generally eased, rapid monetary policy tightening in advanced economies has sharply tightened global financial conditions.

- According to the CBK governor, Kenya should brace for a challenging 2024, including tightening global conditions that will cascade to local levels

Kenya is still at risk of bearing the impacts of new global threats like rising fed rates that may emerge in 2024, financial industry sector players have revealed.

In the past year, the country has confronted challenges ranging from the war in Ukraine, the prolonged drought that affected the country, rising federal rates, and high global inflation.

The rising fed rates led to expensive loans as the country struggled to curb inflation, which currently stands at 6.9 per cent.

Financial experts from Standard Chartered project that the rising fed rates will ease from mid …

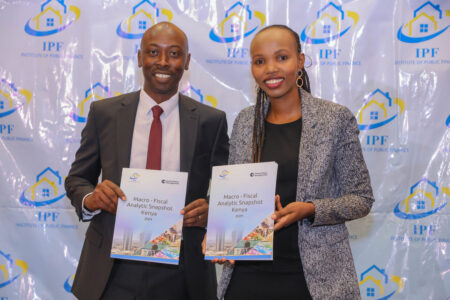

- Kenya’s debt distress has escalated, with loan repayments falling due amid a depreciating shilling against the dollar.

- Other impediments include Kenya’s vulnerability to climate shocks such as drought and floods, which may derail growth over the long term.

- On the expenditure side, fiscal consolidation in the past two years has led to a real per capita spending decline.

Experts have warned that Kenya risks missing its economic growth targets in the medium term as it grapples with high debt distress and a deteriorating macroeconomic operating environment.

The country finds itself in a tight spot following years of successive borrowing, coupled with the inability of the private sector to create sufficient jobs for millions of young people entering the job market annually.

The latest finding by an economic think tank, the Institute of Public Finance (IPF), shows that since 2014, persistent high fiscal deficits have resulted in a swift escalation of …