- Slashing foreign aid: Is Trump right or wrong?

- Arusha bets big on tourism with EAC’s largest conference center

- Regional lender KCB Group net profit grows by 64% to $477 million

- Kenya-UK partnership aims to cut red tape on trade and grow incomes

- AIM Congress 2025 to host high-level talks on global investment shifts

- Can Africa replace king dollar with gold as Its primary store of value?

- Kenya’s Controller of Budget calls for urgent reforms to curb $77.3M debt

- Trump cuts: Africa does not want aid, it needs debt relief

Browsing: KCB Bank Kenya

- In the three months to March 2023, Group’s total assets rose by 39.8 percent to close at $11.8 billion buoyed by DRC subsidiary TMB.

- Revenue increased by 26.9 percent to $267.4 million mainly driven by the non-funded income from customer transactions across the Group.

- This is the Group’s newest subsidiary in the Democratic Republic of Congo.

- It demonstrated the range and diversified income streams across the group’s businesses, adequate to cover the elevated operating and funding costs.

Regional lender KCB Group Plc posted $68.8 million in profit after tax for the first quarter 2023, a marginal drop attributable to acquisition and consolidation costs of its newest subsidiary, Trust Merchant Bank (TMB), in the Democratic Republic of Congo.

In the quarter, however, the Group recorded a strong balance sheet growth with total assets hitting $11.8 billion, with TMB contributing 14 percent to the Group’s total assets. The bank said this was …

- KCB Bank Kenya has set aside KSh 250 billion to fund women entrepreneurs in the next five years, cementing the Bank’s role in catalyzing economic growth

- In a newly revamped women offering, the Bank will extend the funding to women-led and owned Small and Medium Enterprises (SMEs) across the country

- Under the KSh 50 billion a year platform, Female-Led and Made Enterprises- FLME, KCB Bank seeks to support entrepreneurship, job creation, and strengthen its outreach

KCB Bank Kenya has set aside KSh 250 billion to fund women entrepreneurs in the next five years, cementing the Bank’s role in catalyzing economic growth.

In a newly revamped women offering, the Bank will extend the funding to women-led and owned Small and Medium Enterprises (SMEs) across the country.

To unlock this, KCB Bank has already eased credit requirements and documentation such as security to support businesses in a transformation that will guarantee faster …

KCB Bank Kenya and the Kenya National Chamber of Commerce and Industries (KNCCI) Mombasa Chapter have signed a partnership to accelerate the provision of credit to enterprises.

In a statement, the partners say the deal will see micro, small, and medium-sized enterprises (MSMEs) access financial and non-financial solutions to help them recover from the fallout occasioned by the Covid-19 pandemic.

KCB Bank Acting Director of Retail Banking Michael Kungu said the partnership will enable MSMEs greater access to financing, helping them to improve their livelihoods while contributing to the country’s recovery from the pandemic.

“We are excited about this partnership with the Mombasa Chapter, it enables us to open a path for more credit to the Small and Medium-Sized entrepreneurs,” he said in Mombasa during the sign off ceremony.

Beyond the credit line, members of the KNCCI Mombasa chapter will also access non-financial solutions including advisory, networking opportunities, training, and …

KCB Bank Kenya has signed a pact with Japan based giant lender Sumitomo Mitsui Banking Corporation (SMBC) to drive cross-border trade and deepen financial inclusion.

The agreement between the two largest banks in their respective regions, signed in Yokohama last week, will see the two lenders expand their financial offerings provided to clients in both East Africa and Japan, effectively enabling more cross border trade flows.

Under the deal, KCB will provide banking services—including banking accounts and cash management, trade finance, export credit agency finance and treasury related products— to customers introduced by SMBC to KCB.

“We believe that new business opportunities will arise from the rapid economic development in Kenya and therefore seek to areas of mutual partnership to support such development, utilizing the product capabilities and global and local network of both banks,” said Paul Russo, the KCB Group Director Regional Businesses during the signing ceremony on …

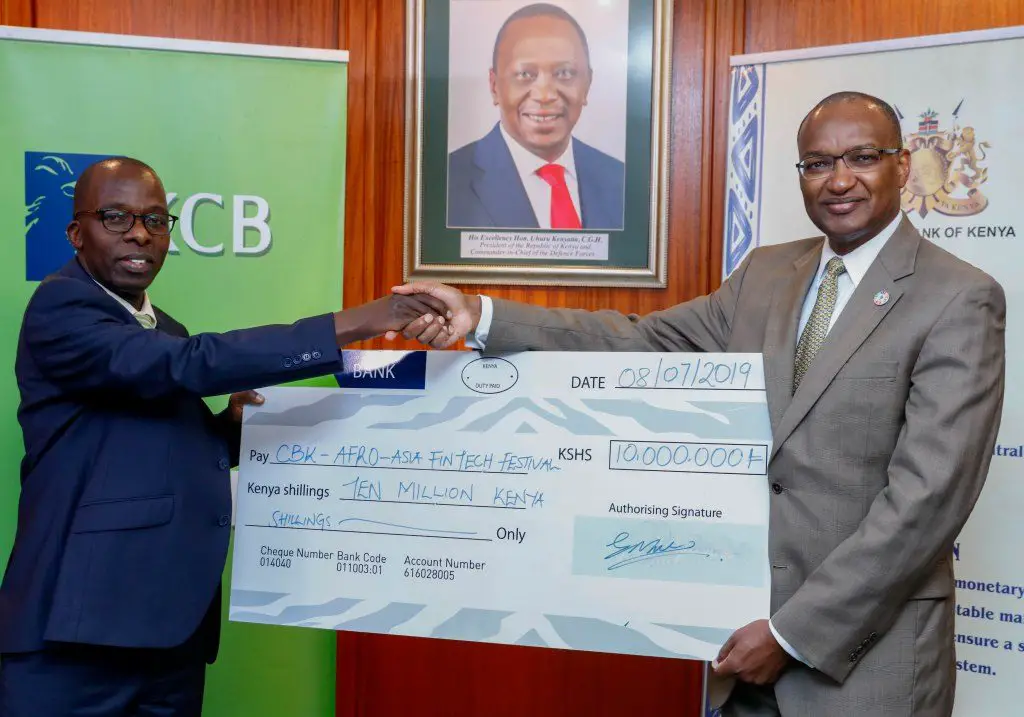

KCB Bank Kenya has committed Ksh10 million (US$97,448) to the Afro-Asia Fintech Festival 2019, a first of its kind in the region which will be held next week.

The funds will go into supporting the mega financial technology (Fintech) summit being hosted by the Central Bank of Kenya (CBK) and the Monetary Authority of Singapore.

The forum will take place between July 15–16 and is themed, ‘Fintech in Savannah’, modeled along the Singapore Fintech Festival.

KCB backing is informed by the need for Kenya to continue driving innovations in the banking sector to boost financial inclusion, the Nairobi Securities Exchange (NSE) listed lender has noted.

Speaking during the cheque handover to the CBK, KCB Group Chief Operating Officer Samuel Makome said: “For the past five years, we have made significant investments in financial technology in the realization that the future of banking is in digital finance. We will therefore remain …

KCB Bank Kenya has launched a Ksh300 million (US$2.9 million) poultry farmer empowerment project in Makueni County, in its latest move to support agribusiness in Kenya.

This will see over 1,000 poultry farmers in Kibwezi benefit from credit facilities, capital, vaccinated insured chicks, chicken feed and vaccines.

The project will be offered under KCB MobiGrow, a mobile-based platform which provides financial and non-financial services to smallholder farmers in Kenya and Rwanda.

Under the project dubbed, ‘From Chick to Market’, poultry farmers will access various tailor-made MobiGrow services.

Upon maturity, the chicken will be bought at a pre-contracted price by KCB market partners, guaranteeing farmers of a ready market.

Proceeds from the sales will then be remitted to farmers through their KCB MobiGrow accounts to ensure the recovery of loan amounts.

“We are committed to growing agribusiness in the country. We continue to accelerate access to financial services which is in …