Trending

- Saudi Islamic Development Bank to the rescue of Uganda with $295 million loan

- Reshaping the future of sustainable food systems in Africa

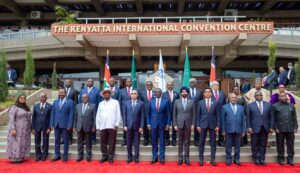

- African Heads of State call for tripling of World Bank’s concessional financing

- SpaceX offers Starlink kit at half price for first-time Kenyan customers

- Mobile Banking Reshaping the Gender Gap in Financial Inclusion

- Unleashing ideas: AIM Congress sets the stage for over 450 dialogue sessions

- Abu Dhabi welcomes over 330 partners for AIM Congress 2024

- Kenyan Farmers Receive $2M Boost from Africa Fertiliser Financing Mechanism