- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: London Stock Exchange (LSE)

Nigeria’s IROKO Partners Limited media company is working on plans to list on the London Stock Exchange (LSE) Alternative Investment Market.

Reports indicate that the Initial Public Offering (IPO) could be effected in the next 12 months. The company had earlier on announced plans to go public either on the London Stock Exchange or a local bourse on the continent but sought an international presence as this may enable further growth of the industry and the company itself.

About Nigeria’s IROKO Partners

The company was founded in 2011 by Jason Njoku and Bastian Gotter and boasts the largest online catalog of Nollywood film content globally.

The media company, according to reports, will raise between $20 million and $30 million, valuing the company at $80 million to $100 million.

While making the announcement in October 2019, the company’s CEO Mr Njoku, however, did not reveal the exact time …

The African Export-Import Bank has announced its plans to list on the London Stock Exchange by way of a $3 billion Initial Public Offering.

The LSE announced on Wednesday that the Afreximbank said it intended to publish a registration document and consider proceeding with an IPO of global depositary receipts (GDRs), representing Class D ordinary shares of the bank.

It stated that the GDRs were expected to be admitted to the standard listing segment of the official list of the FCA and to trading on the main market of the LSE.

The President, Afreximbank, Professor Benedict Oramah, said, the bank was very much at the epicentre of Africa’s trade, which was expected to grow rapidly.

He stated that the growth would be driven by the enactment of Africa Continental Free Trade Agreement that would create an integrated market of 1.3 billion people, widespread urbanisation, favourable demographics and rising investments.

He …

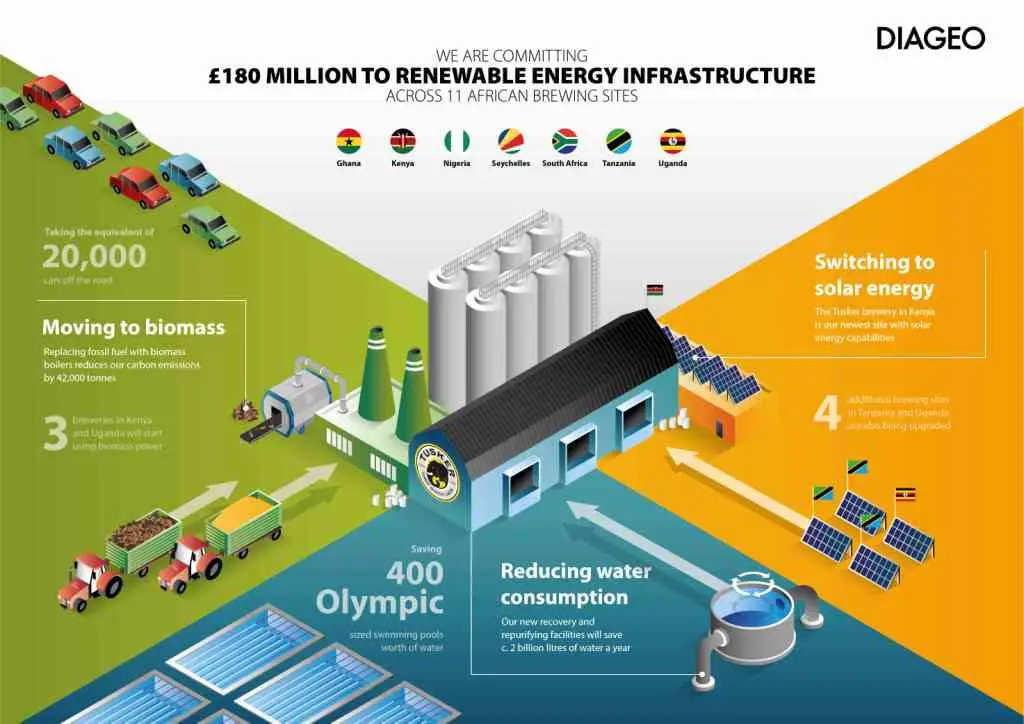

Diageo has committed to invest £180 million (US$217million) in renewable energy resources across its African sites, the British multinational alcoholic beverages company has announced.

According to the world’s second largest distiller, the move is to ensure its breweries are the most carbon and water efficient.

This commitment represents Diageo’s largest environmental investment in a decade confirming its commitment to reducing its carbon footprint and addressing climate change.

READ ALSO:How KBL’s water savings are quenching communities’ thirst

The investment will touch 11 of Diageo’s African brewing sites where it will deliver new solar energy, biomass power and water recovery initiatives.

It is also targeting to bring new infrastructure designed to improve the long-term sustainability of Diageo’s African supply chain in seven countries.

“We believe this is one of the biggest single investments in addressing climate change issues across multiple sub Saharan markets. It demonstrates the strength of our commitment to …

It was suspended from trading at the NSE in May 2017

Troubled logistics firm-Atlas Development and Support Services (ADSS) has been delisted from the Nairobi Securities Exchange (NSE) .

The delisting took effect on April 25, bringing to an end a five-year stint at the Nairobi bourse.

Registered in Guernsey, UK, in 2002, Atlas was admitted to trade at the NSE in December 2014, where it was cross-listed in the London Stock Exchange (LSE)’s Alternative Investment Market (AIM) segment.

In December 2015, the firm decided to close its operations in Kenya, placing its Kenyan subsidiaries into liquidation by way of a Creditors Voluntary Liquidation after financial headwinds.

The firm had hoped the closure of the Kenyan subsidiaries, Ardan Logistics Kenya Ltd, Ardan (Medical Services) Ltd and Ardan (Civil Engineering) Ltd, would improve the group’s overall cost base.

Two years later (May 2017), it was suspended from trading at the NSE …