- Stanbic PMI Report: Mixed performance as Kenya’s agriculture, construction offset manufacturing decline

- Uganda’s land management gets a tech makeover to boost transparency

- Nigeria’s output dips fastest in 19 months on a sharp rise in costs

- Apple faces growing backlash over Congo exploitation

- Why East Africa is staring at higher wheat prices in 2025

- Nairobi Gate SEZ pumps $7 million into Kenya’s agro-processing industry

- What impact will the US election have on Africa?

- Russia and Tanzania unite to double trade, boost Africa market access

Browsing: Standard Bank

- The latest Stanbic IBTC Bank Nigeria PMI shows most companies continued to report less demand, attributable to an increase in the cost of products.

- Nigerian industries reported the sharpest rise in input costs and output prices in six months.

- High pump prices, transportation, and materials for manufacturers continued to hurt businesses in the month under focus.

Inflation in Nigeria

Rising inflationary pressures in Nigeria hit businesses hard at the close of the third quarter, with selling prices increasing by the sharpest margin in six months. The country’s private sector reported marginal job opportunities in September, the lowest in the previous three months.

According to Stanbic IBTC Bank Nigeria PMI, most companies continued to report less demand, attributable to an increase in the cost of products amid thinning incomes. Findings show that business confidence dipped in September and was the second lowest level on record, only just above July.

“Nigeria’s …

- Kenya’s private sector activity and new orders rises for the first time in six months.

- Selling price inflation hits long-run average as cost burdens ease.

- However, PMI shows lowest confidence towards future output in the survey’s history.

Kenya’s business conditions improved in February, expanding private sector activity due to a further softening of inflationary pressures supported a fresh increase in new order volumes.

Stanbic Bank Kenya Purchasing Managers Index (PMI) for February registered at 51.3 per cent as lower fuel prices helped to cool input cost inflation to a 26-month low, supporting the softest increase in output prices for one-and-a-half years.

Improving business conditions are said to have led Kenyan companies to expand staffing levels at a faster rate albeit by largely hiring casuals pointing to a cautionary stance towards hiring permanently.

Nevertheless, confidence regarding future activity fell to a survey low, suggesting a broad degree of uncertainty that activity …

- Kenya’s input prices and output charges rise at much softer rates.

- New orders decrease slightly, survey shows.

- Declines in output and employment ease.

Kenya’s private sector business conditions showed a strong move towards stability in December 2023, as revealed by the latest Purchasing Managers’ Index findings, even though businesses remained less optimistic about the future into 2024.

According to the Stanbic Bank Kenya PMI compiled by S&P Global, rises in input costs and output prices were the softest since April of the previous year, having slowed markedly from record highs in October.

Kenya’s private sector experiences uptick in client spending

Consequently, many companies experienced a recovery in new work amid improved client spending, offsetting the impact of cost-of-living pressures. As a result, new orders, output, and employment all declined to lesser degrees.

The headline figure derived from the survey is the PMI. Readings above 50.0 signal an improvement in …

Business conditions in Kenya remained in a steep decline halfway through the final quarter of the year, according to the latest Purchasing Managers’ Index (PMI) by S&P Global.

This comes amid sizeable falls in output, new orders, and employment in November, as indicated by the PMI, which closely monitors market-moving economic indicators, covering more than 30 advanced and emerging economies worldwide.…

- In Kenya, political protests accelerated the downturn, leading to a sharp dip in output that was the fastest since August last year.

- Forex woes and reports of rising fuel prices and taxes equally pushed up business costs in July.

- In Uganda, data shows output and new orders are edging up steadily on a monthly basis in the past one year.

Kenya’s private sector activity suffered a further drop in demand at the start of the third quarter of the year, latest statistics show, as customers continued to limit spending amid steep inflation. Kenya’s poor data came even as neighbouring Uganda recorded improvements in the health of the its private sector activity. Uganda is experiencing a stronger demand environment despite facing challenges in the macro environment.

In Kenya, political protests accelerated the downturn, according to surveyed firms. This resulted in a sharp contraction in output that was the fastest since August …

- Standard Bank has developed the Africa Trade Barometer, a tool that blends qualitative and quantitative data across African markets.

- The Africa Trade Barometer is instrumental in solving access to information, a significant non-tariff barrier in Africa.

- It provides a near real-time view of trade openness, access to finance, and macroeconomic stability data among others.

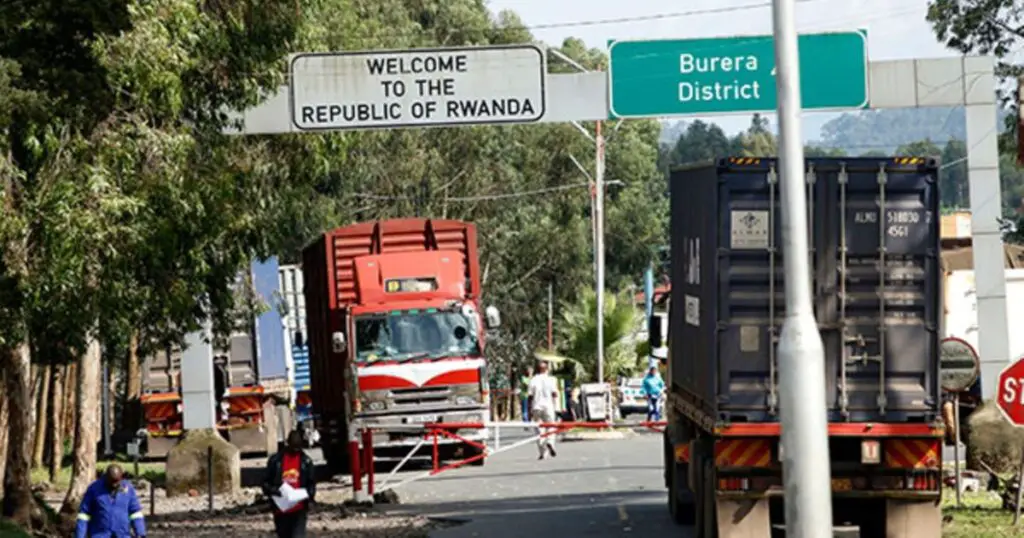

Standard Bank, the biggest lender by assets across Africa, has thrown its weight behind the African Continental Free Trade Area (AfCFTA) saying it is a key opportunity to alleviate poverty, drive economic activity and achieve prosperity.

By eliminating trade barriers, AfCFTA aims to lift about 30 million Africans out of poverty by increasing incomes across the continent by seven percent by 2035. Once implemented, AfCFTA will be the world’s largest free trade area ever rolled out.

Standard Bank wants to power AfCFTA take-off

Recent global supply chain woes suffered in Africa illustrate the urgent need of …

Stanbic Bank Kenya and Industrial Commercial Bank of China (ICBC) have partnered with Chinese Trade Agent Zhejiang International Trading Supply Chain Co. Ltd (Guomao) to launch the Africa China Agent Proposition (ACAP) initiative. (https://navalpost.com/)

The initiative which has been launched in different parts of Africa aims to assist African importers source and validate quality goods, safely and efficiently, from the most competitive suppliers in China.

The ACAP offering is expected to revolutionize African importers’ view of China’s supplier universe. It will also ease the cash flow of African importers by providing access to financing while empowering importers with sight and control of the entire importing and logistics process.

It was initially launched in Nigeria and Ghana in May 2019 with roll out to South Africa and Kenya following.

Currently African importers order from only a handful of trusted Chinese suppliers. This limits the negotiating power of African importers …