In full throttle the world is diving deeper into the Fourth Industrial Revolution (4IR). Resultantly, among the new wave of technologies marking this new era is the adoption of digital currencies such as a CBDC. This relatively nascent era of economic disruption has birthed a need for digital currencies and we might very well be in the twilight years of using the traditional fiat currency. In his book, “The Future of Money: How the Digital Revolution is Transforming Currencies and Finance” economist Eswar Prasad, predicts that the era of cash is drawing to an end and that of central bank digital currencies and other forms of digital cash has begun. Indeed the future of money is evolving and already several countries across the globe are particularly piloting the Central Bank Digital Currencies (CBDCs).

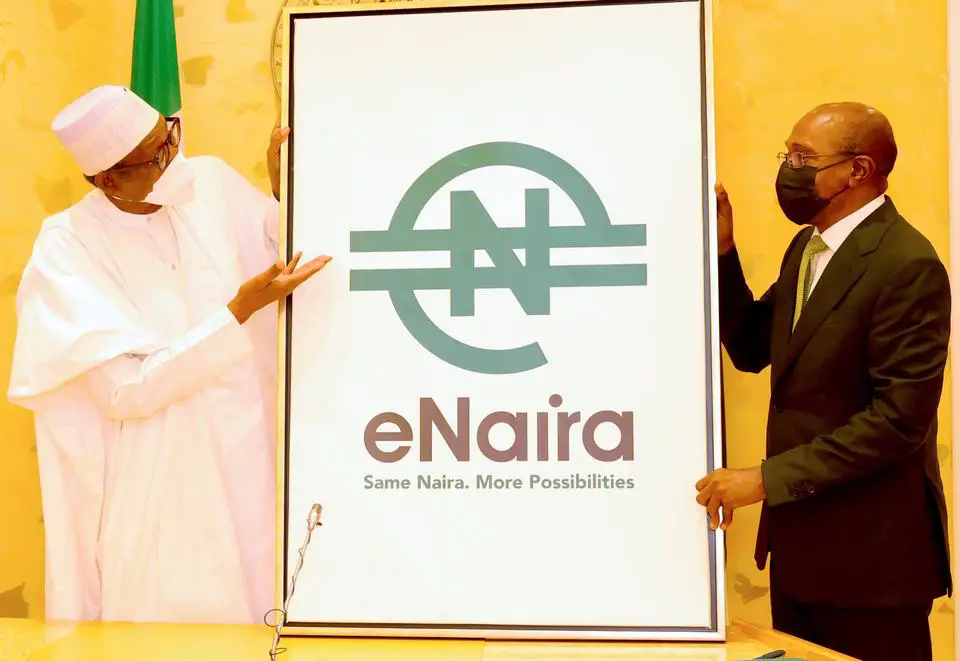

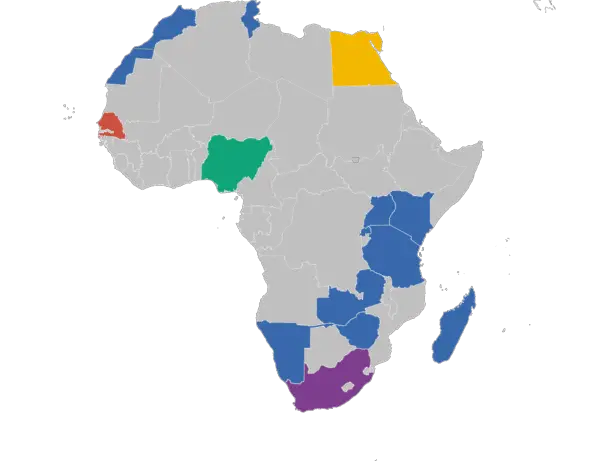

In Africa, albeit slow, the concept of CBDC’s adoption is gaining momentum with several nations in the exploration or piloting phases. Nigeria has launched the ‘e-Naira’ becoming the second country after the Bahamas to roll out a CBDC. By the same token, the South African Reserve Bank is experimenting with a wholesale CBDC, which can only be used by financial institutions for interbank transfers. In addition, the country is also participating in a cross-border pilot with central banks of Australia, Malaysia and Singapore.

Conversely, the Bank of Ghana, is testing a general purpose or retail CBDC, the ‘e-cedi’ which can be used by anyone with either a digital wallet app or a contactless smart card that can be used offline. Over and above, Eswatini, Kenya, Morocco, Namibia, Rwanda, Tanzania, Tunisia, Uganda, Zambia, and Zimbabwe, are all currently in the research stage of CBDC development. According to the International Monetary Fund (IMF), if CBDCs are designed prudently, they can potentially offer more resilience, safety, greater availability and lower costs than private forms of digital money.

A major roadblock that has been encountered by numerous countries has been the issue of trust. African citizens have found themselves in the horns of a dilemma of whether they can fully trust their respective governments in this ambitious endeavor. In a continent where corruption is endemic and the “Its our turn to eat” maxim rings true and reverberates across most, if not all governments.

It comes as no surprise that a culture of mistrust in the government is deeply ingrained in large swathes of Africa’s population. They have borne the brunt of this deleterious vice, that has largely stagnated most economies and retrogressed development at the detriment of ordinary citizens who continue to languish in abject poverty. The very fabric of democracy is not trustworthy in most countries, evidenced by the rampant rigging of votes during elections. Hence the introduction of CBDCs for the most part has been met with some degree of suspicion and criticism.

Read:https://theexchange.africa/tech-business/insurtech-boom-deepening-the-uptake-of-insurance-in-africa/

In light of this, according to the latest corruption perception index (CPI) report by Transparency International, which ranks countries on a scale of zero to 100; with zero being the most corrupt and 100 being the least corrupt; the average index score in Africa is 33, the lowest in the world. In reiteration, some of the most corrupt countries in Africa include, South Sudan, Somalia, Libya, Equatorial Guinea, DRC, Burundi, Chad Sudan, Comoros, Guinea Bissau, Congo, Eritrea, Zimbabwe, Nigeria, CAR, Guinea, Mozambique, Madagascar, Uganda and Cameroon.

Can African citizens trust their governments in this new age endeavor?

Source/Twitter

Just what is a CBDC and what’s all the craze about?

Central Bank Digital Currencies (CBDCs) are digital tokens or digital versions of cash issued by a country’s central bank, that are more secure and less volatile than crypto assets. They are pegged to the value of that country’s fiat or physical currency. Some advantages of a CBDC include: to provide businesses and consumers with privacy, transferability, convenience, accessibility, and financial security. CBDCs could also decrease the maintenance a complex financial system requires, reduce cross-border transaction costs, and provide those who currently use alternative money transfer methods with lower-cost options.

Undeniably, CBDC inculcation will deepen financial inclusion in the continent, bringing financial services to the unbanked populace, especially if designed for offline use. In remote rural areas without internet access, digital transactions can be made at little or no cost using simple feature phones. A CBDC can be used to distribute targeted welfare payments, especially during sudden crises such as a pandemic or natural disaster.

According to the IMF, Sub-Saharan Africa is the most expensive region to send and receive money, with an average cost of just under 8 percent of the transfer amount. CBDCs could make sending remittances easier, faster, and cheaper by shortening payment chains and creating more competition among service providers.

The IMF advocates that central banks need to develop the expertise and technical capacity to manage the risks to data privacy, including from potential cyber-attacks, and to financial integrity, which will require countries to strengthen their national identification systems so know-your-customer requirements are more easily enforced.

Also Read:https://theexchange.africa/investing/edtech-startups-transforming-africas-education-landscape/

Existential ‘Trust’ Issues and Plausible Solutions to CBDC adoption

Inarguably, trust is earned and for the successful adoption of CBDC in Africa, citizens need to trust their governments. Trust in the State is associated with positive popular assessments of government performance and its institutions thereof.

Among the top reasons cited for the lack of trust in government is corruption and wrong incentive- driving policies. Indeed, trust has been eroded by corruption. The 2022 Edelman Trust Barometer, which is the largest global survey and foremost authority on trust in business, government, media and NGOs, revealed a cycle of distrust spurred on by African governments and media institutions. The report recommends that they need to rebuild confidence and stem the tide of misinformation.

Africans can only trust their national governments in this endeavor if certain conditions are met. First, African governments should educate their citizens on CBDCs, because only when they fully understand all the nitty-gritties, dotted their “i’s” and crossed their “t’s”, can they begin to cultivate a culture of trust in the government to proceed. Moreover, government institutions need to earn public trust, which is essential for the successful pursuit of CBDCs by African countries. According to the OECD, trust and confidence legitimize decisive and effective action by governments, and encourage citizens and businesses to accept it.

The 2021 World Economic Forum highlighted that, like any digital payment system, CBDC is vulnerable to cyber security attack, account and data breaches and theft, counterfeiting, and even farther-off challenges related to quantum computing. Hence, for African citizens to be comfortable adopting CBDC, they will need to be confident in its security. Ultimately, it will not be successful if it does not carefully consider and invest in a robust cybersecurity strategy, and back it up with a skilled workforce.