- Crypto experts predict that Ethereum (ETH) will surpass bitcoin (BTC) in market cap, and new market entries could look at the former as a better purchase.

- There is confusion among traders between buying, selling or holding (HODL) bitcoin

- A whopping 67 per cent of the experts in the panel agree that it is an excellent time to buy bitcoin, arguing that the currency is experiencing its lowest price for this year

Many people, especially those interested in joining crypto trading as newbies, are utterly confused about whether to buy crypto in these bearish conditions. Bitcoin, specifically, has been experiencing a downward trend since the digital currency hit its highest in November 2021, valued at US$69,000. As of April 29, the price of bitcoin was resting at around US,799. (https://gracesterling.com/)

After the weekend doldrums, the market pulled a good turnaround on April 25. Despite four weeks of downward action, Bitcoin popped its head above the US$40,000 trend with a decent market capitalization. According to crypto enthusiasts Cryptobanter, BTC hasn’t had five straight weeks of downward movement in over two years. However, as traders engage in crypto trading, there is always a key point: past occurrences don’t guarantee future performance.

Cryptos: Is it time to buy, sell or hold?

There is confusion among traders between buying, selling or holding (HODL) bitcoin. This week, Finder gathered a panel of over 35 experts to fill out a survey on the future of bitcoin.

Read: Cryptocurrency mining stagnating the Africa COP27 agenda

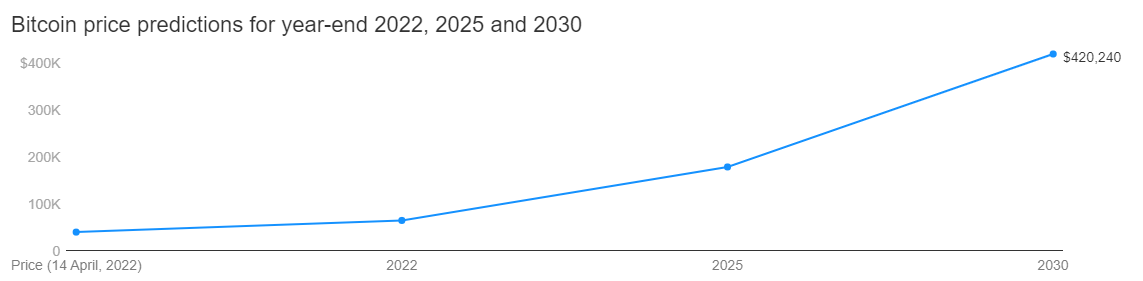

Finder measures expert analysis on the future price of bitcoin using two methods; a weekly survey of five fintech specialists and a quarterly survey of 35 industry experts.

If the report by the fintech experts is anything to go by, Finder estimates the price of bitcoin to hit US$65,185 by the end of 2022, US$179,280 by 2025 and US$420,240 by 2030. How true is that, and can it be verified? Unfortunately, the crypto market is, to a large extent, driven by speculation.

A whopping 67 per cent of the experts in the panel agree that it is an excellent time to buy bitcoin, arguing that the currency is experiencing its lowest price for this year. Only nine per cent of the panel were for exiting the market, arguing that carbon emitted from bitcoin mining is a big concern and should be a matter of concern. The rest are unsure of the step to take in the market.

For the last five months, crypto experts predict that Ethereum (ETH) will surpass bitcoin (BTC) in market cap, and new market entries could look at the former as a better purchase. Ethereum is appealing because of its upcoming merge with the chain proof-of-stake (PoS) system. This will help Ethereum mining to consume less electricity by using an alternative for the proof-of-work (PoW) system and consequently contribute to fewer carbon emissions to the atmosphere.

The crypto atmosphere will change after Elon Musk bought Twitter this week.

Read: Trading strategies to profit from the lucrative cryptocurrency market

What does Elon Musk Acquisition mean for crypto traders?

On April 26, Elon Musk bought Twitter for $US44 billion. He plans to take the company private to initiate, as he says, critical and drastic changes. Musk has outlined his top priorities as enabling free speech and eliminating spam and scam bots on the platform. But what does this acquisition mean for crypto traders?

The success of the crypto coin Dogecoin (DOGE) is primarily linked to the endorsement from Elon Musk. He is known as the DogeFather because of his infatuation and backing of the coin.

Additionally, Twitter is a preferred social platform for crypto, popularly known as Crypto Twitter. Owing to his crypto fascination, Musk may attempt to integrate Twitter as a crypto means of payment. This would offer nearly 400 million users to the crypto market. Since the news broke that the richest man in the world was buying Twitter, Dogecoin went up by 19 per cent.

Interestingly, a few hours after Musk’s acquisition, Twitter muted the United States Securities and Exchange Commission, a long-time nemesis for crypto and Musk innovation.

Bitcoin in different contexts.

The term bitcoin means three things:

- bitcoin as the digital currency (BTC).

- The bitcoin blockchain.

- Bitcoin the network.

Bitcoin (BTC) is internet money transferrable to and from anyone through an internet connection. Every person to person (P2P) transfer is a transaction, and there is a record of each transaction in a blockchain database (Bitcoin blockchain).

The Bitcoin network constitutes thousands of computers worldwide, with each computer in the network referred to as a node.

Read: African governments postponing an inevitable crypto world