- NALA raises 40 million dollars to fuel international expansion and launch its own payment rails for Africa and beyond.

- The US fintech building global payments for emerging markets.

- $40million Series A for NALA, the fintech that took Africa’s payment problems personally.

NALA raises 40 million dollars to build cross-border payments for emerging markets. NALA, one of Africa’s largest fintech companies, has announced the Series funding to support its global expansion and enhance the reliability of payments to Africa by developing its own payment rails.

The past 12 months have been transformative for NALA. The company achieved a 10x increase in revenue, reached profitability, and had positive cash flow.

In the past 20 months, NALA saw a 34x increase in transaction volume. The NALA team has grown from just 7 members to a robust team of over 100. Finally, today, NALA proudly serves 500,000 customers.

The $40 million funding round was led by Lauren Kolodny of Acrew Capital, who was featured in Forbes Midas list in both 2023 and 2024. DST Global and Amplo, represented by Sheel Tyle, also participated.

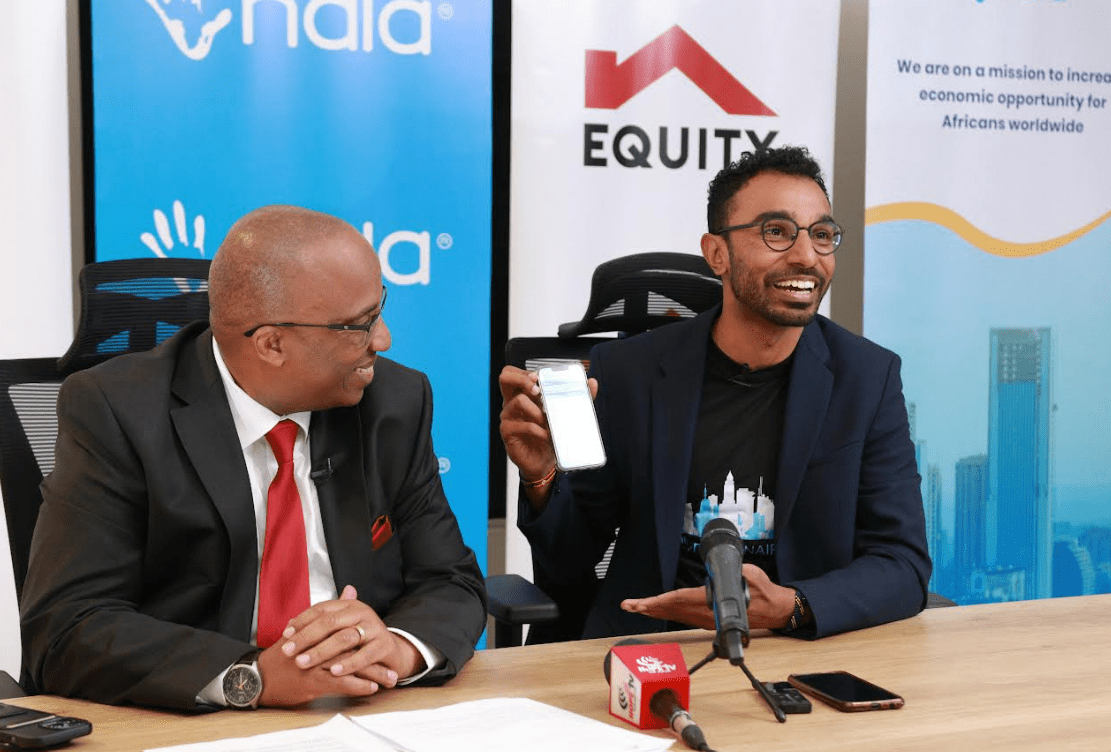

“This $40 million funding round marks a pivotal moment for NALA. It will enable us to go beyond remittances and extend our reach beyond Africa, building a robust payments ecosystem,” said Benjamin Fernandes, Founder & CEO of NALA.

Additionally, the majority of previous investors increased their stakes by taking super pro-rata investment in the round. New investors include Norrsken22, HOF Capital, and notable fintech founders such as Ryan King, co-founder of Chime, Vlad Tenev, co-founder of Robinhood, and the founder of Klarna.

NALA raises 40 million dollars

“We’re reinvesting this money to enhance our infrastructure, ensuring reliable, low-cost payments for all. With the launch of our own payment rails and the expansion of our B2B platform Rafiki, we’re not just talking about change – we’re building it. We’ve got some bold, ambitious plans, give us a couple of years,” said Benjamin Fernandes, Founder & CEO of NALA.

Rafiki aims to lay the payment rails for the next billion users, ensuring reliability, managing treasury directly, improving error mapping, reducing user costs, and streamlining payouts and collections.

Similar to how dLocal revolutionized payments in Latin America and AirWallex transformed the Asian market, Rafiki is set to build a robust payment infrastructure for Africa.

This is NALA’s second round of fundraising in 20 months, having raised $10 million through Accel, Amplo, and Bessemer Partners in 2022.

Other notable angel investors include Jonas, the co-founder & CTO of Monzo, Robinhood founder Vlad Tenev, Laura, the co-founder of Alloy, Deel founder Alex Boaziz, and early employees at Revolut and Wise.

Africa’s payment landscape is undergoing a significant transformation, driven by rapid technological advancements and a surge in fintech innovation. With over 500 million mobile money accounts across the continent, Africa has become a global leader in mobile payment solutions. This growth is fueled by the increasing penetration of smartphones and internet access, coupled with a young, tech-savvy population.

NALA’s success story is a testament to the continent’s burgeoning fintech sector, which is attracting substantial investments and fostering competition.

These platforms are not only making payments more accessible but also driving financial inclusion by reaching the unbanked population.

Despite these advancements, challenges remain. Regulatory hurdles, infrastructure gaps, and cybersecurity concerns need to be addressed to ensure sustainable growth.

However, the momentum is undeniable, and Africa’s payment landscape is poised for continued evolution, promising a more connected and financially inclusive future for the continent.

Read Also: Nala Money: Inside the Billion Digital Payments Ambition