- The Africa fintech accelerator program will be a three-month intensive learning program focusing on business growth and mentoring.

- The AfDB created the Africa Digital Financial Inclusion Facility as a blended finance facility to accelerate digital financial inclusion in Africa.

- The VEI competition in 2022 hosted more than 1000 African fintech startups.

The steady growth of Africa’s fintech companies has caught the attention of various international investors keen on its lucrative potential. New Visa announced the launch of the Africa Fintech Accelerator Program to assist startups in gaining some foothold in the competitive markets. With investors flooding Africa, its fintech industry might become its most profitable economic activity.

Increase Of Digital Innovation

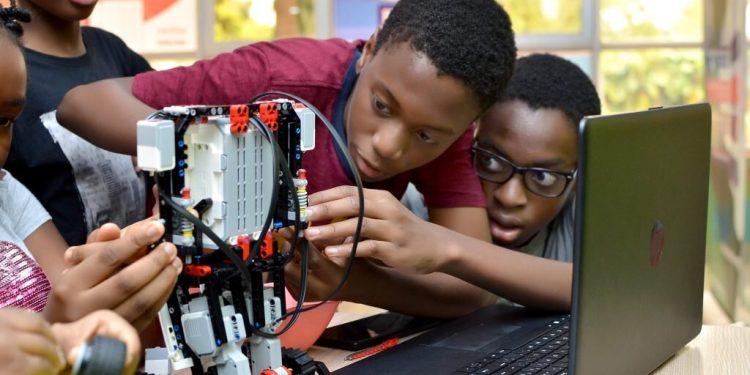

Africa’s digital transformation has taken a turn for the better in terms of innovations and economic growth. Nigeria, Kenya, Egypt and South Africa are prime examples of how shifting to a more digital platform can open vast financial doors. The adoption of Blockchain technology, AI, and the Internet of Things has rapidly increased foreign investments towards the country. Tech startups such as Agritech, New Payment service systems and HealthTech have increased dramatically within the continent.

Despite these innovations, one industry stands at the top of its peers; The fintech industry. Inspired by cryptocurrency, Africa’s fintech industry has created a wave of innovation, inspiration and developments in several communities.

Today among the eleven registered unicorn startups within the continents, seven falls under the fintech category. This shows the continent still has a long way from ensuring complete financial inclusion. Organizations such as Luna, Flutterwave, Yellow Card and many more have inspired others to take up blockchain developments to establish alternative payment service systems for the country.

Read: Africa: Google picks fifteen startups for its accelerator programme.

Initially, many saw the establishment of African fintech startups as a competitor to traditional financial services such as banks. However, it soon became apparent that banks could incorporate blockchain technology to develop their fintech branch.

This led organizations such as Standard Bank, Africa Development Bank and Others to either partner with fintech organizations or created their own. For instance, the AfDB created the Africa Digital Financial Inclusion Facility as a blended finance facility to accelerate digital financial inclusion in Africa. By focusing efforts on digital infrastructure, policy, and regulations, these banks have embraced the concept of digital innovation within Africa.

Visa is among the many international organizations chipping to develop the continent’s fintech industry by establishing the Africa Fintech Accelerator Program.

Africa Fintech Accelerator Program

The Visa-sponsored Africa Fintech Accelerator Program will enable up to 40 African Fintech startups each year to accelerate and grow. The international payment service systems pledged to invest up to $1 billion to contribute to the continent’s digital transformation. This recent initiative aligns with the continent’s vision of advancing various economies through digital innovation.

The program offers two application phases each year and will be open to all African fintech startups containing a workable concept or at its initial stages of operations. Visa will open applications starting July 2023, and all potential startups are encouraged to sign up.

According to the international payment service, the African Fintech Accelerator Program is expected to receive numerous applicants due to its previous success in the Visa Everywhere Initiative (VEI). The VEI competition in 2022 hosted more than 1000 African fintech startups.

Read: Fintech investments are paying dividends; what else can Africa expect?

The sheer volume of innovation and participation was unexpected and would later bring the idea of an accelerator program. The finalist Aficna fintech startups of the VEI have gained an automatic slot within their program.

Alfred F. Kelly Jr., Executive Chairman, said, “Africa has one of the most exciting and admired fintech ecosystems in the world, bringing outstanding entrepreneurial talent to a young digital-first population that is growing fast.“

He added that over the past decade, Visa had increased its investments in Africa as a form of support for its vision and its impending digital transformation. The Africa Fintech Accelerator Program will act as a conduit to bring expertise, connection, and potential partnership to its fintech industry.

The African Fintech Accelerator Program is just the beginning.

Many international organizations genuinely believe that Africa’s digital innovation will one day flip the global economy. According to Otto Williams, Head of Partnerships, Africa’s fintech community will develop new and improved payment service systems. He added that with its current trajectory, Africa would soon achieve better ways of connecting its unbanked citizens, further promoting its digital economy.

Upon this prediction, Visa has operated several additional operations to solidify its position within Africa further. The international payment service unveiled Kenya’s first dedicated Visa Sub-Saharan Africa Innovation Studio.

This new project will provide a state-of-the-art environment to accommodate new clients and partnerships within the East African Tech Hub. The studio provided the necessary tools to co-create future-ready payment and commercial solutions, driving complete financial inclusion ever so closely.

Read: Italian Agency Launch Kenyan Entrepreneur’s accelerator program.

Visa also introduced new programs to support women’s empowerment with financial partners. Since Africa houses the highest number of women entrepreneurs, it provides the highest potential for innovation within the Tech industry.

Visa launched She’s Next, a program that provides funding, mentoring and networking opportunities to female enterprenuers. The program will aid Africa’s fintech Industry and lead growing SMBs in Egypt, Kenya, Morocco and South Africa.

With the ever-growing need for better innovations, Africa has proven capable of developing revolutionary concepts if given a chance. Visa and other financial payment services have taken the step to improve Africa’s fintech industry.